MI Paycheck Calculator Tool

Introduction to MI Paycheck Calculator Tool

The MI Paycheck Calculator Tool is a valuable resource for employees and employers in Michigan, designed to calculate take-home pay and gross pay based on various factors such as hourly wage, annual salary, tax deductions, and benefits. This tool helps individuals and businesses navigate the complexities of payroll calculations, ensuring accuracy and compliance with state and federal regulations. In this article, we will explore the features and benefits of the MI Paycheck Calculator Tool, as well as provide a step-by-step guide on how to use it.

Features of the MI Paycheck Calculator Tool

The MI Paycheck Calculator Tool offers a range of features that make it an essential tool for anyone involved in payroll calculations. Some of the key features include: * Hourly and Salary Calculations: The tool can calculate take-home pay and gross pay for both hourly and salaried employees. * Tax Deductions: The tool takes into account various tax deductions, including federal income tax, state income tax, and local taxes. * Benefits and Deductions: The tool allows users to input benefits and deductions, such as health insurance, 401(k), and other benefits. * Pay Frequency: The tool can calculate pay for various pay frequencies, including bi-weekly, monthly, and quarterly.

Benefits of Using the MI Paycheck Calculator Tool

Using the MI Paycheck Calculator Tool offers several benefits, including: * Accuracy: The tool ensures accurate calculations, reducing the risk of errors and discrepancies. * Compliance: The tool helps users comply with state and federal regulations, including tax laws and labor laws. * Time-Saving: The tool saves time and effort, allowing users to focus on other important tasks. * Flexibility: The tool can be used for various pay frequencies and calculation types, making it a versatile tool for businesses and individuals.

How to Use the MI Paycheck Calculator Tool

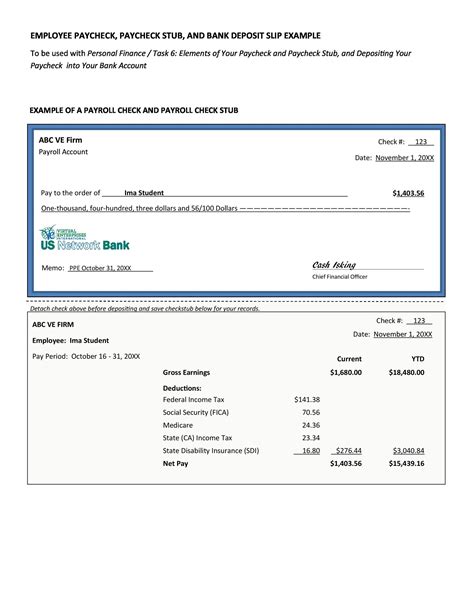

Using the MI Paycheck Calculator Tool is straightforward and easy. Here’s a step-by-step guide: * Enter Employee Information: Enter the employee’s name, hourly wage or annual salary, and pay frequency. * Enter Tax Information: Enter the employee’s tax filing status, number of dependents, and other tax-related information. * Enter Benefits and Deductions: Enter the employee’s benefits and deductions, such as health insurance and 401(k). * Calculate Pay: Click the calculate button to generate the employee’s take-home pay and gross pay.

📝 Note: It's essential to enter accurate and up-to-date information to ensure accurate calculations.

Common Payroll Calculations

The MI Paycheck Calculator Tool can be used for various payroll calculations, including: * Gross Pay: The tool can calculate an employee’s gross pay based on their hourly wage or annual salary. * Take-Home Pay: The tool can calculate an employee’s take-home pay based on their gross pay and tax deductions. * Tax Deductions: The tool can calculate tax deductions based on an employee’s tax filing status, number of dependents, and other tax-related information.

| Payroll Calculation | Formula |

|---|---|

| Gross Pay | Hourly Wage x Hours Worked |

| Take-Home Pay | Gross Pay - Tax Deductions |

| Tax Deductions | Gross Pay x Tax Rate |

As we can see from the table above, payroll calculations involve various formulas and factors. The MI Paycheck Calculator Tool simplifies these calculations, making it easier for businesses and individuals to manage their payroll.

In summary, the MI Paycheck Calculator Tool is a valuable resource for anyone involved in payroll calculations. Its features and benefits make it an essential tool for ensuring accuracy, compliance, and efficiency in payroll management. By following the step-by-step guide and using the tool correctly, users can generate accurate take-home pay and gross pay calculations, as well as comply with state and federal regulations.

What is the MI Paycheck Calculator Tool?

+

The MI Paycheck Calculator Tool is a online tool designed to calculate take-home pay and gross pay based on various factors such as hourly wage, annual salary, tax deductions, and benefits.

How do I use the MI Paycheck Calculator Tool?

+

To use the MI Paycheck Calculator Tool, simply enter the employee’s information, including their name, hourly wage or annual salary, pay frequency, tax filing status, number of dependents, and other tax-related information. Then, click the calculate button to generate the employee’s take-home pay and gross pay.

What are the benefits of using the MI Paycheck Calculator Tool?

+

The benefits of using the MI Paycheck Calculator Tool include accuracy, compliance, time-saving, and flexibility. The tool ensures accurate calculations, helps users comply with state and federal regulations, saves time and effort, and can be used for various pay frequencies and calculation types.