7 Figures: National Guard Officer Salary Breakdown

National Guard Officer Salary Breakdown: Understanding the Numbers

The National Guard is a reserve component of the US Armed Forces that provides support to civil authorities and helps maintain national security. As a National Guard officer, you’ll have the opportunity to serve your country, develop valuable skills, and earn a competitive salary. In this post, we’ll break down the National Guard officer salary structure, highlighting the key factors that affect your take-home pay.

Factors Affecting National Guard Officer Salary

Several factors influence a National Guard officer’s salary, including:

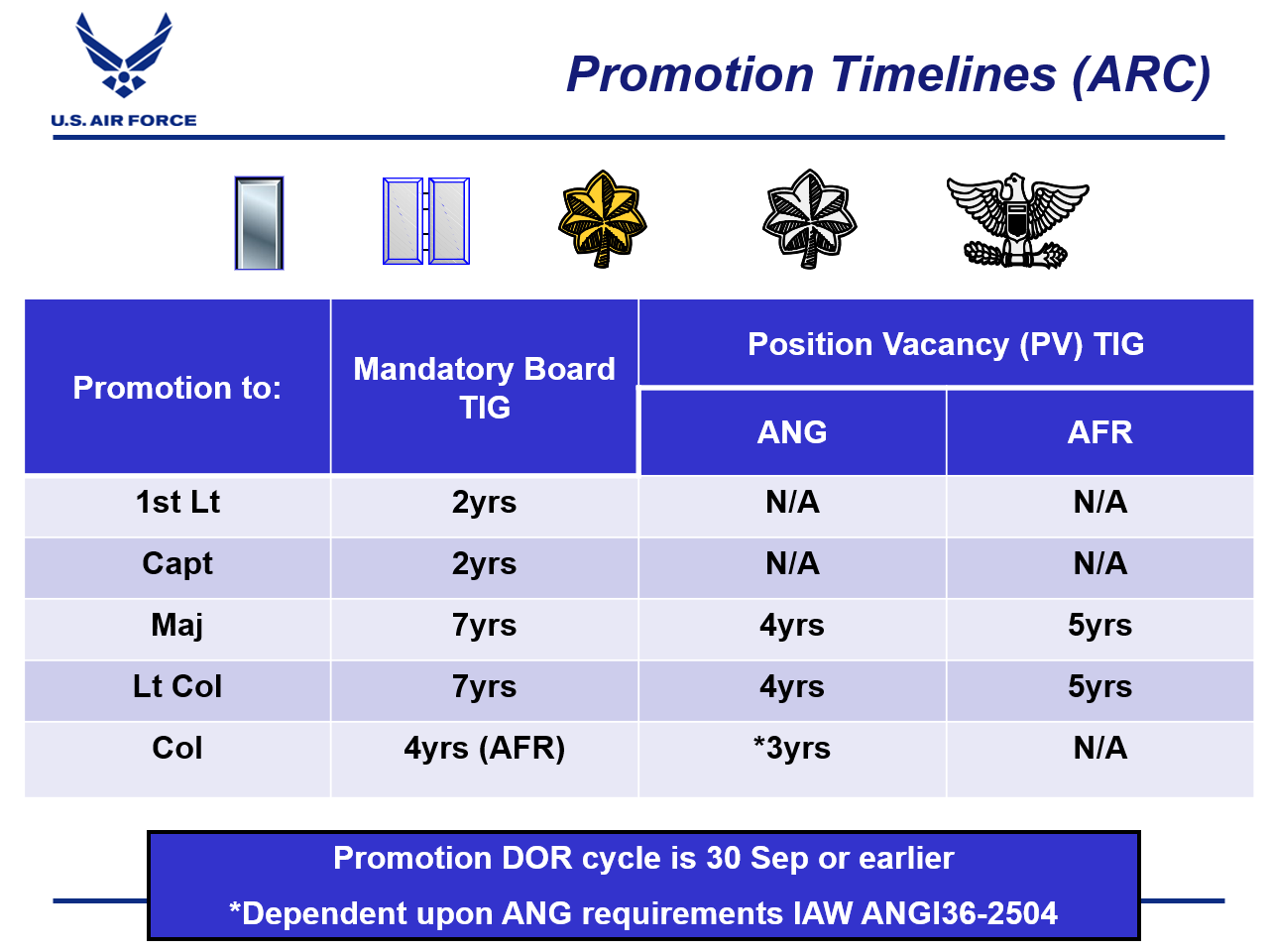

- Rank: Your military rank is the primary determinant of your salary. As you move up the ranks, your pay increases.

- Time in Service: The longer you serve, the higher your salary.

- Time in Grade: The amount of time you’ve spent in your current rank also impacts your salary.

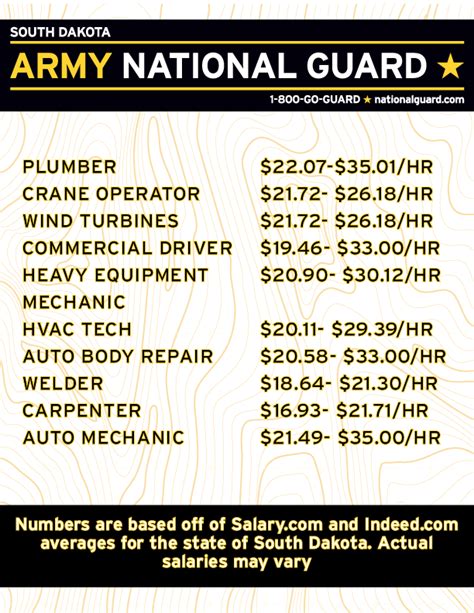

- Education: Your level of education can affect your salary, especially if you have a degree or specialized training.

- Specialty: Certain military specialties, such as medicine or law, may come with higher salaries.

National Guard Officer Salary Ranges

Here are the typical salary ranges for National Guard officers, based on rank and time in service:

| Rank | Minimum Time in Service | Maximum Time in Service | Monthly Salary Range |

|---|---|---|---|

| Second Lieutenant (O-1) | 0 years | 2 years | $3,287.10 - $4,136.40 |

| First Lieutenant (O-2) | 2 years | 4 years | $3,788.20 - $5,144.30 |

| Captain (O-3) | 4 years | 8 years | $4,637.50 - $6,664.50 |

| Major (O-4) | 8 years | 12 years | $5,583.30 - $8,241.90 |

| Lieutenant Colonel (O-5) | 12 years | 18 years | $6,663.60 - $10,530.30 |

| Colonel (O-6) | 18 years | 22 years | $8,045.40 - $13,414.10 |

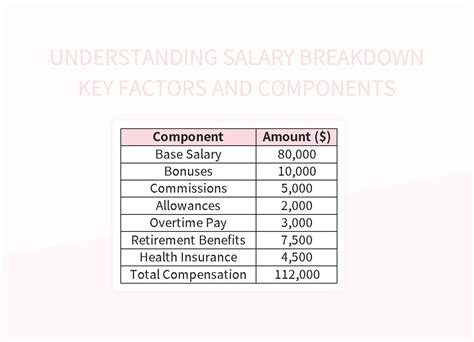

National Guard Officer Allowances and Benefits

In addition to your base salary, you’ll receive various allowances and benefits as a National Guard officer, including:

- Basic Allowance for Subsistence (BAS): A monthly stipend for food expenses.

- Basic Allowance for Housing (BAH): A monthly stipend for housing expenses, based on your location and family size.

- Special Duty Pay: Additional pay for specialized duties, such as flying or diving.

- Hazardous Duty Pay: Additional pay for duties that involve hazardous conditions.

- Health Insurance: Comprehensive health insurance for you and your family.

- Retirement Benefits: Eligibility for the military’s retirement system, which provides a pension and other benefits.

Tax Benefits for National Guard Officers

As a National Guard officer, you may be eligible for certain tax benefits, including:

- Tax-Free Allowances: BAS and BAH are tax-free, which can help reduce your taxable income.

- Tax-Free Education Assistance: The National Guard offers education assistance programs, such as the GI Bill, which can help you pursue higher education.

- State Tax Benefits: Some states offer tax benefits for National Guard members, such as exemptions from state income tax.

[📝] Note: Tax laws and regulations can change frequently, so it's essential to consult with a tax professional to understand your specific situation.

Conclusion

As a National Guard officer, your salary will depend on your rank, time in service, and other factors. While the base salary ranges are competitive, it’s essential to consider the various allowances and benefits that can impact your take-home pay. By understanding the National Guard officer salary structure, you can better plan your financial future and make informed decisions about your military career.

What is the starting salary for a National Guard officer?

+

The starting salary for a National Guard officer is approximately $3,287.10 per month, which is the minimum salary for a Second Lieutenant (O-1) with less than 2 years of service.

Do National Guard officers receive benefits in addition to their salary?

+

Yes, National Guard officers receive various benefits, including Basic Allowance for Subsistence (BAS), Basic Allowance for Housing (BAH), health insurance, and retirement benefits.

Are National Guard officers eligible for tax benefits?

+

Yes, National Guard officers may be eligible for certain tax benefits, including tax-free allowances and tax-free education assistance.