Money Mentors Worksheets: Financial Wisdom for Kids

Money Mentors Worksheets are an excellent resource for teaching children the fundamentals of financial literacy. Through engaging activities and practical exercises, these worksheets provide a structured approach to instill financial wisdom in young minds. This blog post delves into the importance of financial education for kids, how to effectively use these worksheets, and the long-term benefits for your children's financial health.

The Importance of Early Financial Education

Financial literacy is more than just understanding how to save or spend money; it’s about fostering a mindset that empowers children to make informed decisions throughout their lives. Here are some key reasons why starting financial education early is crucial:

- Habit Formation: Studies show that many financial habits are formed by age seven. Early education helps in cultivating positive financial behaviors.

- Empowerment: Understanding money gives children control over their finances, reducing future financial stress.

- Confidence: Knowledge about money matters can boost a child’s confidence in managing personal finances and making economic decisions.

- Future Preparedness: Early financial education equips kids with the skills necessary to navigate the complex financial systems of adulthood.

By using Money Mentors Worksheets, you’re not just teaching them about coins and notes; you’re shaping their future financial well-being.

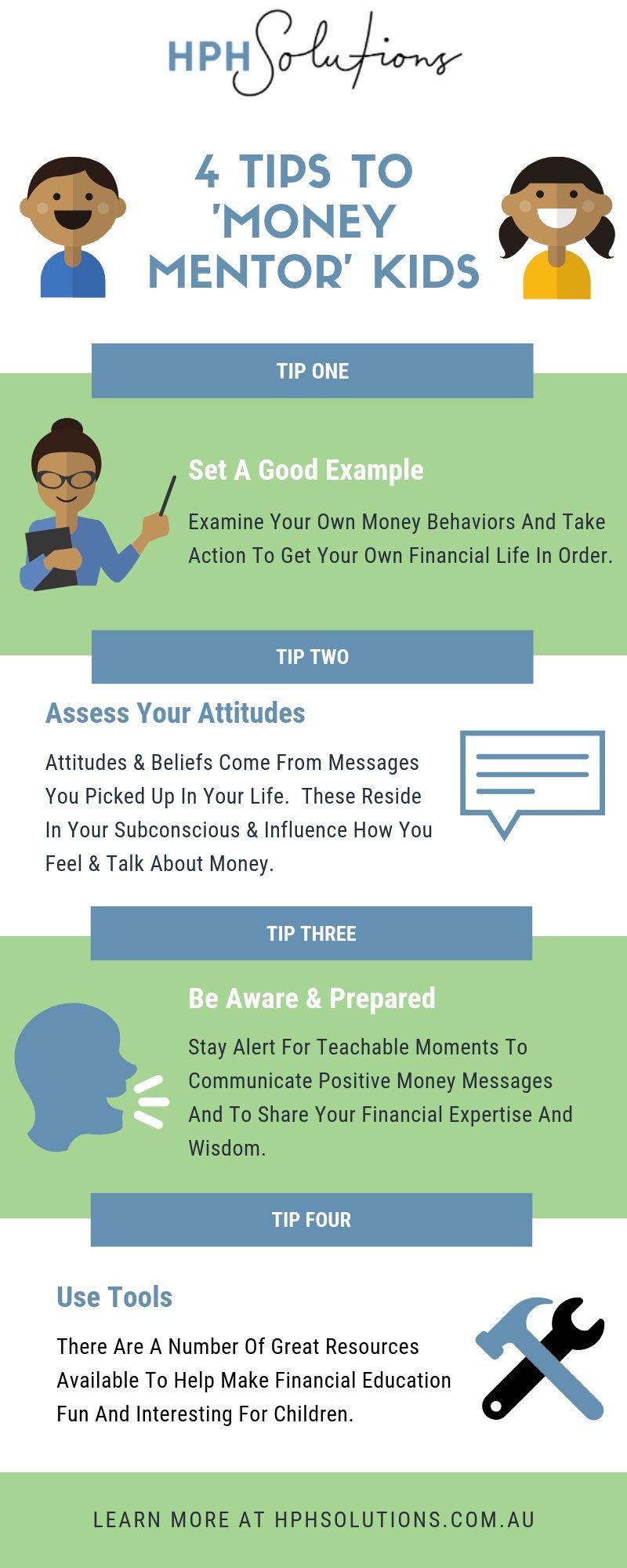

How to Use Money Mentors Worksheets Effectively

Here are steps to make the most out of these educational tools:

1. Age Appropriateness

Begin with worksheets that match your child’s age and cognitive development:

- For younger children (ages 5-8), use worksheets focused on identifying coins, counting money, and basic budgeting.

- For older kids (ages 9-12), worksheets can include concepts like saving, spending wisely, and simple interest.

- Teenagers can engage with advanced topics like compound interest, credit, taxes, and investing.

2. Set Financial Goals

Involve your child in setting short-term and long-term financial goals. Use worksheets to:

- Plan for purchases or savings targets.

- Track progress towards their goals.

3. Incorporate Daily Life

Link the lessons from the worksheets to real-world scenarios:

- Use grocery shopping as an opportunity to discuss budgeting and comparing prices.

- Encourage kids to save up for toys or gadgets, applying concepts like delayed gratification.

4. Make It Fun

Financial education doesn’t have to be dry:

- Create treasure hunts with ‘coins’ to teach the value of money.

- Use games like Monopoly or apps designed for financial education to make learning interactive.

5. Review and Reflect

After completing worksheets, review the lessons:

- Ask open-ended questions about what they learned.

- Encourage them to share insights or any new understanding they’ve gained.

💡 Note: It's important not to rush through the worksheets but to ensure each lesson is absorbed and understood by the child.

Long-Term Benefits of Financial Education

Investing time in teaching children about money using tools like Money Mentors Worksheets yields multiple long-term advantages:

1. Improved Money Management Skills

Kids who learn early:

- Budget and save better.

- Are less likely to incur excessive debt in adulthood.

- Make more informed investment decisions.

2. Financial Independence

Financially literate individuals are:

- More likely to achieve financial independence.

- Able to manage their finances without relying on others.

- Prepared to face economic downturns with resilience.

3. Enhanced Decision Making

Financial education improves:

- Critical thinking when it comes to financial choices.

- The ability to weigh costs and benefits.

- Decision-making skills applicable in various life situations.

4. Generational Wealth Creation

Understanding money can:

- Lead to better wealth accumulation strategies.

- Promote a cycle of financial education within families.

- Contribute positively to society by fostering economic growth.

In conclusion, Money Mentors Worksheets serve as a foundation for building a financially savvy future. By engaging with these resources, children learn the practical application of financial concepts, setting them on a path towards fiscal responsibility and prosperity. It's an investment in their future, providing them with the tools to navigate the complexities of personal finance with confidence and competence.

What age is appropriate to start using Money Mentors Worksheets?

+

Money Mentors Worksheets can be introduced as early as age 5, focusing on basic money identification and counting. Each age group has tailored activities suitable for their developmental stage.

How often should I go through the worksheets with my child?

+The frequency can vary, but generally, a weekly session ensures the child absorbs the material while keeping it engaging and not overwhelming.

Can these worksheets be used in schools?

+Yes, Money Mentors Worksheets are versatile enough for classroom use, supporting teachers in delivering financial education effectively.