5 Key Pay Differences for Military Married vs Single

Financial Implications of Marriage in the Military

Being in the military comes with unique financial benefits and challenges. When it comes to marriage, the financial implications can be significant. Military personnel who are married may receive additional benefits and pay, but there are also some key differences in pay between military married and single personnel.

Basic Allowance for Housing (BAH)

One of the main differences in pay between military married and single personnel is the Basic Allowance for Housing (BAH). BAH is a tax-free allowance that is paid to military personnel to help cover the cost of housing. Married military personnel typically receive a higher BAH rate than single personnel, especially if they have dependents. For example, a married E-4 with dependents in the Army would receive a higher BAH rate than a single E-4 in the same location.

| Pay Grade | Married with Dependents | Single |

|---|---|---|

| E-4 | $1,200 - $1,800 | $900 - $1,400 |

| E-5 | $1,400 - $2,000 | $1,000 - $1,600 |

Basic Allowance for Subsistence (BAS)

Another difference in pay between military married and single personnel is the Basic Allowance for Subsistence (BAS). BAS is a tax-free allowance that is paid to military personnel to help cover the cost of food. Married military personnel typically receive a higher BAS rate than single personnel, especially if they have dependents. For example, a married E-4 with dependents in the Army would receive a higher BAS rate than a single E-4 in the same location.

| Pay Grade | Married with Dependents | Single |

|---|---|---|

| E-4 | $369.39 | $282.50 |

| E-5 | $413.10 | $342.50 |

Family Separation Allowance (FSA)

Military personnel who are married and have dependents may also be eligible for Family Separation Allowance (FSA). FSA is a tax-free allowance that is paid to military personnel who are separated from their dependents for more than 30 days. This allowance is designed to help offset the costs associated with maintaining a home and supporting dependents while the military member is away.

| Pay Grade | Married with Dependents |

|---|---|

| E-4 | $250 - $500 |

| E-5 | $300 - $600 |

Cost of Living Allowance (COLA)

Military personnel who are stationed in high-cost areas may also be eligible for Cost of Living Allowance (COLA). COLA is a tax-free allowance that is paid to military personnel to help offset the costs associated with living in high-cost areas. Married military personnel may receive a higher COLA rate than single personnel, especially if they have dependents.

| Pay Grade | Married with Dependents | Single |

|---|---|---|

| E-4 | $500 - $1,000 | $300 - $800 |

| E-5 | $700 - $1,400 | $500 - $1,200 |

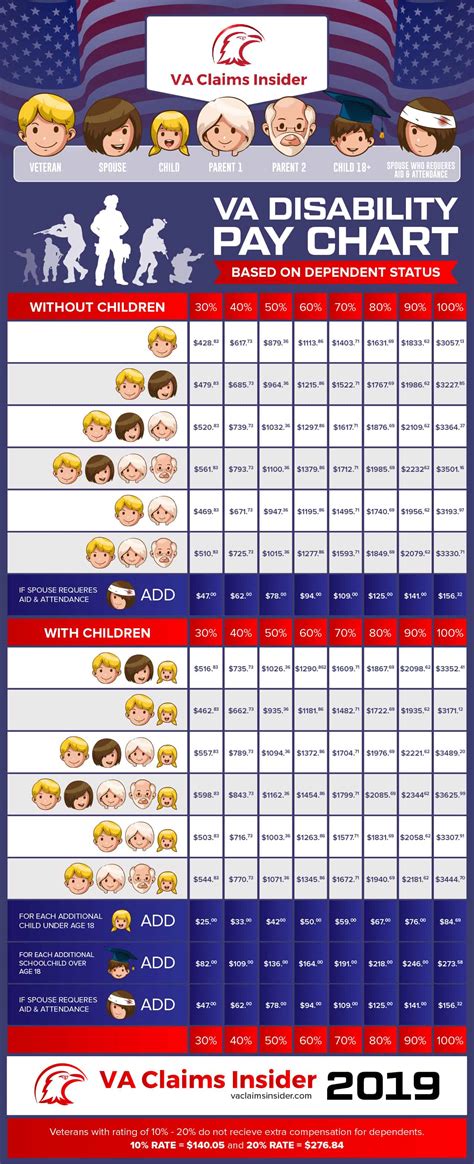

Dependency and Indemnity Compensation (DIC)

Finally, military personnel who are married and have dependents may also be eligible for Dependency and Indemnity Compensation (DIC). DIC is a tax-free benefit that is paid to the dependents of military personnel who die in service. Married military personnel may also be eligible for DIC if they have dependents.

📝 Note: DIC rates vary depending on the military member's pay grade and time in service.

In conclusion, there are several key pay differences between military married and single personnel. Married military personnel typically receive higher allowances for housing, subsistence, family separation, cost of living, and dependency and indemnity compensation. These allowances are designed to help offset the costs associated with maintaining a home and supporting dependents.

What is the difference in BAH between military married and single personnel?

+

The difference in BAH between military married and single personnel varies depending on pay grade and location. However, married military personnel typically receive a higher BAH rate than single personnel, especially if they have dependents.

Do military personnel receive higher pay if they are married?

+

Military personnel do not receive higher pay if they are married. However, married military personnel may receive higher allowances for housing, subsistence, family separation, cost of living, and dependency and indemnity compensation.

What is the purpose of FSA?

+

The purpose of FSA is to help offset the costs associated with maintaining a home and supporting dependents while the military member is away.

Related Terms:

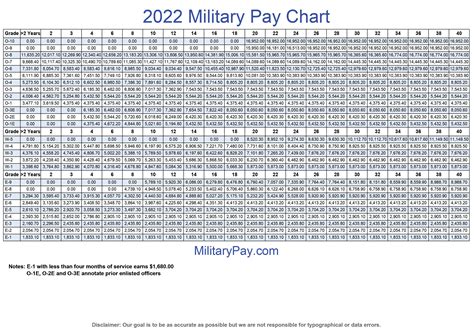

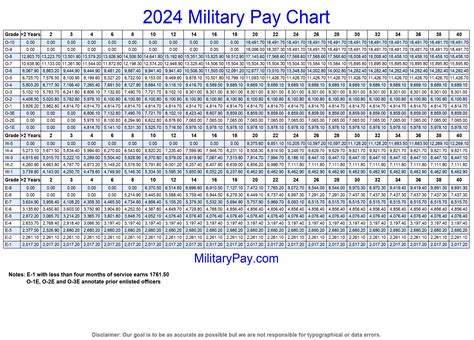

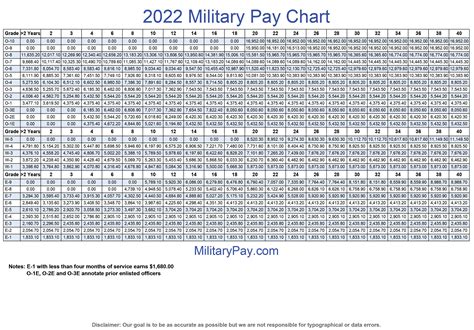

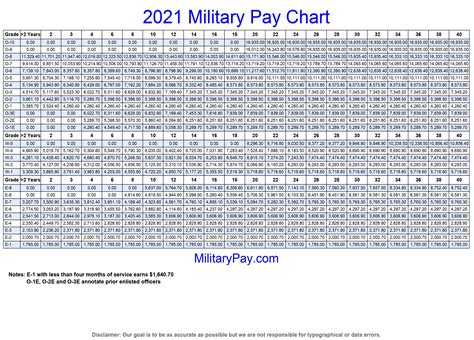

- Military marriage pay chart

- Military Pay chart 2024

- Military dependent pay chart

- 2025 military pay chart

- Army deployment pay calculator 2024

- Military pay Calculator