5 Montana Paycheck Tips

Introduction to Montana Paycheck Tips

When it comes to managing your finances, understanding your paycheck is crucial. In Montana, as in other states, knowing how to navigate the intricacies of your paycheck can help you make informed decisions about your financial health. This guide will walk you through five essential tips to help Montanans better understand and manage their paychecks.

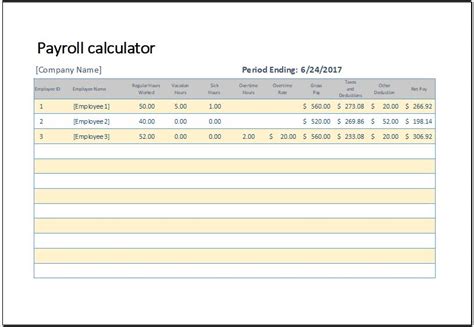

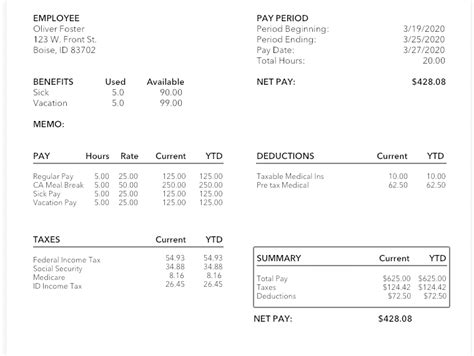

Tip 1: Understand Your Pay Stub

The first step in managing your paycheck is to understand what’s on your pay stub. Your pay stub is more than just a piece of paper or an electronic document; it’s a detailed breakdown of your earnings and deductions. Here are the key components to look for: - Gross Pay: The total amount of money you earned before any deductions. - Net Pay: The amount of money you take home after all deductions have been made. - Taxes: Includes federal, state, and local taxes withheld. - Benefits and Deductions: This can include health insurance, retirement savings, and other deductions such as life insurance or union dues.

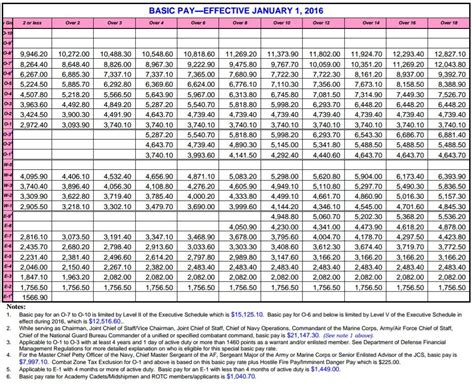

Tip 2: Manage Your Taxes

Taxes are a significant part of your paycheck deductions. Understanding how taxes work and how they affect your net pay is vital. Montana has a progressive income tax system, with rates ranging from 1% to 6.9%. It’s essential to review your tax withholding to ensure you’re not overpaying or underpaying your taxes. If you’re getting a large refund, it might be a sign that you’re having too much withheld, and you might consider adjusting your withholding.

Tip 3: Leverage Benefits and Deductions

Many employers offer benefits that can be deducted from your paycheck, such as health insurance, retirement plans (like 401(k) or IRA), and flexible spending accounts (FSAs). These deductions can reduce your taxable income, thereby reducing the amount of taxes you owe. For example, contributing to a retirement plan not only saves you money on taxes but also helps you build a nest egg for the future.

Tip 4: Plan for Retirement

Planning for retirement is a long-term investment in your financial future. Montana, like other states, encourages its residents to save for retirement through various plans. Here are some ways to plan for retirement: - Contribute to a 401(k) or Similar Plan: If your employer offers a 401(k) plan, consider contributing, especially if they match your contributions. This is essentially free money that can significantly boost your retirement savings. - Consider an IRA: If your employer doesn’t offer a retirement plan, or if you’re self-employed, an Individual Retirement Account (IRA) can be a good alternative. - Automate Your Savings: Set up automatic transfers from your paycheck or bank account to your retirement account to make saving easier and less prone to being neglected.

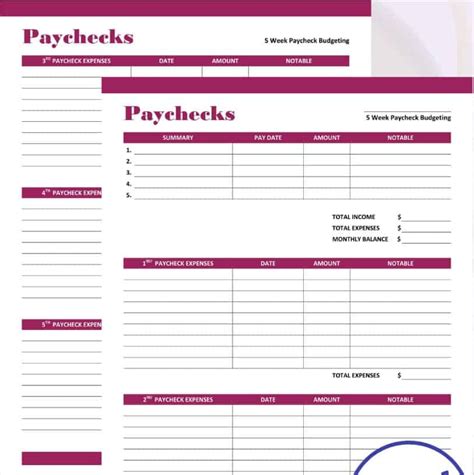

Tip 5: Monitor and Adjust

Financial situations can change rapidly. It’s crucial to regularly review your paycheck and adjust as necessary. This includes: - Checking for Errors: Ensure your pay stub is accurate, and all deductions are correct. - Adjusting Withholding: If you’ve had a change in income, marital status, or number of dependents, you may need to adjust your tax withholding. - Reviewing Benefits: Periodically review the benefits you’re enrolled in to ensure they still align with your needs and budget.

💡 Note: Regularly reviewing your paycheck and making adjustments as needed can help you stay on top of your finances and avoid any potential issues down the line.

In the end, managing your paycheck effectively is about being informed and proactive. By understanding your pay stub, managing your taxes, leveraging benefits, planning for retirement, and monitoring your finances, you can make the most of your hard-earned money and secure a stronger financial future in Montana.

What is the difference between gross pay and net pay?

+

Gross pay is the total amount earned before deductions, while net pay is the amount taken home after all deductions, including taxes and benefits, have been made.

How do I adjust my tax withholding?

+

You can adjust your tax withholding by submitting a new W-4 form to your employer. This form allows you to claim allowances and make other adjustments to change the amount of taxes withheld from your paycheck.

What are the benefits of contributing to a retirement plan?

+

Contributing to a retirement plan, such as a 401(k), can reduce your taxable income, lower your tax bill, and help you save for retirement. Many employers also match contributions, which can significantly boost your retirement savings.