5 Navy Federal Tips

Introduction to Navy Federal

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. It provides a wide range of financial services, including banking, loans, credit cards, and investments. As a member-owned cooperative, Navy Federal is committed to helping its members achieve their financial goals. In this article, we will explore five valuable tips for getting the most out of your Navy Federal membership.

Tip 1: Take Advantage of Competitive Loan Rates

Navy Federal offers highly competitive loan rates, making it an excellent choice for members looking to borrow money. Whether you’re in the market for a personal loan, auto loan, or mortgage, Navy Federal’s rates are often lower than those offered by traditional banks. Additionally, members can take advantage of flexible repayment terms and minimal fees. To get the best rates, it’s essential to have a good credit score and to shop around for the best deals.

Tip 2: Maximize Your Savings with High-Yield Accounts

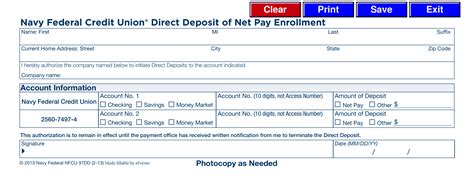

Navy Federal offers a range of high-yield savings accounts that can help members earn more interest on their deposits. The Basic Savings Account and Premium Savings Account are two popular options, offering competitive interest rates and minimal fees. Members can also take advantage of certificates and individual retirement accounts (IRAs) to save for long-term goals. To maximize your savings, consider setting up automatic transfers from your checking account and taking advantage of Navy Federal’s mobile banking app.

Tip 3: Use the Navy Federal Mobile Banking App

The Navy Federal mobile banking app is a powerful tool that allows members to manage their accounts on the go. With the app, you can check your account balances, transfer funds, pay bills, and deposit checks remotely. The app is available for both iOS and Android devices and is highly rated by members. To get the most out of the app, be sure to enable two-factor authentication and set up account alerts to stay on top of your finances.

Tip 4: Take Advantage of Investment Opportunities

Navy Federal offers a range of investment products and services, including brokerage accounts, mutual funds, and retirement accounts. Members can work with a financial advisor to create a personalized investment plan that meets their goals and risk tolerance. To get started, consider attending one of Navy Federal’s free investment seminars or workshops. These events provide valuable information and insights on investing and can help you make informed decisions about your finances.

Tip 5: Utilize Navy Federal’s Financial Education Resources

Navy Federal is committed to helping its members achieve financial wellness. The credit union offers a range of financial education resources, including online articles, webinars, and workshops. These resources cover topics such as budgeting, saving, investing, and credit management. Members can also take advantage of one-on-one financial counseling and planning services. To get the most out of these resources, consider setting up a meeting with a financial advisor or attending a workshop in person.

💡 Note: Navy Federal's financial education resources are available to all members and can be accessed through the credit union's website or mobile banking app.

In summary, Navy Federal offers a wide range of financial services and resources that can help members achieve their financial goals. By taking advantage of competitive loan rates, maximizing your savings, using the mobile banking app, investing in your future, and utilizing financial education resources, you can get the most out of your Navy Federal membership.

What are the benefits of joining Navy Federal Credit Union?

+

As a member of Navy Federal Credit Union, you can enjoy competitive loan rates, high-yield savings accounts, and a range of financial education resources. You’ll also have access to a network of branches and ATMs, as well as online and mobile banking services.

How do I become a member of Navy Federal Credit Union?

+

To become a member of Navy Federal Credit Union, you’ll need to meet the eligibility requirements, which include being a member of the armed forces, a veteran, or a family member of a current or former military member. You can apply for membership online or in person at a Navy Federal branch.

What types of loans does Navy Federal offer?

+

Navy Federal offers a range of loan products, including personal loans, auto loans, mortgages, and home equity loans. The credit union also offers credit cards and lines of credit.