5 NC Paycheck Tips

Understanding Your North Carolina Paycheck

When it comes to managing your finances, understanding your paycheck is crucial. For residents of North Carolina, knowing how their paychecks are calculated and what deductions to expect can help in budgeting and financial planning. NC paycheck tips can guide you through the process, ensuring you make the most out of your earnings. In this article, we’ll delve into the key aspects of North Carolina paychecks, including taxes, deductions, and benefits, to provide you with a comprehensive guide.

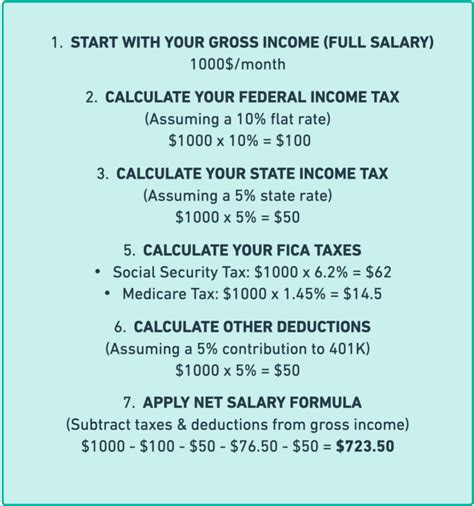

1. North Carolina State Income Tax

North Carolina has a state income tax that applies to the earnings of its residents. The tax rate can vary, and it’s essential to understand how much of your income goes towards state taxes. As of the last update, North Carolina has a flat income tax rate, which means that regardless of your income level, you’re taxed at the same rate. This information is vital for calculating your take-home pay and planning your expenses accordingly.

2. Federal Income Tax

In addition to state income tax, federal income tax is also deducted from your paycheck. The federal tax system has tax brackets, meaning the tax rate increases as your income rises. Understanding both state and federal tax rates can help you estimate your total tax liability and plan your finances more effectively. Utilizing tax calculators or consulting with a financial advisor can provide more accurate estimates based on your specific situation.

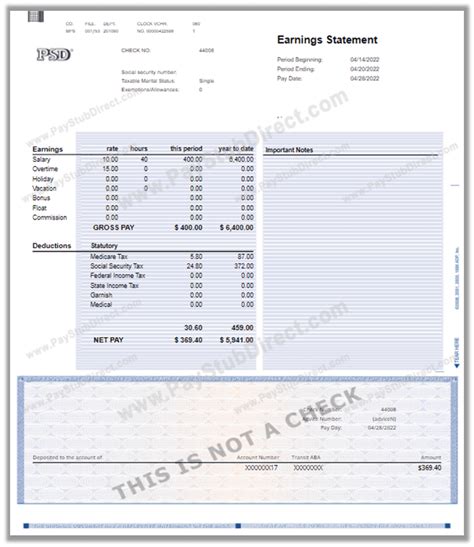

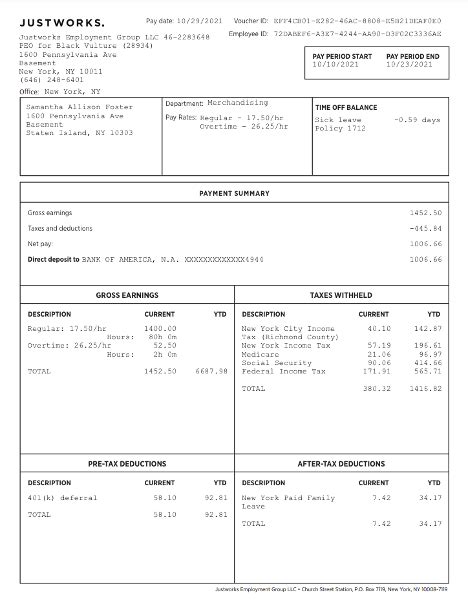

3. Deductions and Benefits

Besides taxes, other deductions are made from your paycheck, including: - Health Insurance Premiums: If your employer offers health insurance as a benefit, the premiums might be deducted from your paycheck. - Retirement Contributions: Contributions to retirement plans like 401(k) or IRA can be deducted pre-tax, reducing your taxable income. - Other Benefits: Life insurance, disability insurance, and other benefits offered by your employer might also be deducted.

| Deduction | Description |

|---|---|

| Health Insurance | Premiums for health insurance coverage |

| Retirement Contributions | Contributions to retirement savings plans |

| Other Benefits | Life insurance, disability insurance, etc. |

4. Managing Your Paycheck

To make the most out of your paycheck, consider the following NC paycheck tips: - Budgeting: Create a budget that accounts for all deductions and taxes. - Savings: Allocate a portion of your income towards savings and emergency funds. - Investments: Consider investing in retirement plans or other investment vehicles. - Tax Planning: Utilize tax deductions and credits to minimize your tax liability.

5. Staying Informed

Staying informed about changes in tax laws, both at the state and federal levels, is crucial. Tax reforms and changes in benefits and deductions can significantly impact your paycheck. Regularly reviewing your paycheck and staying updated with financial news can help you adjust your financial plans accordingly.

📝 Note: It's essential to review your paycheck stub regularly to ensure accuracy and understand all deductions.

In summary, understanding your North Carolina paycheck involves knowing about state and federal taxes, various deductions, and how to manage your finances effectively. By following these NC paycheck tips and staying informed, you can better navigate your financial situation and make informed decisions about your earnings.

What is the current state income tax rate in North Carolina?

+

As of the last update, North Carolina has a flat state income tax rate. It’s crucial to check the latest tax rates as they are subject to change.

How can I reduce my tax liability in North Carolina?

+

Utilizing tax deductions and credits, contributing to retirement plans, and consulting with a financial advisor can help minimize your tax liability.

What are some common deductions from a North Carolina paycheck?

+

Common deductions include federal and state income taxes, health insurance premiums, retirement contributions, and other benefits like life and disability insurance.