Montana Paycheck Calculator Tool

Introduction to Montana Paycheck Calculator Tool

The Montana Paycheck Calculator Tool is a valuable resource for individuals and businesses in Montana to calculate the accuracy of their paychecks. This tool takes into account the various factors that affect take-home pay, including gross income, tax deductions, and benefits. With the Montana Paycheck Calculator Tool, users can ensure that their paychecks are accurate and compliant with state and federal regulations.

How the Montana Paycheck Calculator Tool Works

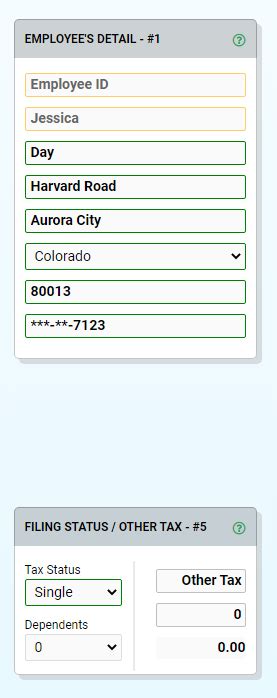

The Montana Paycheck Calculator Tool is a user-friendly online application that requires users to input their relevant payroll information. This includes: * Gross income: The total amount of money earned before taxes and deductions * Tax filing status: The user’s marital status and number of dependents * Number of allowances: The number of exemptions claimed on the user’s tax return * Pay frequency: The frequency at which the user receives their paycheck (e.g., biweekly, monthly) Once the user inputs this information, the tool calculates the net pay (take-home pay) by subtracting taxes, deductions, and other withholdings from the gross income.

Benefits of Using the Montana Paycheck Calculator Tool

The Montana Paycheck Calculator Tool offers several benefits to users, including: * Accuracy: The tool ensures that paychecks are accurate and compliant with state and federal regulations * Convenience: The tool is easy to use and provides quick results * Flexibility: The tool allows users to calculate paychecks for different scenarios, such as changes in income or tax filing status * Compliance: The tool helps users ensure that their paychecks are compliant with state and federal regulations, reducing the risk of penalties and fines

Features of the Montana Paycheck Calculator Tool

The Montana Paycheck Calculator Tool includes several features that make it a valuable resource for users, including: * Tax tables: The tool uses the latest tax tables to ensure accurate calculations * Automatic updates: The tool is updated regularly to reflect changes in tax laws and regulations * Customizable: The tool allows users to customize their calculations based on their individual needs * Printable results: The tool provides printable results, making it easy for users to keep a record of their calculations

Example Use Cases for the Montana Paycheck Calculator Tool

The Montana Paycheck Calculator Tool can be used in a variety of scenarios, including: * New hire: The tool can be used to calculate the paycheck for a new employee * Pay raise: The tool can be used to calculate the paycheck for an employee who has received a pay raise * Change in tax filing status: The tool can be used to calculate the paycheck for an employee who has experienced a change in tax filing status (e.g., marriage, divorce) * Change in benefits: The tool can be used to calculate the paycheck for an employee who has experienced a change in benefits (e.g., health insurance, 401(k))

📝 Note: The Montana Paycheck Calculator Tool is for informational purposes only and should not be used as a substitute for professional tax advice.

Using the Montana Paycheck Calculator Tool for Business

The Montana Paycheck Calculator Tool can also be used by businesses to calculate the accuracy of their employees’ paychecks. This can help businesses ensure that they are compliant with state and federal regulations and reduce the risk of penalties and fines. The tool can also be used to calculate the cost of benefits and other withholdings for employees.

| Gross Income | Tax Deductions | Net Pay |

|---|---|---|

| $50,000 | $10,000 | $40,000 |

| $75,000 | $15,000 | $60,000 |

Best Practices for Using the Montana Paycheck Calculator Tool

To get the most out of the Montana Paycheck Calculator Tool, users should follow these best practices: * Use accurate information: Users should input accurate information to ensure accurate calculations * Use the latest tax tables: Users should ensure that they are using the latest tax tables to ensure accurate calculations * Customize calculations: Users should customize their calculations based on their individual needs * Keep records: Users should keep a record of their calculations for future reference

In summary, the Montana Paycheck Calculator Tool is a valuable resource for individuals and businesses in Montana to calculate the accuracy of their paychecks. By using this tool, users can ensure that their paychecks are accurate and compliant with state and federal regulations. The tool is user-friendly, customizable, and provides printable results. By following best practices and using the tool correctly, users can get the most out of the Montana Paycheck Calculator Tool.

What is the Montana Paycheck Calculator Tool?

+

The Montana Paycheck Calculator Tool is an online application that calculates the accuracy of paychecks for individuals and businesses in Montana.

How does the Montana Paycheck Calculator Tool work?

+

The tool requires users to input their relevant payroll information, including gross income, tax filing status, and number of allowances, and then calculates the net pay by subtracting taxes, deductions, and other withholdings.

What are the benefits of using the Montana Paycheck Calculator Tool?

+

The tool offers several benefits, including accuracy, convenience, flexibility, and compliance with state and federal regulations.