Nebraska Paycheck Calculator Tool

Introduction to Nebraska Paycheck Calculator Tool

The Nebraska Paycheck Calculator Tool is a valuable resource for employees and employers in the state of Nebraska. This tool allows users to calculate their take-home pay, gross pay, and other relevant details. It takes into account various factors such as federal income tax, state income tax, and other deductions. In this article, we will delve into the features and benefits of the Nebraska Paycheck Calculator Tool, as well as provide a step-by-step guide on how to use it.

Features of the Nebraska Paycheck Calculator Tool

The Nebraska Paycheck Calculator Tool offers several features that make it an essential tool for calculating paychecks. Some of the key features include: * Calculation of gross pay: The tool calculates the gross pay based on the user’s hourly wage or annual salary. * Calculation of federal income tax: The tool takes into account the user’s filing status, number of allowances, and other factors to calculate the federal income tax. * Calculation of state income tax: The tool calculates the state income tax based on Nebraska’s tax rates and the user’s income. * Calculation of other deductions: The tool allows users to input other deductions such as health insurance, 401(k), and other benefits. * Calculation of take-home pay: The tool calculates the take-home pay based on the user’s gross pay, federal income tax, state income tax, and other deductions.

Benefits of the Nebraska Paycheck Calculator Tool

The Nebraska Paycheck Calculator Tool offers several benefits to employees and employers in the state of Nebraska. Some of the key benefits include: * Accuracy: The tool provides accurate calculations, reducing the risk of errors and disputes. * Convenience: The tool is easy to use and can be accessed online, making it a convenient option for users. * Time-saving: The tool saves time and effort, as users do not have to manually calculate their paychecks. * Compliance: The tool ensures compliance with federal and state tax laws, reducing the risk of penalties and fines.

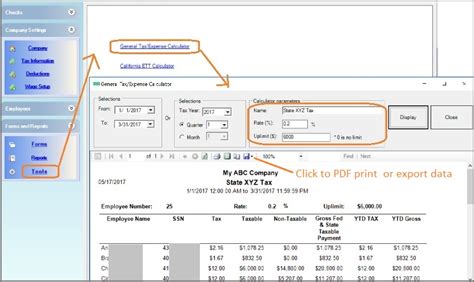

How to Use the Nebraska Paycheck Calculator Tool

Using the Nebraska Paycheck Calculator Tool is straightforward and easy. Here are the steps to follow: * Step 1: Enter your hourly wage or annual salary. * Step 2: Select your filing status and number of allowances. * Step 3: Enter your other income, such as tips or bonuses. * Step 4: Enter your deductions, such as health insurance or 401(k). * Step 5: Click the “Calculate” button to get your results.

📝 Note: It is essential to input accurate information to get accurate results.

Example of Using the Nebraska Paycheck Calculator Tool

Let’s say an employee earns an hourly wage of 25 and works 40 hours a week. The employee is single and has one allowance. The employee also has health insurance and 401(k) deductions. Here is an example of how to use the Nebraska Paycheck Calculator Tool: <table> <tr> <th>Hourly Wage</th> <th>Filing Status</th> <th>Number of Allowances</th> <th>Other Income</th> <th>Deductions</th> </tr> <tr> <td>25 Single 1 0</td> <td>Health Insurance: 100, 401(k): 200</td> </tr> </table> Using the Nebraska Paycheck Calculator Tool, the employee's take-home pay would be approximately 1,942 per month.

Conclusion and Final Thoughts

In conclusion, the Nebraska Paycheck Calculator Tool is a valuable resource for employees and employers in the state of Nebraska. It provides accurate calculations, convenience, and compliance with federal and state tax laws. By following the steps outlined in this article, users can easily use the tool to calculate their take-home pay, gross pay, and other relevant details. Whether you are an employee or an employer, the Nebraska Paycheck Calculator Tool is an essential tool to have in your arsenal.

What is the Nebraska Paycheck Calculator Tool?

+

The Nebraska Paycheck Calculator Tool is a online tool that calculates an employee’s take-home pay, gross pay, and other relevant details based on their hourly wage or annual salary, filing status, number of allowances, and other factors.

How do I use the Nebraska Paycheck Calculator Tool?

+

To use the Nebraska Paycheck Calculator Tool, simply enter your hourly wage or annual salary, select your filing status and number of allowances, enter your other income and deductions, and click the “Calculate” button to get your results.

Is the Nebraska Paycheck Calculator Tool accurate?

+

Yes, the Nebraska Paycheck Calculator Tool is accurate and provides reliable calculations based on the user’s input. However, it is essential to input accurate information to get accurate results.