Military Spouses Residency Relief Act Benefits

Introduction to the Military Spouses Residency Relief Act

The Military Spouses Residency Relief Act (MSRRA) is a federal law that provides certain benefits and protections to spouses of military personnel. The law, which was enacted in 2009, is designed to alleviate some of the burdens that military spouses face when their spouse is relocated to a different state due to military orders. In this blog post, we will explore the benefits of the MSRRA and how it can impact military spouses.

Background and Purpose of the MSRRA

The MSRRA was created to address the unique challenges that military spouses face when their spouse is relocated to a different state. Military personnel are often required to move to different states or even countries as part of their military service, and their spouses are often forced to relocate with them. This can cause a range of problems, including disruptions to the spouse’s career, education, and personal life. The MSRRA is designed to provide some relief to military spouses by allowing them to maintain their residency in their home state, even if they are required to move to a different state due to their spouse’s military orders.

Benefits of the MSRRA

The MSRRA provides several benefits to military spouses, including: * Exemption from state taxes: Under the MSRRA, military spouses are exempt from paying state taxes on their income in the state where they are living due to their spouse’s military orders. * Right to vote: The MSRRA allows military spouses to maintain their residency in their home state, which means they can continue to vote in that state even if they are living in a different state due to their spouse’s military orders. * Access to in-state tuition: The MSRRA also allows military spouses to access in-state tuition rates at public colleges and universities in the state where they are living, which can help make higher education more affordable. * Protection from double taxation: The MSRRA protects military spouses from being taxed on their income in both the state where they are living and their home state.

Eligibility for MSRRA Benefits

To be eligible for MSRRA benefits, military spouses must meet certain requirements, including: * Their spouse must be a member of the military (including the Army, Navy, Air Force, Marine Corps, and Coast Guard). * They must be married to their spouse at the time of the relocation. * They must be relocated to a different state due to their spouse’s military orders. * They must be living in the state where their spouse is stationed.

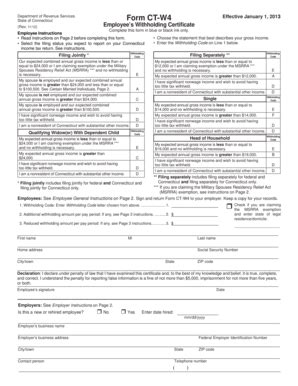

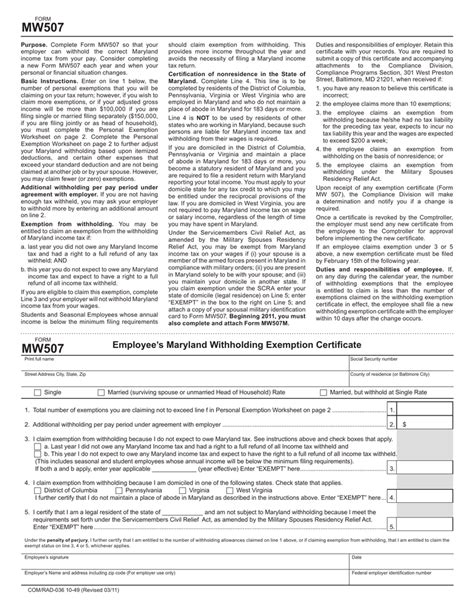

How to Claim MSRRA Benefits

To claim MSRRA benefits, military spouses will need to provide documentation to the state where they are living, including: * A copy of their spouse’s military orders. * A copy of their marriage certificate. * Proof of residency in their home state. * Proof of income.

👉 Note: Military spouses should check with the state where they are living to determine the specific documentation required to claim MSRRA benefits.

Impact of the MSRRA on Military Spouses

The MSRRA has had a significant impact on military spouses, providing them with greater flexibility and freedom to pursue their careers and education without being burdened by the challenges of relocation. By allowing military spouses to maintain their residency in their home state, the MSRRA has helped to reduce the stress and disruption associated with military relocation.

Common Challenges Faced by Military Spouses

Despite the benefits of the MSRRA, military spouses still face a range of challenges, including: * Disruptions to their career: Military spouses often face disruptions to their career due to relocation, which can make it difficult to maintain a consistent income and build a professional network. * Difficulty accessing education and training: Military spouses may face challenges accessing education and training in their field due to relocation, which can make it difficult to advance their career. * Strained relationships: Military spouses may experience strained relationships with their spouse and other family members due to the stress and disruption of relocation.

| Challenge | Impact on Military Spouses |

|---|---|

| Disruptions to career | Difficulty maintaining a consistent income and building a professional network |

| Difficulty accessing education and training | Challenges advancing their career and accessing higher education |

| Strained relationships | Difficulty maintaining healthy relationships with their spouse and other family members |

Conclusion and Final Thoughts

In conclusion, the Military Spouses Residency Relief Act provides important benefits and protections to military spouses, including exemption from state taxes, the right to vote, access to in-state tuition, and protection from double taxation. While the MSRRA has had a significant impact on military spouses, they still face a range of challenges, including disruptions to their career, difficulty accessing education and training, and strained relationships. By understanding the benefits and challenges of the MSRRA, military spouses can better navigate the complexities of military relocation and build a stronger, more resilient life.

What is the Military Spouses Residency Relief Act?

+

The Military Spouses Residency Relief Act is a federal law that provides certain benefits and protections to spouses of military personnel, including exemption from state taxes, the right to vote, access to in-state tuition, and protection from double taxation.

Who is eligible for MSRRA benefits?

+

To be eligible for MSRRA benefits, military spouses must meet certain requirements, including being married to a member of the military, being relocated to a different state due to their spouse’s military orders, and living in the state where their spouse is stationed.

How do I claim MSRRA benefits?

+

To claim MSRRA benefits, military spouses will need to provide documentation to the state where they are living, including a copy of their spouse’s military orders, a copy of their marriage certificate, proof of residency in their home state, and proof of income.