5 Ways Military Pay Advance Loans Can Help

Financial Challenges Faced by Military Personnel

Military personnel often face unique financial challenges that can be difficult to navigate. From frequent deployments to limited access to financial resources, it’s not uncommon for military families to struggle with managing their finances. One solution that can provide temporary relief is a military pay advance loan. In this article, we’ll explore five ways these loans can help military personnel overcome financial difficulties.

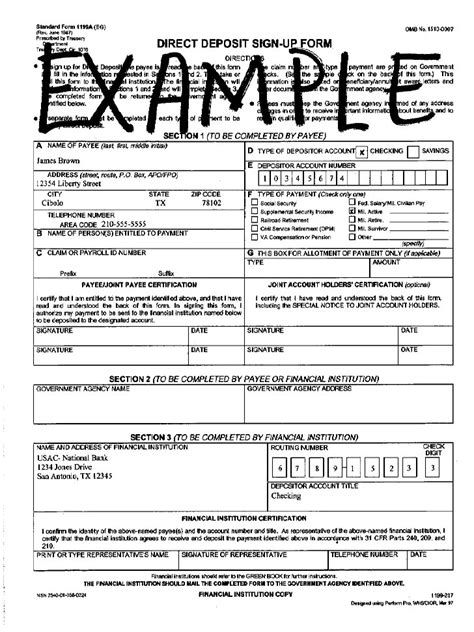

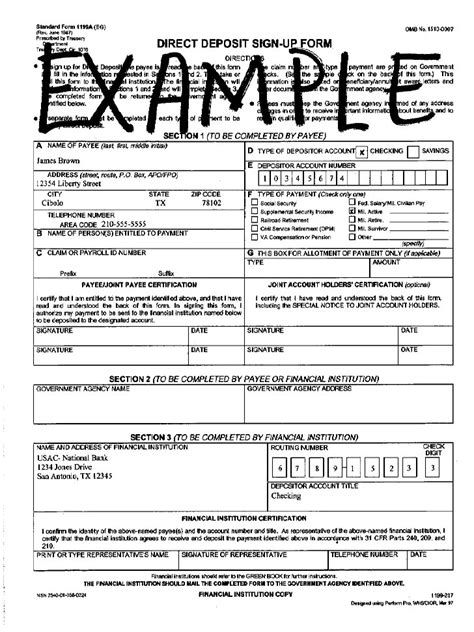

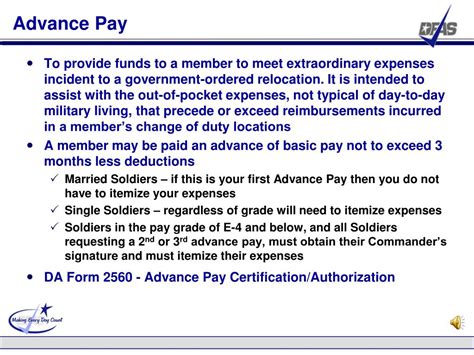

What is a Military Pay Advance Loan?

A military pay advance loan is a type of short-term loan designed specifically for military personnel. These loans are usually offered by private lenders and are based on the borrower’s upcoming military pay. The loan amount is typically a percentage of the borrower’s next paycheck, and repayment is usually due on the next pay date.

5 Ways Military Pay Advance Loans Can Help

1. Emergency Funding

Military pay advance loans can provide emergency funding for unexpected expenses, such as car repairs, medical bills, or other financial emergencies. These loans can help military personnel cover essential expenses until their next paycheck.

2. Avoiding NSF Fees

Insufficient funds (NSF) fees can be costly and damaging to one’s credit score. A military pay advance loan can help military personnel avoid NSF fees by providing a temporary loan to cover essential expenses, such as rent/mortgage payments, utility bills, and grocery bills.

3. Building Credit

Some lenders offer military pay advance loans with the option to report payments to the credit bureaus. This can help military personnel establish or rebuild their credit history, which can be beneficial for future loan applications or other financial endeavors.

4. Convenience and Accessibility

Military pay advance loans are often more accessible than traditional loans, as they can be applied for online or over the phone. This convenience can be especially helpful for military personnel who are deployed or have limited access to financial resources.

5. No Credit Check Requirements

Many lenders offering military pay advance loans do not require a credit check, which can be beneficial for military personnel with poor or no credit history. However, it’s essential to note that some lenders may still perform a credit check, so it’s crucial to review the loan terms and conditions before applying.

📝 Note: While military pay advance loans can provide temporary financial relief, they should be used responsibly and only in emergency situations. It's essential to review the loan terms, including interest rates and repayment terms, before applying.

Alternative Options to Consider

Before applying for a military pay advance loan, it’s essential to consider alternative options, such as:

- Military Assistance Programs: Many organizations, such as the Navy-Marine Corps Relief Society and the Army Emergency Relief, offer financial assistance to military personnel in need.

- Personal Savings: Building an emergency fund can help military personnel cover unexpected expenses and avoid the need for a short-term loan.

- Budgeting: Creating a budget and prioritizing expenses can help military personnel manage their finances more effectively and avoid financial emergencies.

Conclusion

Military pay advance loans can provide temporary financial relief for military personnel facing unique financial challenges. While these loans can be helpful, it’s essential to use them responsibly and consider alternative options before applying. By understanding the benefits and limitations of military pay advance loans, military personnel can make informed decisions about their financial well-being.

What is the typical interest rate for a military pay advance loan?

+

The typical interest rate for a military pay advance loan varies depending on the lender, but it’s usually higher than traditional loans. Some lenders may charge interest rates as high as 36% APR.

Can I apply for a military pay advance loan if I have bad credit?

+

Yes, many lenders offering military pay advance loans do not require a credit check. However, some lenders may still perform a credit check, so it’s essential to review the loan terms and conditions before applying.

How long does it take to receive a military pay advance loan?

+

The processing time for a military pay advance loan varies depending on the lender, but it’s usually faster than traditional loans. Some lenders may offer same-day or next-day funding.