Missouri Payroll Calculator Tool

Introduction to Missouri Payroll Calculator Tool

The Missouri Payroll Calculator Tool is a comprehensive online resource designed to help employers and employees navigate the complexities of payroll calculations in the state of Missouri. With its user-friendly interface and advanced features, this tool simplifies the process of calculating payroll taxes, deductions, and other essential components of employee compensation. In this article, we will delve into the details of the Missouri Payroll Calculator Tool, exploring its benefits, features, and applications.

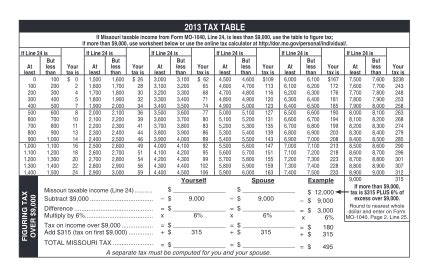

Understanding Missouri Payroll Taxes

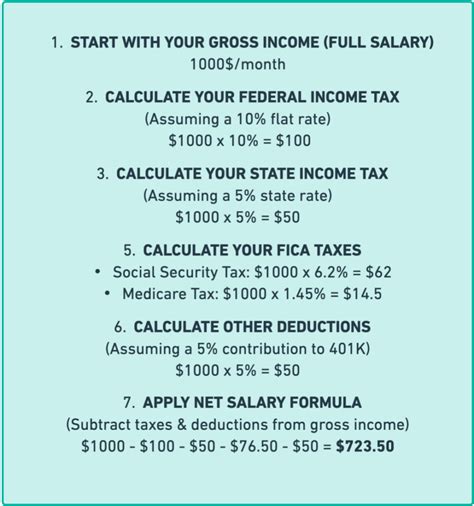

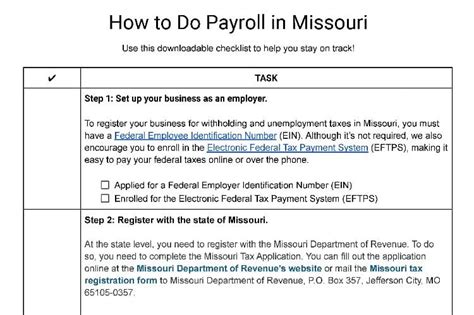

Before diving into the specifics of the Missouri Payroll Calculator Tool, it is essential to understand the basics of payroll taxes in Missouri. The state imposes a range of taxes on employers, including income tax, unemployment tax, and workers’ compensation tax. Employers must also comply with federal tax regulations, including Social Security and Medicare taxes. The Missouri Payroll Calculator Tool takes into account these various taxes and regulations, ensuring that users can accurately calculate their payroll obligations.

Features of the Missouri Payroll Calculator Tool

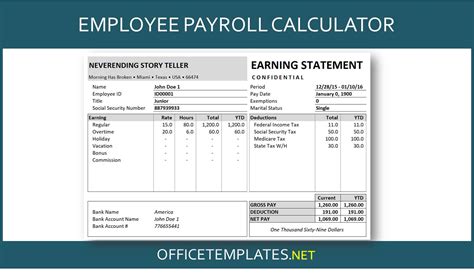

The Missouri Payroll Calculator Tool boasts an array of features that make it an indispensable resource for employers and employees alike. Some of the key features include: * Tax calculations: The tool provides accurate calculations of state and federal taxes, including income tax, unemployment tax, and workers’ compensation tax. * Deductions: Users can input various deductions, such as health insurance premiums, 401(k) contributions, and other benefits. * Gross-to-net calculations: The tool calculates net pay based on gross pay, taking into account all applicable taxes and deductions. * Compliance: The Missouri Payroll Calculator Tool ensures compliance with state and federal regulations, reducing the risk of errors and penalties.

Benefits of Using the Missouri Payroll Calculator Tool

The Missouri Payroll Calculator Tool offers numerous benefits to employers and employees, including: * Accuracy: The tool eliminates the risk of human error, providing accurate calculations and reducing the likelihood of penalties and fines. * Efficiency: The tool streamlines the payroll process, saving time and resources for employers. * Transparency: Employees can use the tool to understand their pay stubs and deductions, promoting transparency and trust. * Compliance: The tool ensures compliance with state and federal regulations, reducing the risk of errors and penalties.

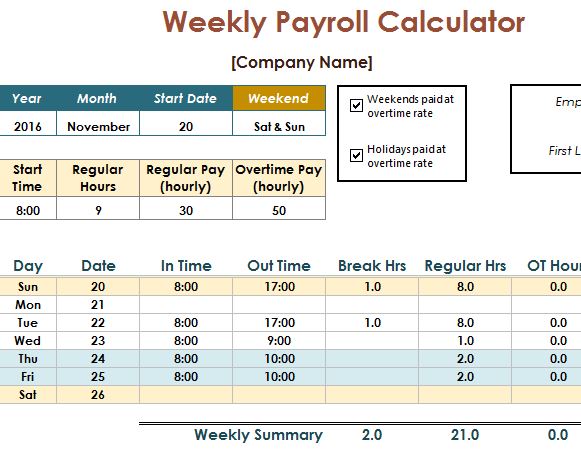

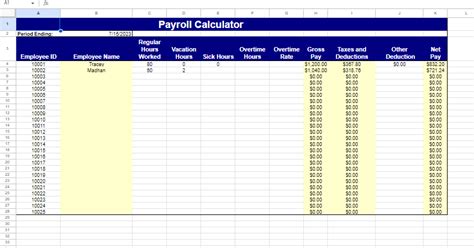

How to Use the Missouri Payroll Calculator Tool

Using the Missouri Payroll Calculator Tool is straightforward and intuitive. Here are the steps to follow: * Input employee information: Users must input basic employee information, including name, address, and Social Security number. * Enter pay rates and hours: Users must enter the employee’s pay rate and hours worked. * Select deductions: Users can select various deductions, such as health insurance premiums and 401(k) contributions. * Calculate taxes: The tool calculates state and federal taxes based on the input information. * Review and print: Users can review the calculations and print out the results for their records.

📝 Note: It is essential to ensure the accuracy of the input information to guarantee accurate calculations.

Applications of the Missouri Payroll Calculator Tool

The Missouri Payroll Calculator Tool has a range of applications, including: * Small business owners: The tool is ideal for small business owners who need to manage payroll for their employees. * HR professionals: HR professionals can use the tool to streamline payroll processes and ensure compliance with regulations. * Employees: Employees can use the tool to understand their pay stubs and deductions, promoting transparency and trust.

| Feature | Description |

|---|---|

| Tax calculations | Accurate calculations of state and federal taxes |

| Deductions | Input various deductions, such as health insurance premiums and 401(k) contributions |

| Gross-to-net calculations | Calculate net pay based on gross pay, taking into account all applicable taxes and deductions |

In summary, the Missouri Payroll Calculator Tool is a powerful resource for employers and employees, providing accurate calculations, streamlining payroll processes, and ensuring compliance with regulations. By understanding the features, benefits, and applications of the tool, users can harness its full potential and simplify their payroll management.

What is the Missouri Payroll Calculator Tool?

+

The Missouri Payroll Calculator Tool is a comprehensive online resource designed to help employers and employees navigate the complexities of payroll calculations in the state of Missouri.

How do I use the Missouri Payroll Calculator Tool?

+

Using the Missouri Payroll Calculator Tool is straightforward and intuitive. Simply input employee information, enter pay rates and hours, select deductions, calculate taxes, and review and print the results.

What are the benefits of using the Missouri Payroll Calculator Tool?

+

The Missouri Payroll Calculator Tool offers numerous benefits, including accuracy, efficiency, transparency, and compliance with state and federal regulations.