5 Navy Payday Tips

Introduction to Navy Payday Tips

As a member of the Navy, managing your finances effectively is crucial to ensure a stable and secure financial future. With the unique challenges and opportunities that come with naval service, it’s essential to have a solid understanding of how to make the most of your payday. In this article, we’ll explore five key tips to help you navigate the world of Navy payday and make informed decisions about your finances.

Understanding Your Navy Pay

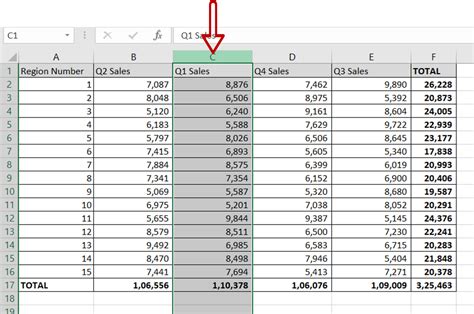

Before we dive into the tips, it’s essential to understand the basics of Navy pay. Base pay is the primary component of your compensation, and it’s based on your rank and time in service. In addition to base pay, you may also receive special pays and allowances, which can vary depending on your specific role and circumstances. It’s crucial to have a clear understanding of your pay structure to make the most of your finances.

Navy Payday Tip 1: Create a Budget

Creating a budget is the foundation of effective financial management. Start by tracking your income and expenses to get a clear picture of where your money is going. Make a list of your essential expenses, such as rent, utilities, and food, and prioritize them accordingly. You can use the 50/30/20 rule as a guideline, allocating 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Navy Payday Tip 2: Take Advantage of Savings Opportunities

The Navy offers several savings opportunities that can help you build wealth over time. The Thrift Savings Plan (TSP) is a retirement savings plan that allows you to contribute a portion of your pay to a tax-deferred account. You can also take advantage of savings deposit programs, such as the Savings Deposit Program (SDP), which offers a guaranteed 10% interest rate on deposits made while deployed. Be sure to explore these options and make the most of them to secure your financial future.

Navy Payday Tip 3: Manage Your Debt

Debt can be a significant challenge for many Navy personnel, especially when it comes to high-interest loans and credit cards. Consolidate your debt into lower-interest loans or credit cards, and focus on paying off high-priority debts first. You can also consider working with a credit counselor to get personalized advice and support. Remember, managing your debt effectively is crucial to achieving long-term financial stability.

Navy Payday Tip 4: Invest in Your Education

Investing in your education can have a significant impact on your long-term financial prospects. The Navy offers several education benefits, including the GI Bill and Tuition Assistance, which can help you pursue higher education or vocational training. Be sure to explore these options and make the most of them to enhance your career prospects and earning potential.

Navy Payday Tip 5: Plan for the Future

Finally, it’s essential to plan for the future and consider your long-term financial goals. Retirement planning is a critical aspect of financial management, and the Navy offers several resources to help you get started. You can also consider working with a financial advisor to get personalized advice and support. Remember, planning for the future is essential to achieving financial stability and security.

| Pay Component | Description |

|---|---|

| Base Pay | Primary component of Navy pay, based on rank and time in service |

| Special Pays | Additional pays for specific roles or circumstances, such as hazardous duty pay or flight pay |

| Allowances | Monetary allowances for specific expenses, such as food or housing |

📝 Note: Be sure to review your pay stub carefully to ensure accuracy and understand your pay structure.

In summary, managing your finances effectively as a member of the Navy requires a combination of budgeting, savings, debt management, education, and planning for the future. By following these five tips and taking advantage of the resources available to you, you can achieve financial stability and security, both during and after your naval service.

What is the Thrift Savings Plan (TSP)?

+

The Thrift Savings Plan (TSP) is a retirement savings plan that allows Navy personnel to contribute a portion of their pay to a tax-deferred account.

How do I consolidate my debt?

+

Consolidating your debt involves combining multiple debts into a single loan or credit card with a lower interest rate. You can work with a credit counselor or financial advisor to explore your options and find the best solution for your situation.

What education benefits are available to Navy personnel?

+

The Navy offers several education benefits, including the GI Bill and Tuition Assistance, which can help you pursue higher education or vocational training.