7 Ways Military Retirement Life Insurance Saves You

Understanding Military Retirement Life Insurance

Military retirement life insurance is a valuable benefit offered to military personnel and their families. It provides a tax-free death benefit to beneficiaries, helping to ensure their financial security in the event of the insured’s passing. In this article, we’ll explore the seven ways military retirement life insurance can save you and your loved ones.

1. Tax-Free Benefits

One of the most significant advantages of military retirement life insurance is that the death benefit is tax-free. This means that beneficiaries will not have to pay income tax on the benefits they receive, allowing them to keep more of the money. This can be especially important for families who are already dealing with the emotional and financial challenges of losing a loved one.

💡 Note: It's essential to understand that while the death benefit is tax-free, the premiums paid may be subject to tax.

2. Affordable Premiums

Military retirement life insurance often comes with affordable premiums, making it more accessible to military personnel and their families. The cost of premiums is typically based on the insured’s age, health, and other factors, but the rates are often lower than those offered by civilian insurance companies.

3. Comprehensive Coverage

Military retirement life insurance provides comprehensive coverage that includes a range of benefits, such as:

- A tax-free death benefit

- A waiver of premium benefit, which waives premium payments if the insured becomes totally disabled

- A conversion option, which allows the insured to convert their policy to a different type of insurance

- A loan provision, which allows the insured to borrow against the policy’s cash value

4. Flexibility and Portability

Military retirement life insurance policies are often portable, meaning that the insured can take the policy with them if they leave the military or change jobs. This flexibility is especially important for military personnel who may have careers that involve frequent moves or deployments.

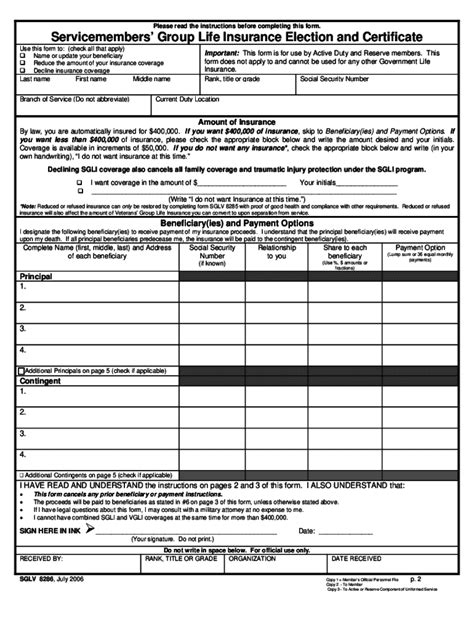

5. Supplemental Coverage

Military retirement life insurance can be used to supplement other life insurance coverage, such as SGLI (Servicemembers’ Group Life Insurance) or VGLI (Veterans’ Group Life Insurance). This can provide additional financial protection for the insured’s beneficiaries and help to ensure their financial security.

6. Cash Value Accumulation

Some military retirement life insurance policies have a cash value component, which allows the insured to accumulate cash value over time. This cash value can be borrowed against or used to pay premiums, providing an additional source of funds in times of need.

7. Survivor Benefits

Finally, military retirement life insurance provides survivor benefits, which can help to ensure the financial security of the insured’s beneficiaries. These benefits can include a monthly annuity payment, a lump sum payment, or a combination of both.

| Benefit | Description |

|---|---|

| Tax-Free Benefits | The death benefit is tax-free, providing more money for beneficiaries. |

| Affordable Premiums | Premiums are often lower than those offered by civilian insurance companies. |

| Comprehensive Coverage | Coverage includes a range of benefits, such as a waiver of premium benefit and a conversion option. |

| Flexibility and Portability | Policies are often portable, allowing the insured to take the policy with them if they leave the military or change jobs. |

| Supplemental Coverage | Policies can be used to supplement other life insurance coverage, such as SGLI or VGLI. |

| Cash Value Accumulation | Some policies have a cash value component, allowing the insured to accumulate cash value over time. |

| Survivor Benefits | Benefits can include a monthly annuity payment, a lump sum payment, or a combination of both. |

In summary, military retirement life insurance provides a range of benefits that can help to ensure the financial security of military personnel and their families. From tax-free benefits to supplemental coverage, these policies offer a comprehensive solution for those who serve our country.

What is military retirement life insurance?

+

Military retirement life insurance is a type of life insurance that is specifically designed for military personnel and their families. It provides a tax-free death benefit to beneficiaries and offers a range of other benefits, such as a waiver of premium benefit and a conversion option.

How much does military retirement life insurance cost?

+

The cost of military retirement life insurance varies depending on a range of factors, including the insured’s age, health, and other factors. However, the premiums are often lower than those offered by civilian insurance companies.

Can I take my military retirement life insurance policy with me if I leave the military?

+

Yes, military retirement life insurance policies are often portable, meaning that the insured can take the policy with them if they leave the military or change jobs.

Related Terms:

- Military Life insurance payout

- Military retirement insurance

- VGLI retired military

- VGLI life insurance

- SGLI Insurance

- SGLI military