5 Fun Money Math Worksheets for Kids

Money management is an essential skill that we often overlook when educating our children. It's not just about knowing how much change to give back; it's about understanding the value of money, the process of budgeting, and making wise financial decisions. To make learning about money engaging, we can turn to math worksheets that blend education with fun. Here, I'll share five exciting and interactive money math worksheets designed for kids, perfect for both home learning and classroom activities.

Payday Pocket Money

The concept of earning money is something that many children grasp as they grow. This worksheet introduces kids to the idea of earning and managing pocket money. Here’s how it works:

- Create a scenario where children receive weekly pocket money.

- List expenses and potential savings, giving children a choice on how to spend or save their money.

- Include real-life scenarios like buying toys, saving for a special item, or contributing to charity.

By simulating a ‘payday’, children learn the basics of income and expenses, setting a foundation for understanding budgeting. They’ll need to:

- Calculate how much money they can spend and how much they should save.

- Make trade-offs between immediate purchases and long-term savings goals.

💡 Note: Encourage kids to use real or play money to make the experience more tangible.

Spending to Win

This game-based worksheet turns spending money into a strategic challenge. Here’s the setup:

- Provide a budget and a list of items with different costs and point values.

- Children must buy items to collect points but must stay within their budget.

They need to:

- Identify which items offer the best value for points within their spending limits.

- Learn about prioritizing purchases, strategic thinking, and basic economics.

| Item | Cost ($) | Points |

|---|---|---|

| Toy Car | 5 | 20 |

| Book | 3 | 15 |

| Candy | 1 | 5 |

💡 Note: Make this worksheet interactive by letting children draw or cut out images of the items they buy to make the experience visual.

Mystery Box Math

This worksheet engages children with an element of surprise, ideal for reinforcing money-counting skills. Here’s the concept:

- Children receive a ‘Mystery Box’ with unknown items inside, each with a price tag.

- They must calculate how much money they need to ‘buy’ the mystery box and then reveal the items inside to see if they’ve got a good deal.

By participating, kids will:

- Learn to count and add up money quickly.

- Practice mental arithmetic and learn to estimate costs.

Budget Balancing Board

This activity teaches the importance of balancing a budget with visual appeal:

- Provide a virtual or physical board divided into categories like savings, spending, and giving.

- Children receive a ‘monthly income’ in the form of play money or credits and must allocate it.

Through this exercise, children will:

- Learn to allocate funds according to their needs and wants.

- Understand the concept of financial balance and the importance of saving.

💡 Note: Use colorful visual aids to represent different categories, making the activity more engaging.

Money Maze

Finally, let’s challenge kids’ problem-solving skills with a Money Maze:

- Create a maze puzzle where each path leads to different financial outcomes like earning more money, losing some, or finding a deal.

- The goal is to navigate the maze to end up with the most money at the end.

Children will:

- Learn to make financial decisions based on risk and reward.

- Understand that money management involves thinking ahead and planning.

The money maze offers a playful yet profound way to teach financial literacy. Children must analyze and make choices that affect their virtual income, helping them understand the broader implications of money decisions in life.

As we've explored, these five money math worksheets provide children with practical and engaging ways to learn about money. From earning pocket money to navigating a financial maze, each activity offers unique insights into financial literacy. By incorporating these worksheets into your child's learning routine, you're not only teaching them about numbers but also life skills that will serve them well in the future. The key takeaway is the balance between spending, saving, and understanding value, fostering a generation equipped with the financial knowledge to make informed decisions.

Are these worksheets suitable for all age groups?

+

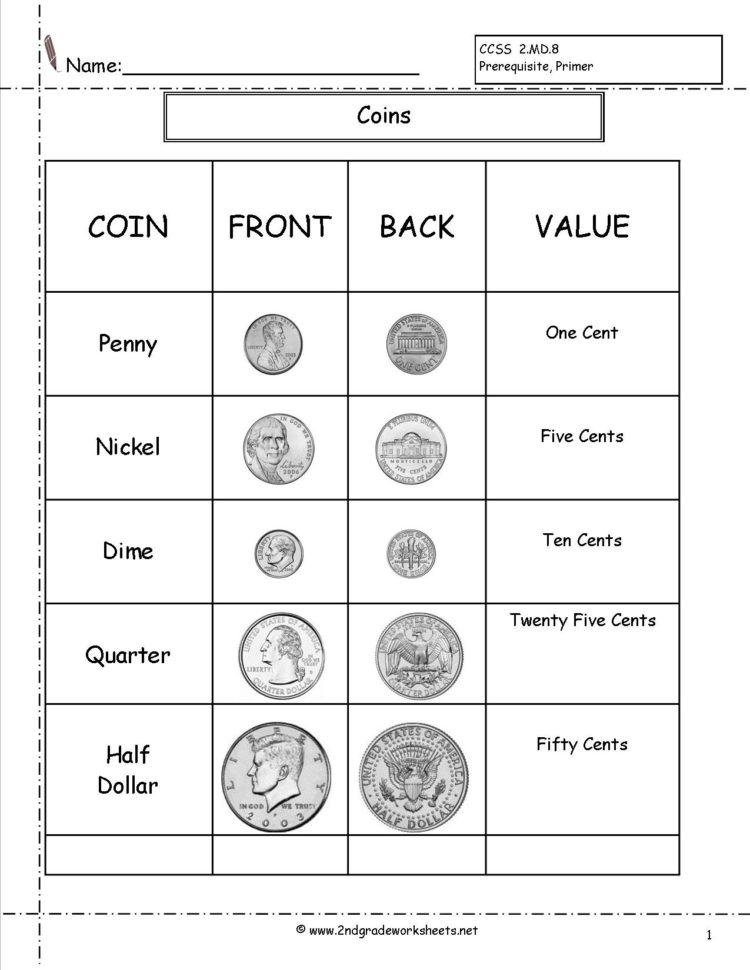

These worksheets can be adapted for different age groups. For younger children, focus on basic counting and recognition of coins, while older children can work on budgeting and more complex arithmetic.

How can I make these worksheets interactive?

+

Use play money, create visual aids, incorporate games, or involve real-life scenarios. Encourage children to physically move items around as they make decisions, enhancing the interactive experience.

Can I use real money with these activities?

+

Using real money can add authenticity to the learning experience. However, ensure supervision to prevent accidents or misuse. Play money is often recommended to keep the focus on learning rather than the value of the money itself.

Do these worksheets teach real financial literacy?

+

Yes, these worksheets introduce fundamental financial concepts like budgeting, saving, spending wisely, and understanding the value of money. They provide a foundation for more complex financial literacy later on.