Monetary Policy Worksheet Answers: Easy Guide for Students

As a student diving into the complexities of economics, understanding monetary policy is paramount. This guide will walk you through what monetary policy is, why it's critical, and how it impacts you. Let's begin with the basics:

What is Monetary Policy?

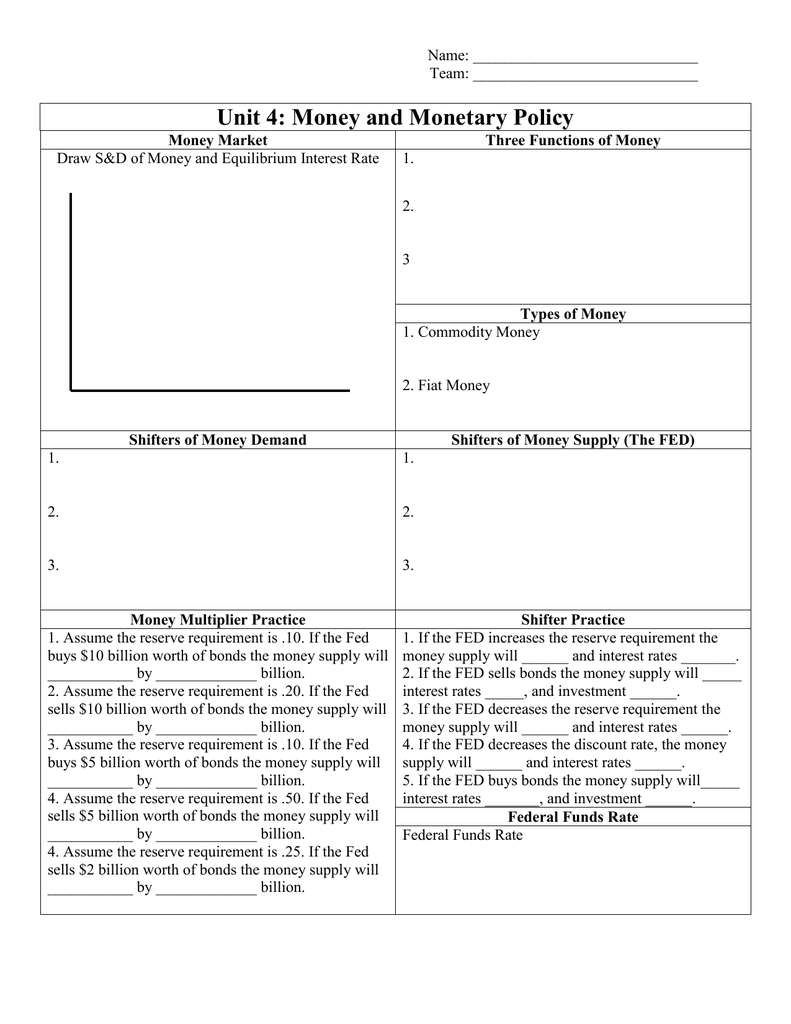

Monetary policy refers to the actions taken by a country's central bank to manage the money supply and influence interest rates. Its primary goal is to achieve economic objectives like controlling inflation, managing employment levels, and promoting stable growth. Here are the key components:

- Interest Rates: Central banks often manipulate interest rates to control economic activity. Lowering rates makes borrowing cheaper, encouraging investment and spending, while raising rates can slow down an overheated economy.

- Reserve Requirements: This dictates the amount of money banks must hold in reserve against deposits, influencing their ability to create loans.

- Open Market Operations: Buying and selling government securities to expand or contract the amount of money in the economy.

💡 Note: Understanding these tools is crucial as they directly affect the liquidity of money in the economy.

How Does Monetary Policy Affect You?

Monetary policy has a direct and indirect impact on everyone:

- Interest Rates: Affects loan rates for mortgages, student loans, and credit cards, influencing your borrowing costs.

- Inflation: If managed well, monetary policy can keep inflation at bay, preserving the value of your money.

- Employment: Through its impact on economic growth, it can influence job availability and wages.

| Aspect | Impact on You |

|---|---|

| Borrowing Costs | Lower rates can make buying a home or financing education more affordable. |

| Savings Returns | Higher interest rates can benefit savers with increased returns. |

| Inflation | Monetary policy aims to stabilize inflation, maintaining your purchasing power. |

| Job Market | It can affect job creation by managing the economic growth rate. |

🌱 Note: Economic stability is the foundation of a secure and prosperous future, making monetary policy essential for everyday life.

Tools of Monetary Policy

Here’s a quick look at the tools central banks employ:

- Open Market Operations (OMO): By buying or selling government bonds, central banks control the amount of money in circulation.

- Discount Rate: The rate at which banks can borrow from the central bank. Lower rates encourage banks to lend more, while higher rates discourage lending.

- Reserve Requirements: Adjusting the percentage of deposits banks must hold influences their lending capacity.

⚙️ Note: Each tool affects the economy differently, and central banks often use a mix of strategies to achieve their targets.

Wrapping Up

Understanding monetary policy is not just about knowing economic terms but recognizing its real-world impacts. From the money in your pocket to the broader economic landscape, every aspect of your life can be influenced by central bank decisions. Here are the key takeaways:

- Monetary policy involves controlling money supply and interest rates to stabilize the economy.

- It uses tools like interest rates, reserve requirements, and open market operations.

- The policy directly impacts your borrowing costs, savings, employment, and purchasing power.

With this knowledge, you can better comprehend economic discussions, make informed financial decisions, and perhaps even engage in more nuanced conversations about economic policy.

What is the difference between monetary and fiscal policy?

+

Monetary policy involves the control of money supply and interest rates by the central bank to manage economic conditions. Fiscal policy, on the other hand, relates to government spending and taxation decisions made by the legislative branch.

How does quantitative easing work?

+

Quantitative easing (QE) is when a central bank buys long-term securities to increase the money supply and encourage lending and investment when conventional monetary policy has become ineffective.

Can monetary policy eliminate inflation?

+

Monetary policy can manage inflation by adjusting interest rates, but it cannot eliminate inflation entirely due to other external and internal factors influencing price levels.