Monthly Expenses Worksheet: Free Printable for Budgeting

Monthly Expenses Worksheet: Free Printable for Budgeting

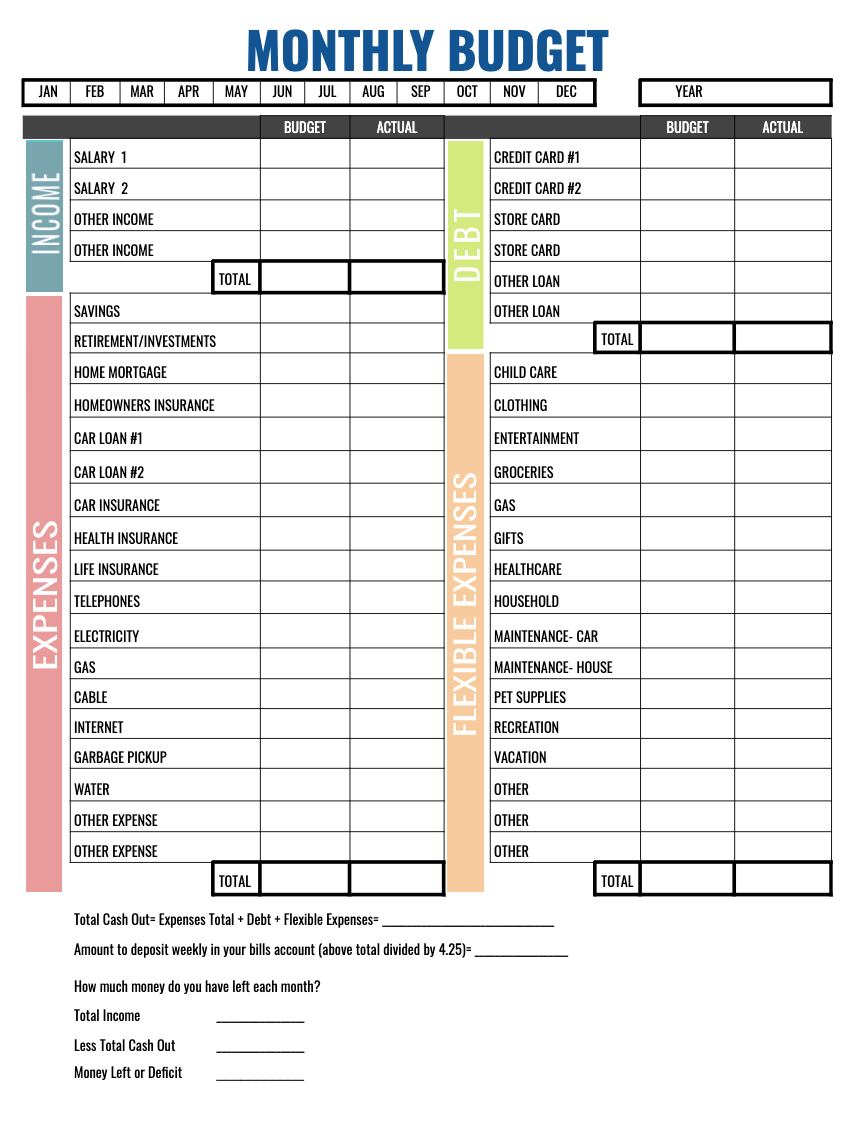

Budgeting can feel overwhelming, especially when you're dealing with numerous expenses on a monthly basis. Creating a structured approach to managing your finances not only helps you keep track of your spending but also empowers you to make informed financial decisions. Here's a detailed guide on how to make the most out of a monthly expenses worksheet, ensuring that every penny is accounted for and every financial goal is within reach.

Why Use a Monthly Expenses Worksheet?

Before diving into how to use a monthly expenses worksheet, let's briefly touch on why this tool is beneficial:

- Organization: It helps you organize all your expenses in one place, making it easier to analyze your spending patterns.

- Visibility: Provides a clear overview of where your money is going, highlighting areas where you might be overspending.

- Goal Setting: Facilitates setting realistic financial goals by giving you a baseline of your monthly outgoings.

- Control: With a clear picture of your expenses, you gain control over your finances, reducing financial stress and enhancing your ability to save.

Setting Up Your Monthly Expenses Worksheet

Setting up your worksheet involves a few simple steps, ensuring that you capture all the necessary financial data:

1. Gather Your Financial Documents

Before you start filling out your worksheet, collect all your financial documents:

- Bank statements

- Credit card statements

- Utility bills

- Rent/Mortgage statements

- Any receipts or invoices for additional expenses

2. Download or Create Your Worksheet

You can either use a free printable worksheet or create your own using a spreadsheet application like Microsoft Excel or Google Sheets. Here's a basic template you might find useful:

| Category | Fixed Expenses | Variable Expenses |

|---|---|---|

| Housing | Rent/Mortgage | Home Maintenance |

| Utilities | Electricity, Water | Internet, Phone |

| Food | Groceries | Dining Out |

| Transportation | Car Payment, Insurance | Gas, Public Transport |

| Entertainment | Subscriptions | Movies, Concerts |

| Healthcare | Insurance | Meds, Doctor Visits |

| Savings & Debt | Emergency Fund | Loan Payments |

3. Fill Out Your Worksheet

Here are the steps to fill out your worksheet:

- Categorize Your Expenses: Use the categories from the table above or customize them to fit your personal spending habits.

- Record Fixed Expenses: Enter the amounts for expenses that are the same or very similar each month.

- Estimate Variable Expenses: For variable expenses, use an average or your best estimate based on past spending.

- Total Each Category: Add up each category's total expenses.

- Calculate the Total: Sum all categories for a monthly expense total.

💡 Note: Don't forget to account for irregular expenses like annual insurance payments or gifts by setting aside money monthly.

Using Your Worksheet to Make Budget Adjustments

With your expenses now documented, it's time to use this information to make budgeting decisions:

1. Set Budget Limits

Based on your income and total expenses:

- Limit Expenses: Set a cap for discretionary spending like entertainment or dining out.

- Adjust Savings: Ensure you're saving enough by comparing your savings goals with your spending.

2. Monitor Your Expenses

Track your expenses throughout the month to see if you're staying within your limits:

- Real-Time Tracking: Use apps or a notebook to jot down expenses as they occur.

- Weekly Reviews: Spend some time each week to update your worksheet and assess your financial health.

3. Analyze and Adjust

At the end of the month, compare your projected expenses with your actual expenses:

- Identify Overspending: See where you went over budget and consider why.

- Adjust Budgets: Modify your budget limits based on your analysis.

The Benefits of Long-Term Tracking

Tracking your expenses over time offers several long-term benefits:

1. Financial Trend Analysis

Observe how your expenses change over months or years:

- Inflation Impact: Understand how inflation affects your spending power.

- Spending Habits: Recognize changes in your financial behavior.

2. Better Financial Planning

With historical data, you can:

- Set Realistic Goals: Plan your financial goals with actual data in mind.

- Build a Stronger Emergency Fund: Understand how much you need to save to cover unforeseen expenses.

In this final part, we summarize the key points of using a monthly expenses worksheet for effective budgeting: Using a monthly expenses worksheet provides invaluable insights into your financial health, allowing you to make informed decisions, curb unnecessary spending, and plan for the future. Whether you're saving for a vacation, managing debt, or building an emergency fund, this tool helps bring clarity and control to your financial life. Keep updating your worksheet regularly, analyze your spending habits, and adjust your budget as your life changes. With time, this practice will become second nature, contributing to your financial stability and growth.

What if I miss recording some expenses during the month?

+

It’s common to miss recording some expenses. At the end of the month, go through your receipts, bank statements, or use financial apps to capture any missed expenses. Over time, you’ll get better at this tracking process.

How do I handle irregular expenses in my monthly budget?

+

Set aside money for these irregular expenses by calculating their annual cost and dividing it by 12. This way, you save monthly for expenses like insurance or holiday gifts, making them less burdensome when they come due.

Can I use a digital version of the worksheet?

+Absolutely! Digital tools like Google Sheets, Excel, or budgeting apps allow for real-time updates, automatic calculations, and easy modification. Choose the format that best suits your lifestyle and tracking needs.