5 Fun Money Worksheets for 2nd Grade Kids

In a world where financial literacy is becoming increasingly important, teaching kids the value of money at a young age can be both educational and entertaining. Second grade is a perfect time to introduce basic financial concepts in a fun and engaging way. This blog post will explore five engaging money worksheets tailored for 2nd grade students, designed to make learning about money both fun and meaningful.

The Basics of Money

Before diving into worksheets, it’s crucial for kids to understand what money is, its different forms, and its basic purpose. Here’s how you can start:

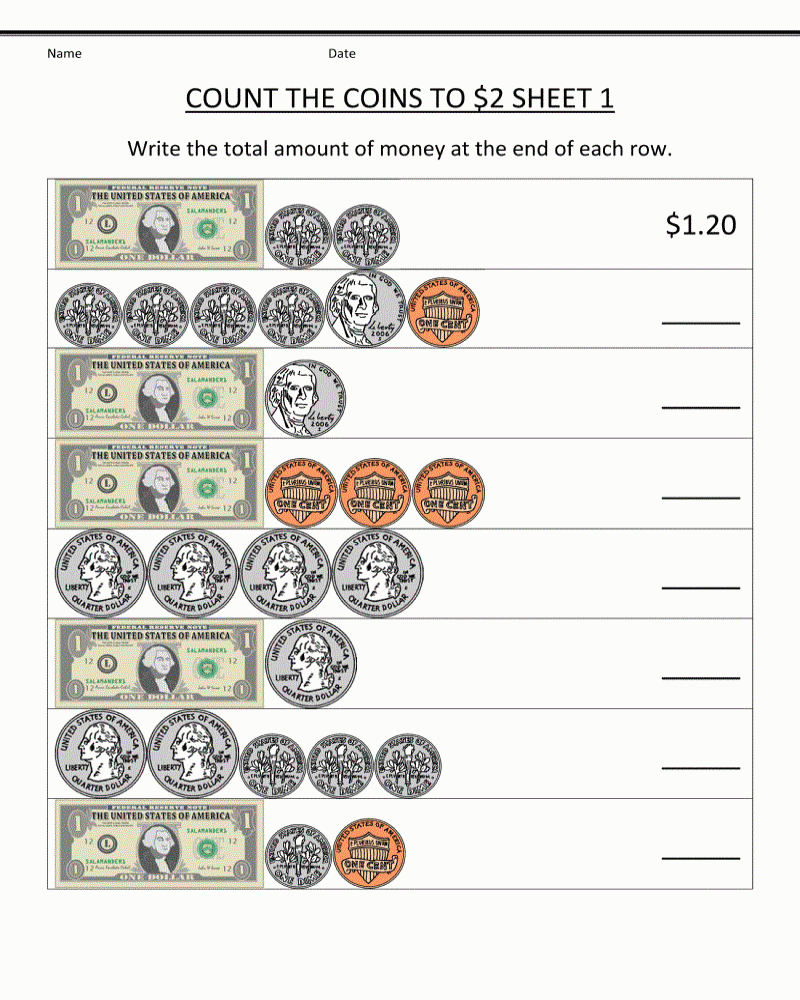

- Introduce coins and bills: Familiarize children with various coins and dollar bills, their values, and the appearance.

- Explain the concept of buying: Discuss how money is used to buy things, emphasizing that goods and services come with a cost.

- Counting practice: Use everyday situations to practice counting money. For example, give them a small amount of play money and ask them to count it.

Worksheet 1: Coin Matching

This worksheet focuses on recognizing and matching different coins:

- Include images of penny, nickel, dime, and quarter on one side of the page.

- Ask children to draw lines connecting each coin to its name and value.

- To add fun, include a treasure hunt element where kids find the coins in an illustration.

💡 Note: This worksheet helps in visual recognition and fine motor skill development through matching activities.

Worksheet 2: Dollar Bill Scramble

The Dollar Bill Scramble worksheet is designed to teach children about:

- The different dollar denominations they might encounter.

- Scrambled images of 1, 5, 10, and 20 bills for them to unscramble.

- Identifying bills by appearance and value.

| Scrambled Image | Correct Image | Value | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

1</td> </tr> <tr> <td><img src="5dollar_scramble.jpg" alt="Scrambled 5 bill” width=“50%”> |  |

5</td> </tr> <tr> <td><img src="10dollar_scramble.jpg" alt="Scrambled 10 bill” width=“50%”> |  |

10</td> </tr> <tr> <td><img src="20dollar_scramble.jpg" alt="Scrambled 20 bill” width=“50%”> |  |

$20 |

🔍 Note: This activity encourages problem-solving and increases familiarity with dollar bills.

Worksheet 3: Shopping Spree

Encourage practical application with this worksheet:

- Create a mock store with prices on various items.

- Give children play money to “buy” items from the store.

- Tasks include:

- Matching the money amount with the price of an item.

- Calculating change or additional money needed if they don’t have enough.

- Ensuring they understand the concept of making purchases within a budget.

Worksheet 4: Piggy Bank Puzzle

This interactive worksheet focuses on saving money:

- Design a puzzle where kids fill in the piggy bank with coins.

- Include tasks like:

- Counting coins to reach a certain amount.

- Coloring coins or small dollar bills according to instructions.

- Filling in the piggy bank with saved money and calculating the total saved.

🌟 Note: This worksheet promotes the idea of saving and the patience involved in accumulating money.

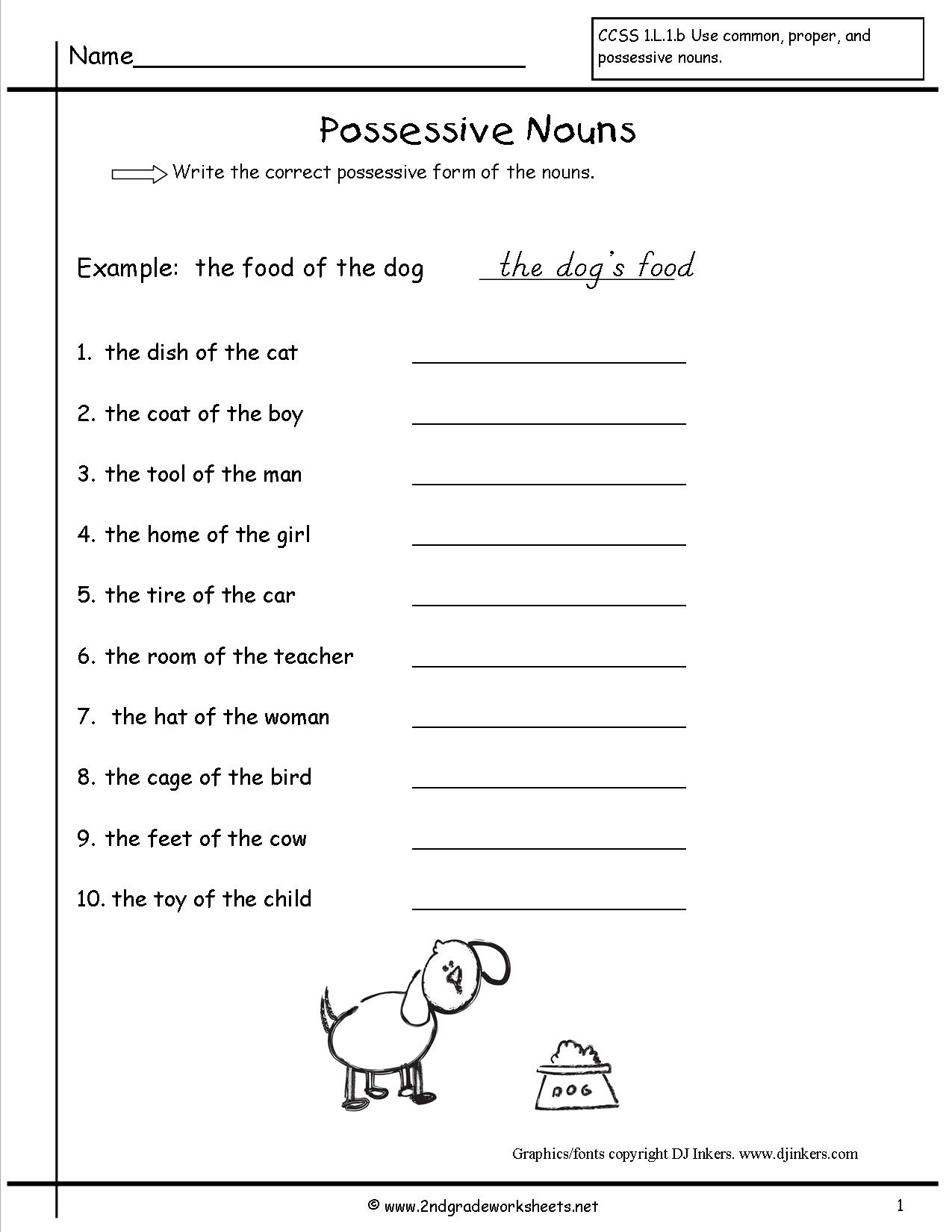

Worksheet 5: Fun with Fractions

Introduce basic fractions through money:

- Worksheet where kids divide money into parts:

- Give a total amount of money, and ask them to show it in different coin combinations.

- Introduce basic fractions: how many cents make up different dollar amounts.

- Promote problem-solving with questions like: “If you have $1, how much is 1⁄2 or 1⁄4 of that?”

Incorporating these worksheets into your teaching will not only educate your children about money management but also spark their interest in financial literacy through engaging activities. By understanding coins and bills, participating in shopping scenarios, saving, and exploring fractions, 2nd graders will build a solid foundation for future financial understanding.

Remember, financial literacy is not just about knowing how much things cost but about understanding the value of money, the importance of saving, and how to budget. With these worksheets, you're not just teaching kids about money; you're laying the groundwork for a lifelong understanding of financial responsibility and economic principles.

Why is financial education important for young children?

+

Financial education helps children understand the value of money, develop responsible financial habits, and prepares them for making informed financial decisions as adults.

How can parents make learning about money fun?

+

Parents can use games, puzzles, and interactive activities to make learning about money an enjoyable experience. Incorporating money-themed board games or setting up a mock store at home can be particularly engaging.

At what age should children start learning about money?

+

Children can start learning about money as early as age 3-4 through basic concepts like coins and bills. More complex ideas like budgeting and saving can be introduced around ages 6-8.