Military

MN Paycheck Calculator Tool

Introduction to MN Paycheck Calculator Tool

The MN Paycheck Calculator Tool is a valuable resource for employees and employers in Minnesota, designed to calculate net pay, gross pay, and tax deductions. This tool takes into account the various tax rates, deductions, and exemptions that apply to Minnesota residents. In this blog post, we will delve into the features and benefits of the MN Paycheck Calculator Tool, and provide a step-by-step guide on how to use it.

Features of the MN Paycheck Calculator Tool

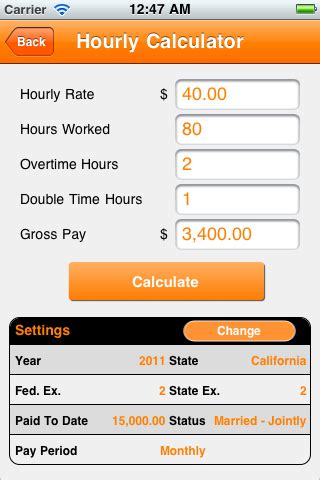

The MN Paycheck Calculator Tool is equipped with the following features: * User-friendly interface: The tool is easy to navigate, making it simple for users to input their data and calculate their paycheck. * Accurate calculations: The tool uses the latest tax tables and regulations to ensure accurate calculations. * Customizable: Users can input their hourly wage, salary, number of dependents, and other relevant information to get a personalized calculation. * Multiple scenarios: Users can calculate their paycheck for different scenarios, such as a raise or a change in marital status.

Benefits of the MN Paycheck Calculator Tool

The MN Paycheck Calculator Tool offers several benefits, including: * Increased accuracy: The tool eliminates the risk of human error, ensuring that calculations are accurate and reliable. * Time-saving: The tool saves users time and effort, as they no longer need to manually calculate their paycheck. * Better financial planning: The tool provides users with a clear understanding of their take-home pay, enabling them to make informed financial decisions. * Compliance with regulations: The tool ensures that users are in compliance with Minnesota tax laws and regulations.

How to Use the MN Paycheck Calculator Tool

To use the MN Paycheck Calculator Tool, follow these steps: * Input your data: Enter your hourly wage, salary, number of dependents, and other relevant information. * Select your filing status: Choose your marital status and number of dependents. * Choose your pay frequency: Select how often you are paid, such as biweekly or monthly. * Calculate your paycheck: Click the calculate button to get your net pay, gross pay, and tax deductions.

📝 Note: It is essential to input accurate data to get a precise calculation.

Tax Rates and Deductions in Minnesota

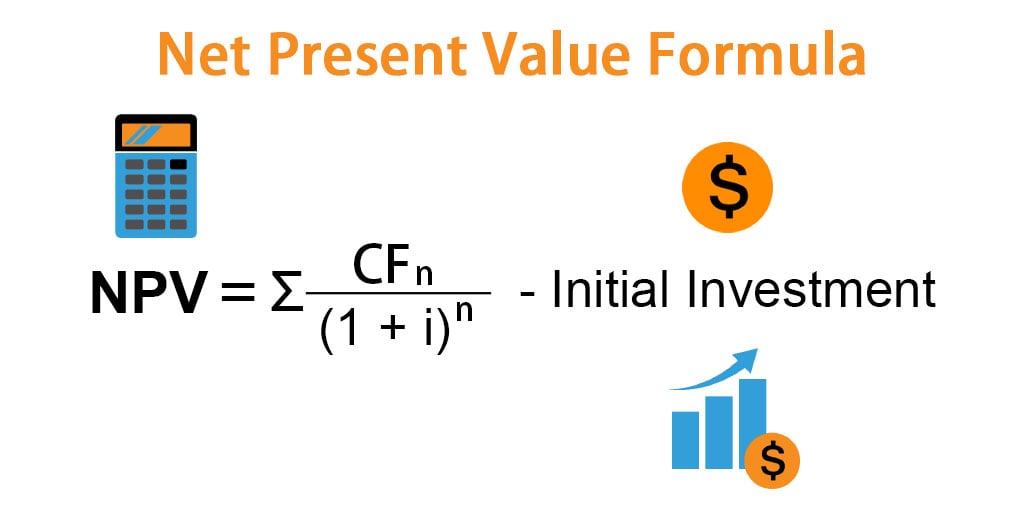

Minnesota has a progressive tax system, with tax rates ranging from 5.35% to 9.85%. The state also offers various tax deductions and exemptions, such as the standard deduction and dependent exemption. The MN Paycheck Calculator Tool takes these tax rates and deductions into account, ensuring that users get an accurate calculation of their take-home pay.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $25,890 | 5.35% |

| $25,891 - $86,260 | 7.05% |

| $86,261 - $164,400 | 7.85% |

| $164,401 and above | 9.85% |

Conclusion and Final Thoughts

In conclusion, the MN Paycheck Calculator Tool is a valuable resource for employees and employers in Minnesota. The tool provides accurate calculations, customizable scenarios, and compliance with regulations. By using the MN Paycheck Calculator Tool, users can gain a better understanding of their take-home pay and make informed financial decisions. Whether you are an employee or an employer, this tool is an essential resource for navigating the complexities of Minnesota tax laws and regulations.

What is the MN Paycheck Calculator Tool?

+

The MN Paycheck Calculator Tool is a resource designed to calculate net pay, gross pay, and tax deductions for employees and employers in Minnesota.

How do I use the MN Paycheck Calculator Tool?

+

To use the MN Paycheck Calculator Tool, input your data, select your filing status, choose your pay frequency, and calculate your paycheck.

What are the tax rates in Minnesota?

+

Minnesota has a progressive tax system, with tax rates ranging from 5.35% to 9.85%.