5 Ways to Calculate Military Pay After Taxes

Understanding Military Pay and Taxes

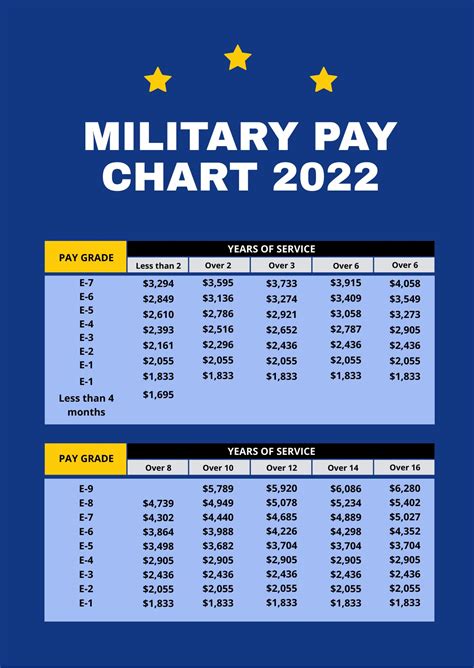

For military personnel, calculating take-home pay can be a complex task due to the various allowances, deductions, and tax laws that apply. It’s essential to understand how military pay is taxed and how to estimate take-home pay to ensure accurate financial planning. In this article, we’ll explore five ways to calculate military pay after taxes, helping you make informed decisions about your finances.

Military Pay Components

Before we dive into calculating take-home pay, let’s review the components of military pay:

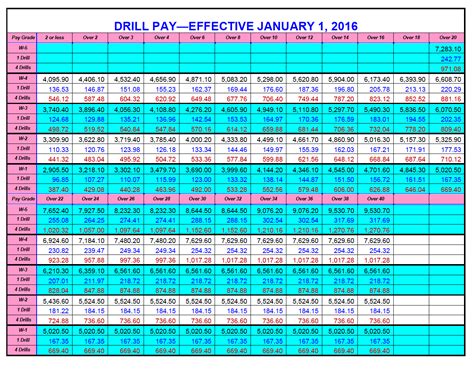

- Basic Pay: The base salary for military personnel, which varies based on rank and time in service.

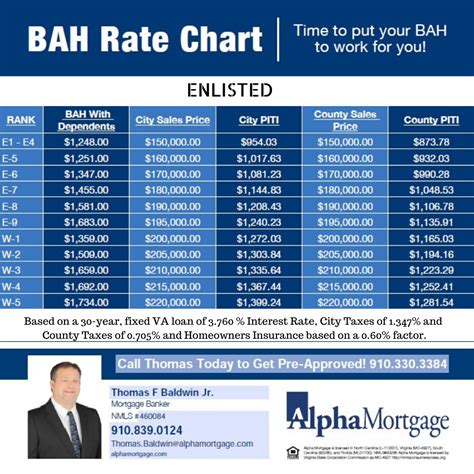

- Allowances: Tax-free payments for housing, food, and other expenses.

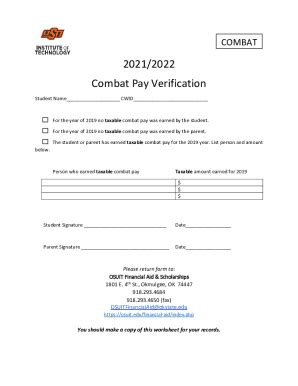

- Special Pays: Additional payments for hazardous duty, jump pay, or other special assignments.

- Bonuses: One-time payments for enlistment, reenlistment, or other incentives.

Method 1: Using a Military Pay Calculator

The easiest way to calculate military pay after taxes is to use a military pay calculator. These online tools consider your rank, time in service, and location to estimate your take-home pay. Some popular military pay calculators include:

- Military Pay Calculator by Military.com

- Pay Calculator by the Department of Defense

- Military Pay Estimator by the Navy Federal Credit Union

Simply input your information, and the calculator will provide an estimate of your take-home pay.

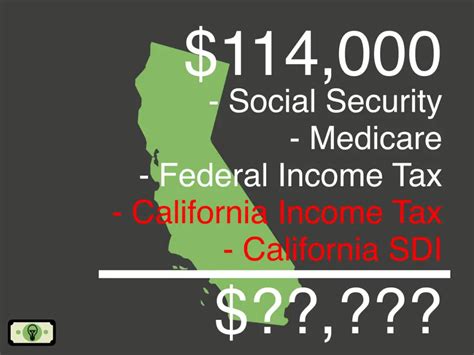

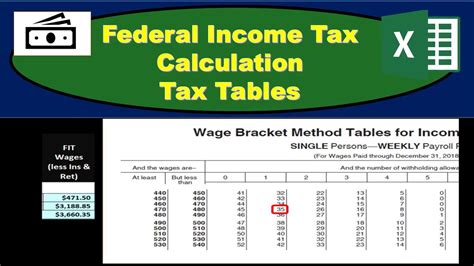

Method 2: Manual Calculation using Tax Tables

If you prefer a more hands-on approach, you can use tax tables to estimate your military pay after taxes. Here’s a step-by-step guide:

- Determine your gross income (basic pay + allowances + special pays + bonuses).

- Calculate your federal income tax using the IRS tax tables.

- Calculate your state income tax (if applicable).

- Subtract your total taxes from your gross income to get your take-home pay.

Tax Tables:

| Taxable Income | Federal Income Tax |

|---|---|

| 0 - 9,875 | 10% |

| 9,876 - 40,125 | 12% |

| 40,126 - 80,250 | 22% |

| 80,251 - 164,700 | 24% |

| 164,701 - 214,700 | 32% |

| 214,701 - 518,400 | 35% |

| $518,401 and above | 37% |

💡 Note: These tax tables are subject to change, so ensure you use the most up-to-date tables for your calculation.

Method 3: Using a Military Pay App

Several mobile apps are designed to help military personnel calculate their pay and benefits. Some popular apps include:

- Military Pay (iOS, Android)

- PayCalc (iOS, Android)

- Military Benefits (iOS, Android)

These apps often include features like pay calculators, benefits estimators, and tax tables to help you estimate your take-home pay.

Method 4: Consulting with a Financial Advisor

If you’re unsure about calculating your military pay after taxes or have complex financial situations, consider consulting a financial advisor. They can help you:

- Estimate your take-home pay based on your individual circumstances.

- Create a personalized budget and financial plan.

- Provide guidance on tax planning and optimization.

Find a Financial Advisor:

- Military OneSource: A free financial counseling service for military personnel and their families.

- Navy Federal Credit Union: Offers financial planning and counseling services for military members.

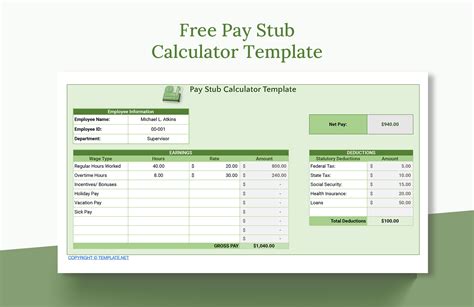

Method 5: Using a Spreadsheets or Budgeting Software

If you’re comfortable with spreadsheets or budgeting software, you can create a customized template to calculate your military pay after taxes. Some popular options include:

- Microsoft Excel

- Google Sheets

- Mint

- Personal Capital

Create a table with columns for your income, deductions, and taxes. Use formulas to calculate your take-home pay based on your individual circumstances.

| Income | Deductions | Taxes | Take-Home Pay |

|---|---|---|---|

| Basic Pay | Allowances | Federal Income Tax | = Income - Deductions - Taxes |

📊 Note: This is a basic example, and you may need to add or modify columns to suit your individual circumstances.

In conclusion, calculating military pay after taxes requires consideration of various factors, including allowances, deductions, and tax laws. By using one of the five methods outlined above, you can estimate your take-home pay and make informed decisions about your finances.

What is the difference between basic pay and allowances?

+

Basic pay is the base salary for military personnel, while allowances are tax-free payments for housing, food, and other expenses.

Do I need to pay state income tax on my military pay?

+

It depends on your state of residence. Some states exempt military pay from state income tax, while others may tax a portion of it.

Can I use a military pay calculator to estimate my take-home pay?

+

Yes, military pay calculators can provide an estimate of your take-home pay based on your rank, time in service, and location.