5 Ways to Calculate National Guard Pay

Understanding National Guard Pay

Serving in the National Guard can be a rewarding experience, offering a chance to serve your country, develop new skills, and earn a steady income. However, calculating National Guard pay can be complex, as it depends on various factors such as rank, time in service, and type of duty. In this article, we will explore five ways to calculate National Guard pay, helping you better understand your compensation.

Method 1: Basic Pay

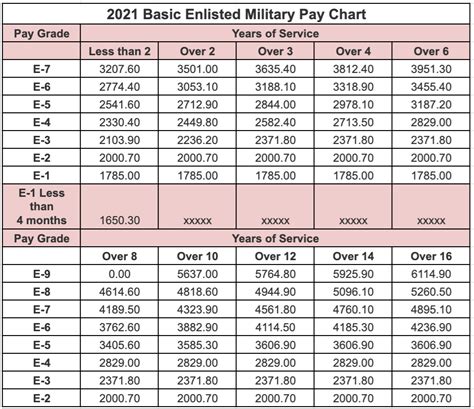

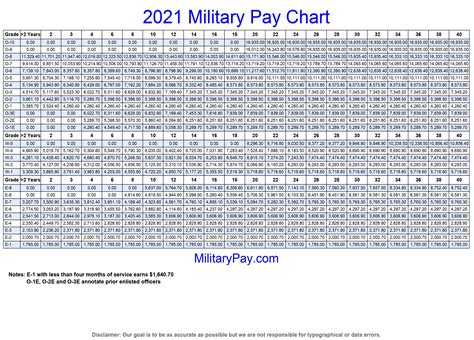

Basic pay is the fundamental component of National Guard pay, and it’s based on your rank and time in service. The National Guard uses the same pay charts as the active-duty military, with pay grades ranging from E-1 (Private) to E-9 (Sergeant Major). To calculate your basic pay, you can use the following steps:

- Determine your pay grade based on your rank and time in service.

- Refer to the National Guard pay chart to find your corresponding monthly basic pay.

- Multiply your monthly basic pay by the number of months you serve in a given year.

For example, let’s say you’re a Sergeant (E-5) with 6 years of service. According to the National Guard pay chart, your monthly basic pay would be 2,964.20. If you serve for 12 months, your annual basic pay would be 35,570.40.

📝 Note: Basic pay is just one component of your overall National Guard pay. You may also receive additional forms of compensation, such as allowances and bonuses.

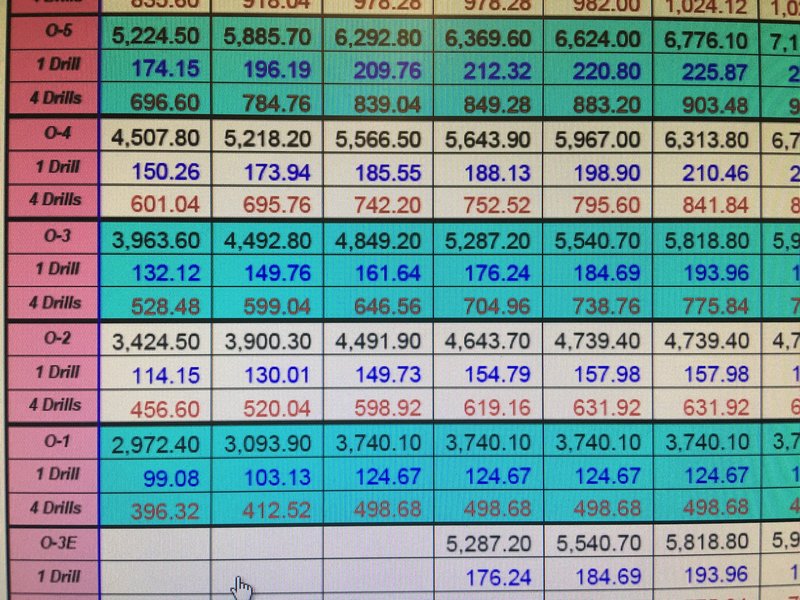

Method 2: Drill Pay

Drill pay is a type of pay that National Guard members receive for attending drill periods, typically one weekend per month. To calculate your drill pay, you can use the following steps:

- Determine your pay grade based on your rank and time in service.

- Refer to the National Guard pay chart to find your corresponding drill pay rate.

- Multiply your drill pay rate by the number of drill periods you attend in a given year.

For example, let’s say you’re a Sergeant (E-5) with 6 years of service, and you attend 12 drill periods per year. According to the National Guard pay chart, your drill pay rate would be 444.40 per drill period. Your annual drill pay would be 5,332.80.

Method 3: Annual Training (AT) Pay

Annual Training (AT) pay is a type of pay that National Guard members receive for attending their annual two-week training period. To calculate your AT pay, you can use the following steps:

- Determine your pay grade based on your rank and time in service.

- Refer to the National Guard pay chart to find your corresponding AT pay rate.

- Multiply your AT pay rate by the number of days you attend AT in a given year.

For example, let’s say you’re a Sergeant (E-5) with 6 years of service, and you attend 14 days of AT per year. According to the National Guard pay chart, your AT pay rate would be 130.60 per day. Your annual AT pay would be 1,828.40.

Method 4: Allowances

Allowances are a type of pay that National Guard members receive to help offset the cost of living expenses, such as food and housing. To calculate your allowances, you can use the following steps:

- Determine your Basic Allowance for Housing (BAH) rate based on your location and pay grade.

- Determine your Basic Allowance for Subsistence (BAS) rate based on your pay grade.

- Add your BAH and BAS rates to your basic pay to calculate your total annual compensation.

For example, let’s say you’re a Sergeant (E-5) with 6 years of service, and you live in a high-cost area. Your BAH rate would be 2,100 per month, and your BAS rate would be 369.39 per month. Your annual allowances would be 25,200 (BAH) + 4,432.68 (BAS) = $29,632.68.

📝 Note: Allowances can vary greatly depending on your location and pay grade. Be sure to check the National Guard's website for the most up-to-date allowance rates.

Method 5: Special Pays

Special pays are a type of pay that National Guard members receive for performing specific duties or having specialized skills. To calculate your special pays, you can use the following steps:

- Determine your special pay rate based on your duty or skill.

- Multiply your special pay rate by the number of months you serve in a given year.

For example, let’s say you’re a Sergeant (E-5) with 6 years of service, and you serve as a drill sergeant. Your special pay rate would be 500 per month. Your annual special pay would be 6,000.

| Pay Component | Rate | Annual Amount |

|---|---|---|

| Basic Pay | $2,964.20/month | $35,570.40/year |

| Drill Pay | $444.40/drill period | $5,332.80/year |

| Annual Training (AT) Pay | $130.60/day | $1,828.40/year |

| Allowances | $2,469.39/month (BAH + BAS) | $29,632.68/year |

| Special Pays | $500/month | $6,000/year |

In conclusion, calculating National Guard pay can be complex, but by using the five methods outlined above, you can get a better understanding of your total annual compensation. Remember to factor in all components of your pay, including basic pay, drill pay, AT pay, allowances, and special pays.

How often do National Guard members receive pay?

+

National Guard members typically receive pay twice a month, on the 1st and 15th of each month.

Do National Guard members receive pay for attending drill periods?

+

Yes, National Guard members receive drill pay for attending drill periods, typically one weekend per month.

How do allowances affect National Guard pay?

+

Related Terms:

- national guard pay calculator

- Air National Guard pay calculator

- Military pay Calculator

- Air Force Reserve pay calculator

- Air Force pay Calculator

- Military pay Calculator monthly