5 Navy Federal Tips

Introduction to Navy Federal

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. With a wide range of financial products and services, Navy Federal has become a go-to institution for many individuals and families. In this post, we will explore five essential tips for getting the most out of Navy Federal, from managing your accounts to optimizing your financial strategy.

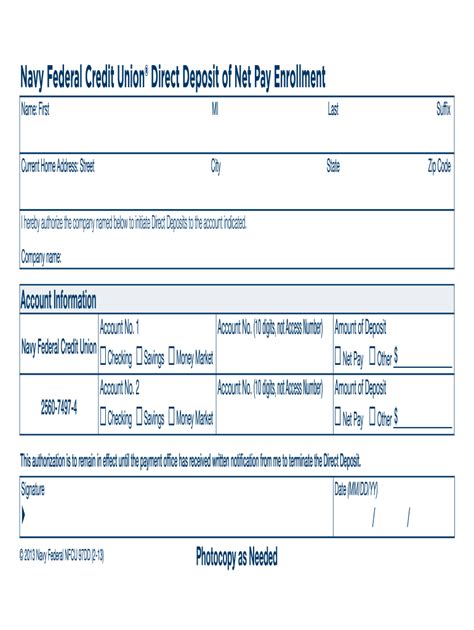

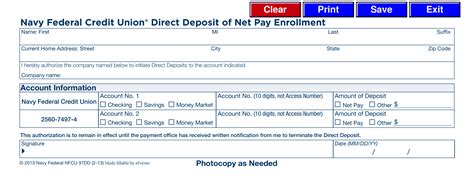

Tip 1: Understand Your Account Options

Navy Federal offers a variety of account types, each with its unique features and benefits. To make the most of your membership, it’s essential to understand the differences between each account. Some popular account options include: * Active Duty Checking: Designed for active-duty military personnel, this account offers no monthly fees and reduced ATM fees. * Everyday Savings: A basic savings account with competitive interest rates and low minimum balance requirements. * Certificate: A time deposit account with higher interest rates for longer term commitments.

📝 Note: Be sure to review the terms and conditions of each account to determine which one best suits your financial needs.

Tip 2: Take Advantage of Loan Options

Navy Federal offers a range of loan products, including personal loans, auto loans, and mortgages. To get the most out of these options, consider the following: * Compare interest rates: Navy Federal often offers competitive interest rates compared to other lenders. * Consider a co-signer: If you have a limited credit history, having a co-signer can improve your chances of approval. * Use the loan calculator: Navy Federal’s online loan calculator can help you determine your monthly payments and choose the best loan option.

Tip 3: Use Online Banking and Mobile Banking

Navy Federal’s online banking and mobile banking services provide convenient access to your accounts, allowing you to: * Check your account balances and transaction history * Transfer funds between accounts * Pay bills and schedule payments * Deposit checks remotely using the mobile banking app

| Feature | Online Banking | Mobile Banking |

|---|---|---|

| Account Management | Yes | Yes |

| Bill Pay | Yes | Yes |

| Remote Deposit | No | Yes |

Tip 4: Leverage Investment and Insurance Options

Navy Federal offers a range of investment and insurance products, including: * Brokerage services: Invest in stocks, bonds, and mutual funds with the help of a financial advisor. * Life insurance: Protect your loved ones with term life insurance or whole life insurance. * Disability insurance: Safeguard your income with short-term or long-term disability insurance.

📊 Note: Be sure to review the terms and conditions of each product to determine which one best suits your financial needs.

Tip 5: Utilize Educational Resources and Tools

Navy Federal provides a variety of educational resources and tools to help you manage your finances effectively, including: * Financial webinars: Learn about personal finance, investing, and retirement planning from expert speakers. * Financial calculators: Use online calculators to determine your retirement savings needs or calculate your loan payments. * Money management workshops: Attend in-person workshops to learn about budgeting, saving, and investing.

In summary, by following these five tips, you can make the most of your Navy Federal membership and achieve your financial goals. Whether you’re looking to manage your accounts, optimize your loans, or plan for the future, Navy Federal has the tools and resources to help you succeed.

What is the minimum balance requirement for a Navy Federal savings account?

+

The minimum balance requirement for a Navy Federal savings account is $5.

Can I apply for a Navy Federal loan online?

+

Yes, you can apply for a Navy Federal loan online through their website or mobile banking app.

Does Navy Federal offer investment services?

+

Yes, Navy Federal offers brokerage services and investment products, including stocks, bonds, and mutual funds.