2012 Military Pay Rates Explained

Understanding 2012 Military Pay Rates

The military pay scale is a vital aspect of serving in the armed forces. It’s essential to understand how the pay rates work, especially for those who are considering joining the military or are already serving. In this article, we’ll delve into the 2012 military pay rates, explaining the different factors that affect pay, the various pay grades, and how to calculate your take-home pay.

Military Pay Grades

The military uses a pay grade system to determine an individual’s salary. The pay grades are based on a combination of the individual’s rank and time in service. The pay grades are divided into three main categories: Enlisted, Warrant Officer, and Officer.

Enlisted Pay Grades

| Pay Grade | Rank |

|---|---|

| E-1 | Private (PVT) |

| E-2 | Private Second Class (PV2) |

| E-3 | Private First Class (PFC) |

| E-4 | Specialist/Corporal (SPC/CPL) |

| E-5 | Sergeant (SGT) |

| E-6 | Staff Sergeant (SSG) |

| E-7 | Sergeant First Class (SFC) |

| E-8 | Master Sergeant/First Sergeant (MSG/1SG) |

| E-9 | Sergeant Major (SGM) |

Warrant Officer Pay Grades

| Pay Grade | Rank |

|---|---|

| W-1 | Warrant Officer 1 (WO1) |

| W-2 | Chief Warrant Officer 2 (CW2) |

| W-3 | Chief Warrant Officer 3 (CW3) |

| W-4 | Chief Warrant Officer 4 (CW4) |

| W-5 | Chief Warrant Officer 5 (CW5) |

Officer Pay Grades

| Pay Grade | Rank |

|---|---|

| O-1 | Second Lieutenant (2LT) |

| O-2 | First Lieutenant (1LT) |

| O-3 | Captain (CPT) |

| O-4 | Major (MAJ) |

| O-5 | Lieutenant Colonel (LTC) |

| O-6 | Colonel (COL) |

| O-7 | Brigadier General (BG) |

| O-8 | Major General (MG) |

| O-9 | Lieutenant General (LTG) |

| O-10 | General (GEN) |

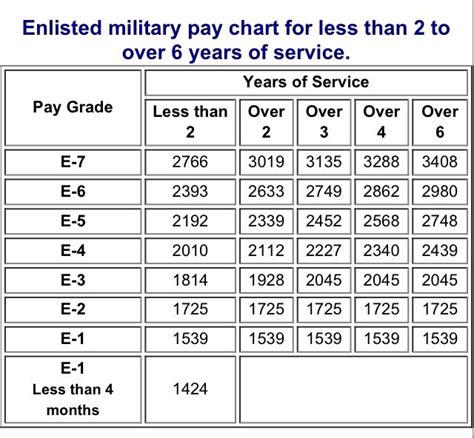

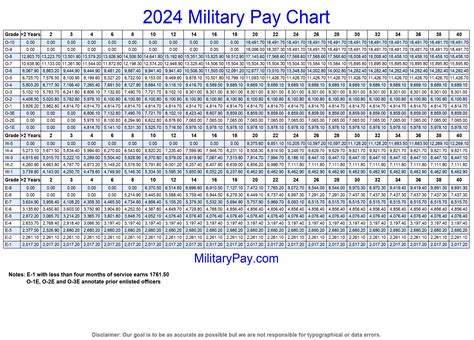

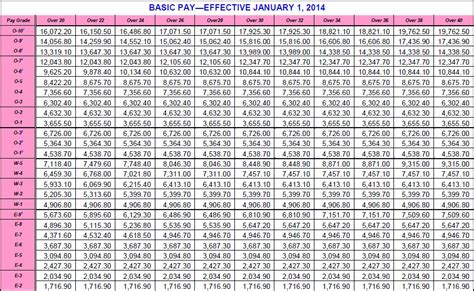

2012 Military Pay Rates

The 2012 military pay rates are based on the fiscal year 2012 budget. The rates are effective from January 1, 2012, to December 31, 2012.

Basic Pay Rates

| Pay Grade | Years of Service |

| <2 | 2 | 4 | 6 | 8 | |

| E-1 | $1,733.10 | $1,733.10 | $1,733.10 | $1,733.10 | $1,733.10 |

| E-2 | $1,899.90 | $1,949.50 | $1,999.10 | $2,048.70 | $2,098.30 |

| E-3 | $2,048.70 | $2,099.30 | $2,150.90 | $2,202.50 | $2,254.10 |

| … | … | … | … | … | … |

Allowances and Special Pays

In addition to basic pay, military personnel may receive allowances and special pays. These include:

- Basic Allowance for Subsistence (BAS): 223.84 per month for enlisted personnel and 246.24 per month for officers.

- Basic Allowance for Housing (BAH): varies by location and pay grade.

- Special Duty Pay: varies by specialty and pay grade.

- Hazardous Duty Pay: $150 per month.

- Jump Pay: $150 per month.

Calculating Take-Home Pay

To calculate your take-home pay, you’ll need to consider your basic pay, allowances, and special pays. Here’s a step-by-step guide:

- Determine your basic pay based on your pay grade and years of service.

- Add your allowances, including BAS and BAH.

- Add any special pays you’re eligible for.

- Calculate your gross income by adding your basic pay, allowances, and special pays.

- Subtract any taxes and deductions to determine your take-home pay.

📝 Note: The above rates and calculations are for illustration purposes only. Actual pay rates and calculations may vary depending on individual circumstances.

Conclusion

Understanding the 2012 military pay rates is essential for anyone serving in the armed forces. By knowing your pay grade, basic pay, allowances, and special pays, you can calculate your take-home pay and plan your finances accordingly. Remember to consider all the factors that affect your pay, including your rank, time in service, and location.

What is the difference between basic pay and allowances?

+

Basic pay is the monthly salary paid to military personnel based on their pay grade and years of service. Allowances, on the other hand, are additional forms of compensation provided to help military personnel cover the costs of living, including food and housing.

How do I calculate my take-home pay?

+

To calculate your take-home pay, start by determining your basic pay based on your pay grade and years of service. Then, add your allowances, including BAS and BAH. Next, add any special pays you’re eligible for. Finally, subtract any taxes and deductions to determine your take-home pay.

What is the purpose of special duty pay?

+

Special duty pay is a form of compensation provided to military personnel who perform specific duties or serve in certain specialties. The purpose of special duty pay is to recognize and reward military personnel for their unique contributions to the armed forces.

Related Terms:

- 2013 Military Pay Chart

- 2011 Military pay Chart

- Military Pay chart 2024

- Military Pay Chart 2014

- 2009 military pay chart

- 2010 military pay Chart