5 Minnesota Tax Tips

Introduction to Minnesota Tax Tips

Minnesota, known as the North Star State, is a place of stunning natural beauty and vibrant culture. When it comes to taxes, Minnesota has its own set of rules and regulations that residents and businesses must follow. Understanding these tax laws can help individuals and companies navigate the complex world of taxation, potentially saving them money and avoiding legal issues. In this article, we will explore five key Minnesota tax tips that can help you make the most of your financial situation.

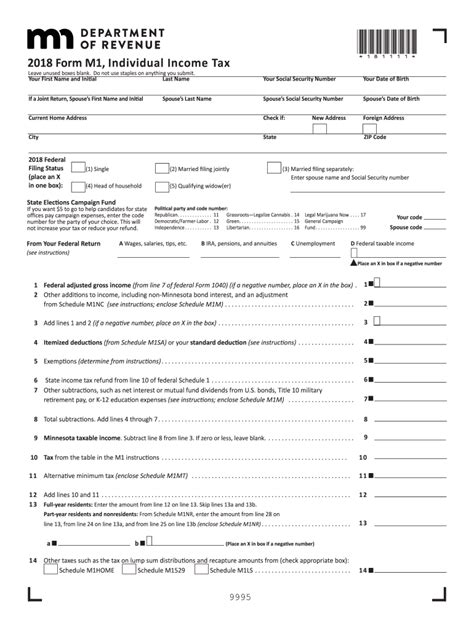

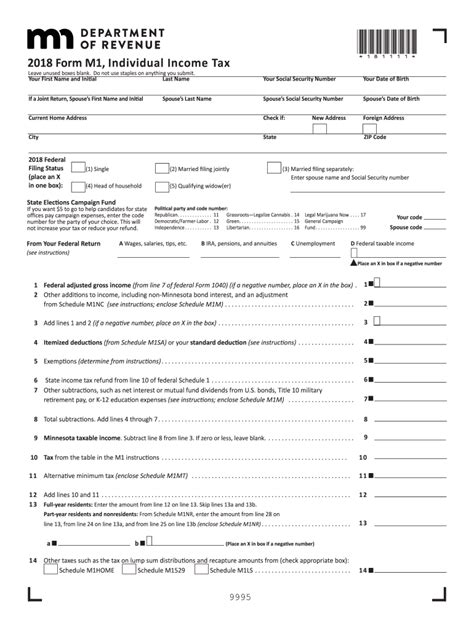

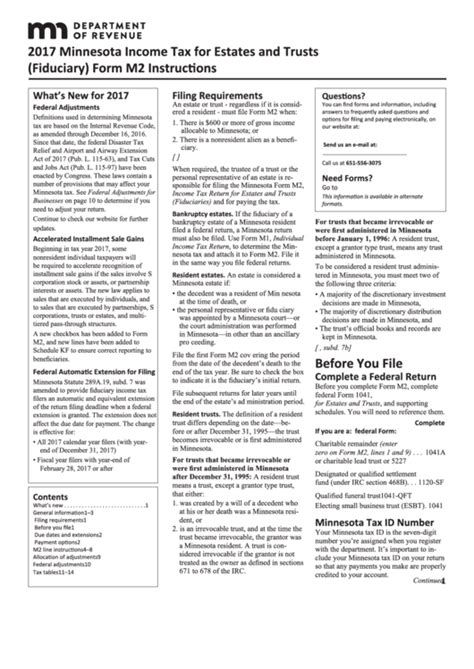

Understanding Minnesota Income Tax

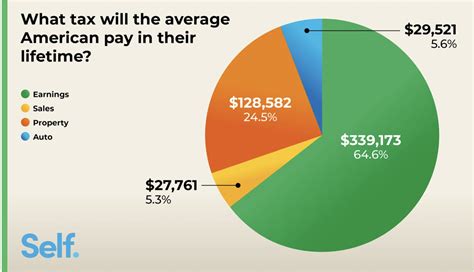

Minnesota has a progressive income tax system, which means that higher-income earners are taxed at a higher rate. The state has several income tax brackets, ranging from 5.35% to 9.85%. It’s essential to understand which tax bracket you fall into and how it affects your take-home pay. Keeping accurate records of your income and expenses can help you maximize your deductions and minimize your tax liability. Additionally, Minnesota allows taxpayers to deduct certain expenses, such as charitable donations and mortgage interest, which can help reduce their taxable income.

Tax Credits for Minnesota Residents

Minnesota offers several tax credits that can help residents reduce their tax liability. One of the most popular tax credits is the Working Family Credit, which provides a refundable credit to low- and moderate-income working families. Other tax credits available in Minnesota include the Dependent Care Credit and the Education Credit. These credits can provide significant savings for eligible taxpayers, so it’s essential to review the eligibility criteria and apply for them if you qualify.

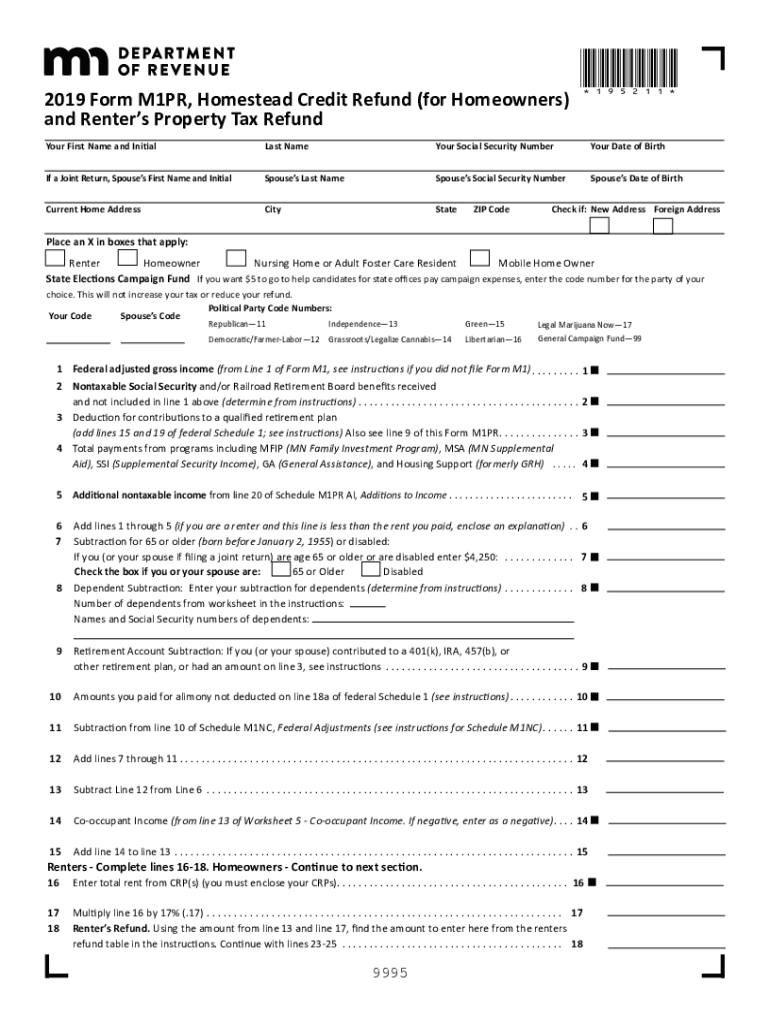

Property Taxes in Minnesota

Property taxes are a significant expense for Minnesota homeowners and businesses. The state has a complex system of property tax classification, which affects the tax rate applied to different types of properties. For example, homestead properties (primary residences) are taxed at a lower rate than non-homestead properties (rental or commercial properties). Understanding how your property is classified and what exemptions are available can help you minimize your property tax liability. Additionally, Minnesota offers several property tax relief programs, such as the Homestead Credit Refund and the Renter’s Credit, which can provide financial assistance to eligible taxpayers.

Minnesota Sales Tax

Minnesota has a statewide sales tax rate of 6.875%, which applies to most goods and services. However, some items are exempt from sales tax, such as groceries and clothing. Additionally, some cities and counties in Minnesota impose a local sales tax, which can increase the overall sales tax rate. Understanding what items are subject to sales tax and what exemptions are available can help you make informed purchasing decisions and avoid unexpected tax liabilities.

Minnesota Tax Audit and Appeals

If you’re selected for a tax audit or disagree with a tax assessment, it’s essential to understand your rights and options. Minnesota taxpayers have the right to appeal a tax decision and request a hearing with the Minnesota Tax Court. It’s crucial to seek professional advice from a tax expert or attorney to ensure you’re prepared for the appeals process and can present a strong case. Additionally, keeping accurate and detailed records of your tax-related documents can help you navigate the audit and appeals process more efficiently.

📝 Note: Tax laws and regulations are subject to change, so it's essential to stay up-to-date with the latest information and consult with a tax professional if you're unsure about any aspect of Minnesota taxation.

As we’ve explored the five key Minnesota tax tips, it’s clear that understanding the state’s tax laws and regulations can help individuals and businesses save money and avoid legal issues. By keeping accurate records, taking advantage of tax credits, and understanding property and sales tax, Minnesota taxpayers can make the most of their financial situation. Whether you’re a resident or a business owner, staying informed about Minnesota taxation can help you navigate the complex world of taxes with confidence.

What is the Minnesota income tax rate?

+

Minnesota has a progressive income tax system with rates ranging from 5.35% to 9.85%.

What tax credits are available in Minnesota?

+

Minnesota offers several tax credits, including the Working Family Credit, Dependent Care Credit, and Education Credit.

How do I appeal a tax decision in Minnesota?

+

If you disagree with a tax assessment, you can appeal to the Minnesota Tax Court and request a hearing.