5 Ways to Pay Off Navy Loans Fast

Managing Your Navy Loans: 5 Strategies to Pay Off Your Debt Faster

Are you a Navy personnel struggling to pay off your loans? You’re not alone. Many service members face financial challenges due to the unique demands of their careers. However, with the right strategies, you can pay off your Navy loans faster and achieve financial stability. In this article, we’ll explore five effective ways to manage your debt and secure your financial future.

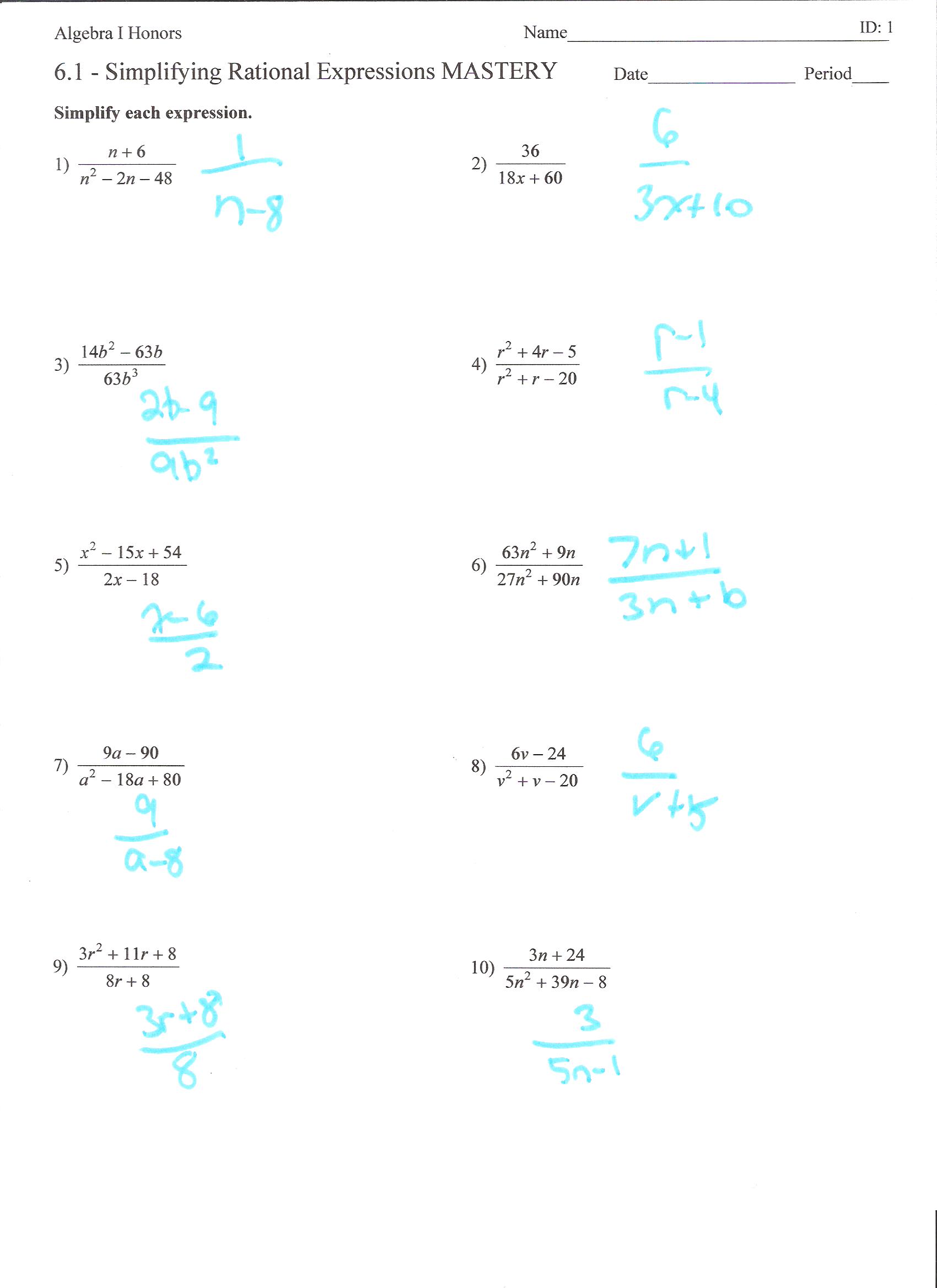

Understand Your Navy Loans

Before we dive into the strategies, it’s essential to understand the types of loans available to Navy personnel. The most common loans include:

- Navy Federal Credit Union Loans: These loans offer competitive interest rates and flexible repayment terms.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans provide favorable terms and lower interest rates.

- Military Personnel Loans: These loans are designed for service members and offer lower interest rates and more lenient repayment terms.

1. Snowball Method: Pay Off Smaller Loans First

The snowball method involves paying off smaller loans first, while making minimum payments on larger loans. This approach provides a psychological boost as you quickly eliminate smaller debts and see progress.

How it works:

- List all your Navy loans, starting with the smallest balance.

- Make minimum payments on all loans except the smallest one.

- Apply as much money as possible to the smallest loan until it’s paid off.

- Repeat the process with the next smallest loan.

🔥 Note: This method can be motivating, but it may not always be the most efficient way to pay off debt. Consider the next method for a more strategic approach.

2. Avalanche Method: Pay Off Loans with High Interest Rates First

The avalanche method involves paying off loans with the highest interest rates first, while making minimum payments on other loans. This approach can save you money in interest over time.

How it works:

- List all your Navy loans, starting with the highest interest rate.

- Make minimum payments on all loans except the one with the highest interest rate.

- Apply as much money as possible to the loan with the highest interest rate until it’s paid off.

- Repeat the process with the next loan with the highest interest rate.

3. Consolidation Loans: Simplify Your Payments

If you have multiple Navy loans with high interest rates or difficult repayment terms, a consolidation loan may be a good option. This involves combining multiple loans into one loan with a lower interest rate and a single monthly payment.

Benefits:

- Simplified payments

- Lower interest rates

- Reduced debt burden

How to apply:

- Check with your lender or the Navy Federal Credit Union to see if you’re eligible for a consolidation loan.

- Compare interest rates and repayment terms to ensure you’re getting a better deal.

- Apply for the consolidation loan and wait for approval.

4. Bi-Weekly Payments: Reduce Your Loan Term

Making bi-weekly payments can help you pay off your Navy loans faster by reducing the principal balance more quickly.

How it works:

- Divide your monthly payment in half and pay it every two weeks.

- This will result in 26 payments per year, rather than 12.

- Apply the extra payment to the principal balance to reduce the loan term.

5. Increase Your Income: Boost Your Payments

Increasing your income can provide more money in your budget to apply to your Navy loans. Consider the following options:

- Take on a side job: Freelance work, part-time jobs, or selling items online can provide extra income.

- Sell unwanted items: Declutter your home and sell items you no longer need or use.

- Ask for a raise: If possible, ask your supervisor for a raise or promotion.

| Strategy | Benefits |

|---|---|

| Snowball Method | Quickly eliminates smaller debts, provides psychological boost |

| Avalanche Method | Saves money in interest over time, efficient way to pay off debt |

| Consolidation Loans | Simplifies payments, reduces interest rates and debt burden |

| Bi-Weekly Payments | Reduces loan term, applies extra payment to principal balance |

| Increase Your Income | Provides more money in your budget to apply to loans |

To sum up, paying off your Navy loans requires a strategic approach. By understanding your loan options, using the snowball or avalanche method, consolidating loans, making bi-weekly payments, and increasing your income, you can eliminate your debt and achieve financial stability.

What is the best way to pay off Navy loans?

+

The best way to pay off Navy loans depends on your individual financial situation. Consider using the snowball method, avalanche method, or consolidating loans to simplify your payments and reduce interest rates.

Can I consolidate my Navy loans?

+

Yes, you may be eligible for a consolidation loan. Check with your lender or the Navy Federal Credit Union to see if you qualify and to compare interest rates and repayment terms.

How can I increase my income to pay off my Navy loans faster?

+

Consider taking on a side job, selling unwanted items, or asking for a raise to increase your income. Apply the extra money to your loans to pay them off faster.