Minnesota Paycheck Calculator Tool

Introduction to Paycheck Calculators

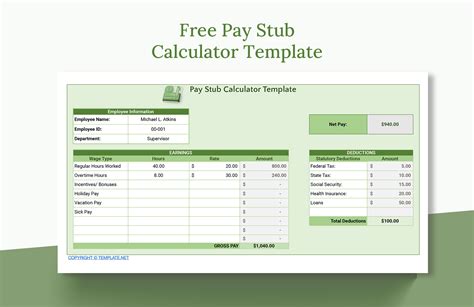

Paycheck calculators are online tools designed to help individuals calculate their take-home pay, also known as net pay, after deducting taxes and other deductions from their gross income. These tools are essential for anyone who wants to understand their payroll and make informed decisions about their finances. In this blog post, we will focus on the Minnesota paycheck calculator tool, exploring its features, benefits, and how it can be used to estimate take-home pay.

Understanding Gross Income and Net Pay

Before diving into the specifics of the Minnesota paycheck calculator, it’s essential to understand the difference between gross income and net pay. Gross income refers to the total amount of money earned by an individual before any deductions are made. This includes salary, wages, tips, and any other form of income. Net pay, on the other hand, is the amount of money that an individual takes home after all deductions have been made. These deductions can include federal and state taxes, social security taxes, health insurance premiums, and other benefits.

Features of the Minnesota Paycheck Calculator Tool

The Minnesota paycheck calculator tool is designed to provide an accurate estimate of take-home pay based on an individual’s gross income and other factors. Some of the key features of this tool include: * Calculation of federal and state income taxes * Calculation of social security taxes and Medicare taxes * Calculation of other deductions, such as health insurance premiums and 401(k) contributions * Ability to enter different types of income, such as salary, wages, and tips * Option to select different filing statuses, such as single or married * Option to select different pay frequencies, such as bi-weekly or monthly

Benefits of Using the Minnesota Paycheck Calculator Tool

Using the Minnesota paycheck calculator tool can provide several benefits, including: * Accurate estimates of take-home pay, allowing individuals to budget and plan their finances more effectively * Convenience, as the tool can be accessed online and used at any time * Flexibility, as the tool allows individuals to enter different types of income and select different filing statuses and pay frequencies * Peace of mind, as individuals can use the tool to ensure that they are taking home the correct amount of money after all deductions have been made

How to Use the Minnesota Paycheck Calculator Tool

Using the Minnesota paycheck calculator tool is relatively straightforward. Here are the steps to follow: * Enter your gross income, including salary, wages, tips, and any other form of income * Select your filing status, such as single or married * Select your pay frequency, such as bi-weekly or monthly * Enter any other deductions, such as health insurance premiums and 401(k) contributions * Click the “calculate” button to estimate your take-home pay

Additional Considerations

When using the Minnesota paycheck calculator tool, there are several additional considerations to keep in mind. These include: * Tax laws and regulations can change, so it’s essential to stay up-to-date with the latest information * Other deductions may not be included in the calculator, such as union dues or charitable contributions * Individual circumstances can affect the accuracy of the calculator, such as self-employment income or investment income

📝 Note: The Minnesota paycheck calculator tool is for estimation purposes only and should not be used as a substitute for professional tax advice.

Minnesota State Taxes

Minnesota has a progressive income tax system, with nine tax brackets ranging from 5.35% to 9.85%. The state also has a number of tax credits and deductions available, including the Working Family Credit and the Dependent Care Credit. When using the Minnesota paycheck calculator tool, it’s essential to understand how these taxes and credits can affect your take-home pay.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $9,550 | 5.35% |

| $9,551 - $20,090 | 7.05% |

| $20,091 - $35,070 | 7.85% |

| $35,071 - $60,390 | 8.85% |

| $60,391 - $120,190 | 9.85% |

In summary, the Minnesota paycheck calculator tool is a valuable resource for anyone who wants to estimate their take-home pay and understand how taxes and other deductions can affect their finances. By following the steps outlined in this blog post and considering the additional factors mentioned, individuals can use the tool to make informed decisions about their money and plan for the future.

To summarize the key points, we have discussed the features and benefits of the Minnesota paycheck calculator tool, how to use the tool, and additional considerations to keep in mind. We have also explored the specifics of Minnesota state taxes and how they can affect take-home pay.

What is the Minnesota paycheck calculator tool?

+

The Minnesota paycheck calculator tool is an online tool designed to help individuals estimate their take-home pay after deducting taxes and other deductions from their gross income.

How do I use the Minnesota paycheck calculator tool?

+

To use the tool, simply enter your gross income, select your filing status and pay frequency, and enter any other deductions. Then, click the “calculate” button to estimate your take-home pay.

What are the tax brackets in Minnesota?

+

Minnesota has a progressive income tax system with nine tax brackets ranging from 5.35% to 9.85%.