5 Military Life Insurance Options After Retirement

Military Life Insurance Options After Retirement: What You Need to Know

As a military service member, you have access to various life insurance options that can provide financial protection for your loved ones in the event of your passing. However, these options may change or become limited after retirement. In this article, we will explore the top 5 military life insurance options available to veterans after retirement, highlighting their benefits, eligibility criteria, and application processes.

Understanding Your Military Life Insurance Options

The Department of Veterans Affairs (VA) and the Department of Defense (DoD) offer several life insurance programs for military personnel and veterans. These programs are designed to provide affordable and flexible coverage options to ensure the financial well-being of your family. Here are five military life insurance options available to veterans after retirement:

1. Veterans' Group Life Insurance (VGLI)

VGLI is a term life insurance program that allows veterans to convert their Servicemembers’ Group Life Insurance (SGLI) coverage to a civilian policy after leaving the military. This program offers coverage up to $400,000, and premiums are based on your age and coverage amount.

Eligibility Criteria:

- You must have had SGLI coverage as a service member

- You must apply for VGLI within 1 year and 120 days of leaving the military

- You must be under the age of 60

Application Process:

- Apply online through the VA website

- Complete the application form (VA Form 29-360)

- Provide required documentation, such as proof of SGLI coverage and military discharge papers

💡 Note: VGLI premiums increase with age, and coverage is limited to $400,000.

2. Service-Disabled Veterans' Life Insurance (S-DVI)

S-DVI is a life insurance program designed for veterans with a service-connected disability. This program offers tax-free coverage up to $10,000, and premiums are based on your age and coverage amount.

Eligibility Criteria:

- You must have a service-connected disability

- You must apply for S-DVI within 2 years of receiving your disability rating

- You must be under the age of 65

Application Process:

- Apply online through the VA website

- Complete the application form (VA Form 29-360)

- Provide required documentation, such as proof of service-connected disability and military discharge papers

📝 Note: S-DVI coverage is limited to $10,000, and premiums increase with age.

3. USAA Life Insurance

USAA is a private insurance company that offers life insurance coverage to military members and veterans. USAA offers term, whole, and universal life insurance policies with competitive premiums and flexible coverage options.

Eligibility Criteria:

- You must be a military member, veteran, or spouse of a military member or veteran

- You must be under the age of 70

Application Process:

- Apply online through the USAA website

- Complete the application form

- Provide required documentation, such as proof of military service and identification

📊 Note: USAA offers competitive premiums and flexible coverage options, but eligibility is limited to military members, veterans, and their spouses.

4. Prudential Life Insurance

Prudential is a private insurance company that offers life insurance coverage to military members and veterans. Prudential offers term, whole, and universal life insurance policies with competitive premiums and flexible coverage options.

Eligibility Criteria:

- You must be a military member or veteran

- You must be under the age of 70

Application Process:

- Apply online through the Prudential website

- Complete the application form

- Provide required documentation, such as proof of military service and identification

💼 Note: Prudential offers competitive premiums and flexible coverage options, but eligibility is limited to military members and veterans.

5. MetLife Life Insurance

MetLife is a private insurance company that offers life insurance coverage to military members and veterans. MetLife offers term, whole, and universal life insurance policies with competitive premiums and flexible coverage options.

Eligibility Criteria:

- You must be a military member or veteran

- You must be under the age of 70

Application Process:

- Apply online through the MetLife website

- Complete the application form

- Provide required documentation, such as proof of military service and identification

👥 Note: MetLife offers competitive premiums and flexible coverage options, but eligibility is limited to military members and veterans.

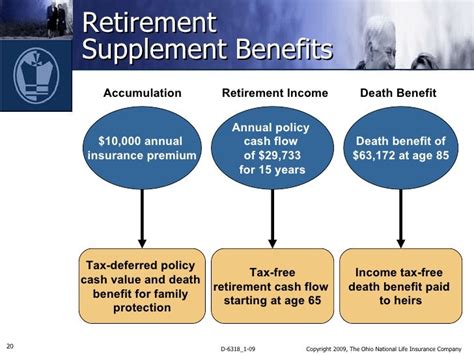

| Insurance Option | Coverage Amount | Premiums | Eligibility Criteria |

|---|---|---|---|

| VGLI | Up to $400,000 | Based on age and coverage amount | Must have had SGLI coverage, under 60 years old |

| S-DVI | Up to $10,000 | Based on age and coverage amount | Must have service-connected disability, under 65 years old |

| USAA Life Insurance | Varying coverage amounts | Competitive premiums | Must be military member, veteran, or spouse, under 70 years old |

| Prudential Life Insurance | Varying coverage amounts | Competitive premiums | Must be military member or veteran, under 70 years old |

| MetLife Life Insurance | Varying coverage amounts | Competitive premiums | Must be military member or veteran, under 70 years old |

In conclusion, there are several military life insurance options available to veterans after retirement. Each option has its benefits, eligibility criteria, and application processes. It’s essential to carefully review each option and choose the one that best suits your needs and budget. Remember to consider factors such as coverage amount, premiums, and flexibility when selecting a life insurance policy.

What is the difference between VGLI and S-DVI?

+

VGLI is a term life insurance program that allows veterans to convert their SGLI coverage to a civilian policy, while S-DVI is a life insurance program designed for veterans with a service-connected disability. VGLI offers coverage up to 400,000, while S-DVI offers tax-free coverage up to 10,000.

Can I apply for VGLI and S-DVI simultaneously?

+

No, you cannot apply for both VGLI and S-DVI at the same time. You must apply for VGLI within 1 year and 120 days of leaving the military, while S-DVI must be applied for within 2 years of receiving your disability rating.

What is the age limit for applying for VGLI and S-DVI?

+

The age limit for applying for VGLI is 60 years old, while the age limit for applying for S-DVI is 65 years old.