5 Navy Federal Tips

Introduction to Navy Federal

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. It offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment services. As a member-owned cooperative, Navy Federal is committed to providing its members with exceptional service, competitive rates, and low fees. In this article, we will provide you with 5 Navy Federal tips to help you make the most of your membership.

Tip 1: Take Advantage of Competitive Rates and Low Fees

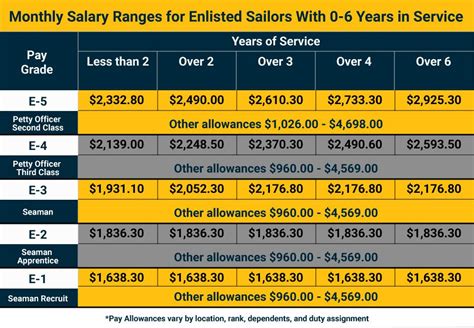

One of the biggest advantages of being a Navy Federal member is access to competitive rates and low fees. Navy Federal offers some of the best rates on savings accounts, certificates, and loans, making it an ideal place to save and borrow money. For example, Navy Federal’s savings accounts offer higher interest rates than many traditional banks, while its loans offer lower interest rates and more flexible repayment terms. By taking advantage of these competitive rates and low fees, you can save money and achieve your financial goals faster.

Tip 2: Use Navy Federal’s Online Banking and Mobile App

Navy Federal’s online banking and mobile app make it easy to manage your accounts, pay bills, and transfer money on the go. The mobile app is available for both iOS and Android devices and offers a range of features, including mobile deposit, bill pay, and account alerts. By using Navy Federal’s online banking and mobile app, you can save time and stay on top of your finances from anywhere.

Tip 3: Explore Navy Federal’s Investment Services

Navy Federal offers a range of investment services, including brokerage accounts, retirement accounts, and investment advice. By investing with Navy Federal, you can diversify your portfolio, save for retirement, and achieve your long-term financial goals. Navy Federal’s investment services are designed to be affordable and accessible, with low fees and minimum investment requirements.

Tip 4: Take Advantage of Navy Federal’s Credit Card Offers

Navy Federal offers a range of credit cards with competitive rates, rewards, and benefits. The Navy Federal Cash Rewards credit card, for example, offers 1.5% cash back on all purchases, with no rotating categories or spending limits. By using a Navy Federal credit card, you can earn rewards, build credit, and enjoy perks like travel insurance and purchase protection.

Tip 5: Use Navy Federal’s Budgeting and Financial Planning Tools

Navy Federal offers a range of budgeting and financial planning tools to help you manage your finances and achieve your goals. The Navy Federal Budgeting Worksheet, for example, is a free online tool that helps you track your income and expenses, create a budget, and set financial goals. By using Navy Federal’s budgeting and financial planning tools, you can take control of your finances, reduce stress, and achieve financial stability.

💡 Note: Navy Federal's budgeting and financial planning tools are available to all members, regardless of their account type or balance.

To summarize, Navy Federal offers a range of products and services that can help you achieve your financial goals. By taking advantage of competitive rates and low fees, using online banking and mobile app, exploring investment services, taking advantage of credit card offers, and using budgeting and financial planning tools, you can make the most of your Navy Federal membership. Whether you’re saving for a short-term goal or planning for long-term financial stability, Navy Federal has the tools and resources you need to succeed.

What are the benefits of being a Navy Federal member?

+

As a Navy Federal member, you can enjoy competitive rates, low fees, and exceptional service, as well as access to a range of financial products and services, including checking and savings accounts, credit cards, loans, and investment services.

How do I become a Navy Federal member?

+

To become a Navy Federal member, you must meet the eligibility requirements, which include being a member of the armed forces, a veteran, or a family member of someone who is. You can apply for membership online or by visiting a branch.

What is the difference between a credit union and a bank?

+

A credit union is a not-for-profit cooperative owned and controlled by its members, while a bank is a for-profit institution owned by shareholders. Credit unions tend to offer better rates and lower fees than banks, as well as more personalized service.