Master Your Mortgage with Magic Income Worksheet

Are you a homeowner or aspiring to become one? If you are, the term mortgage has likely crossed your radar more than once. Navigating the waters of home financing can seem daunting, but with the right tools and knowledge, it becomes manageable. In this post, we'll delve into a strategic approach to managing your mortgage with an innovative tool called the Magic Income Worksheet. This resource can empower you to better understand, plan, and optimize your mortgage to suit your financial situation.

The Basics of Mortgages

Before we dive into the intricacies of the Magic Income Worksheet, let's establish a foundation with mortgage basics:

- Principal: This is the amount you borrow from the lender to purchase your home.

- Interest: This is what you pay the lender for the privilege of borrowing that money. Interest rates can be fixed or variable.

- Loan Term: Typically spans 15, 20, or 30 years, dictating how long you'll be making payments.

- Amortization: The process of paying off the loan over time through regular payments.

Understanding these components is essential because each factor influences how much you will pay over the life of the loan and how quickly you can build equity in your home.

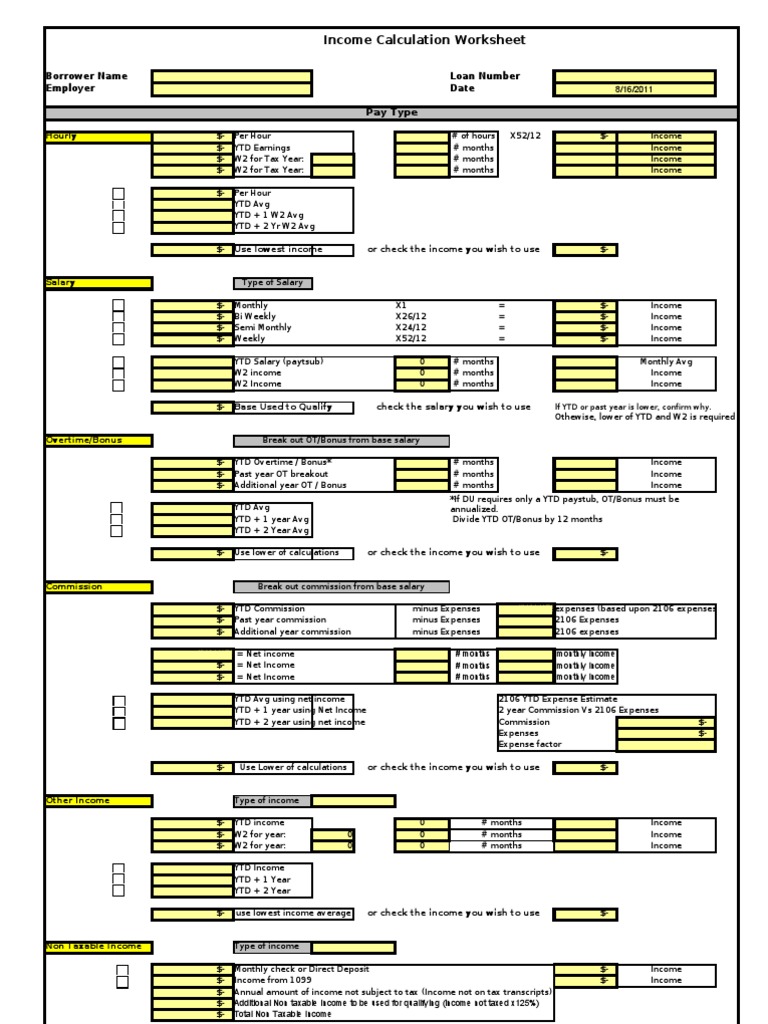

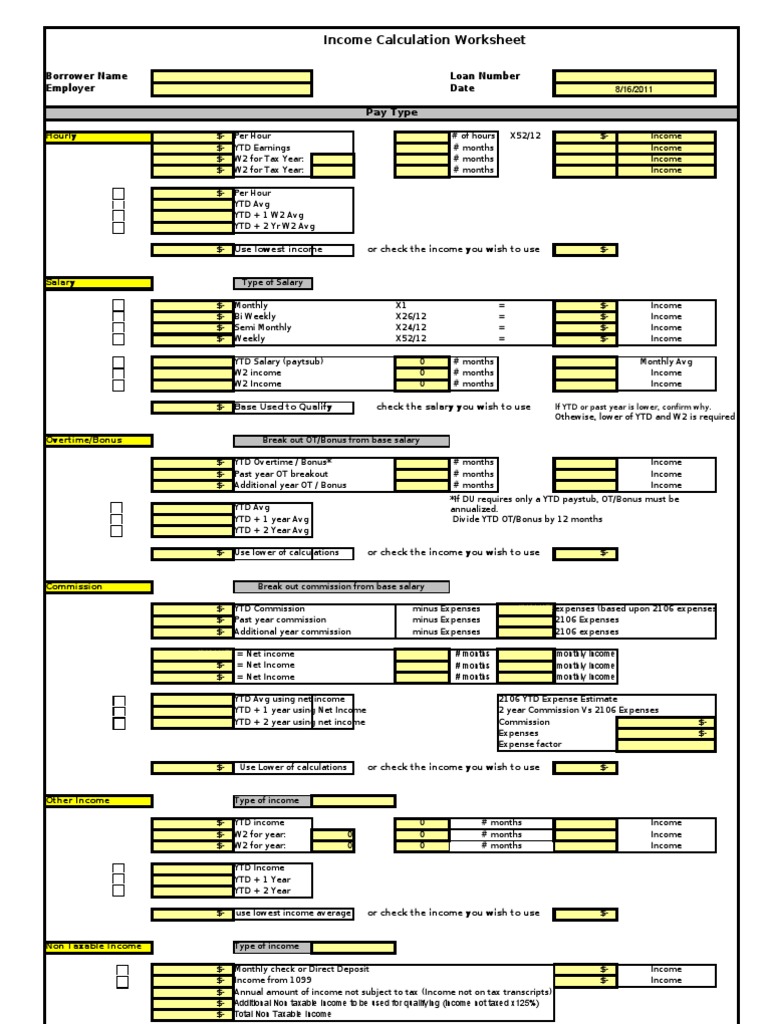

Introducing the Magic Income Worksheet

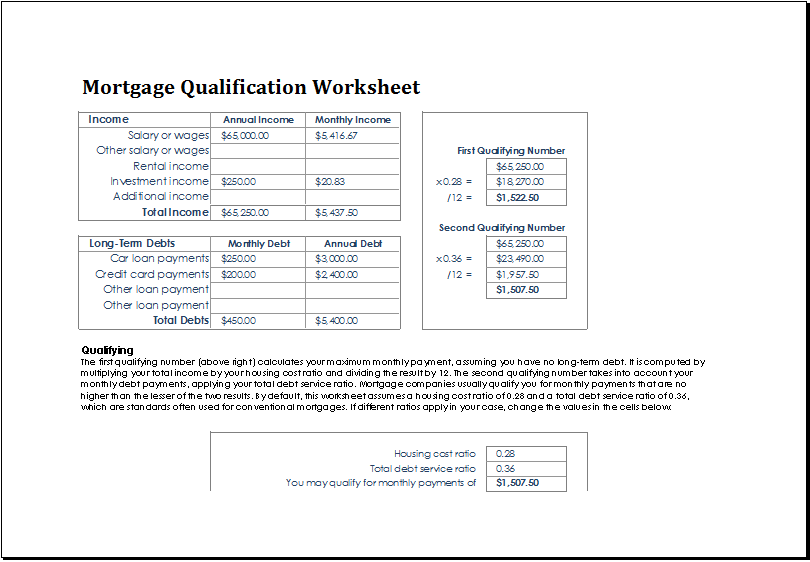

The Magic Income Worksheet is a dynamic tool designed to help homeowners or potential buyers calculate their mortgage affordability. Here’s how it works:

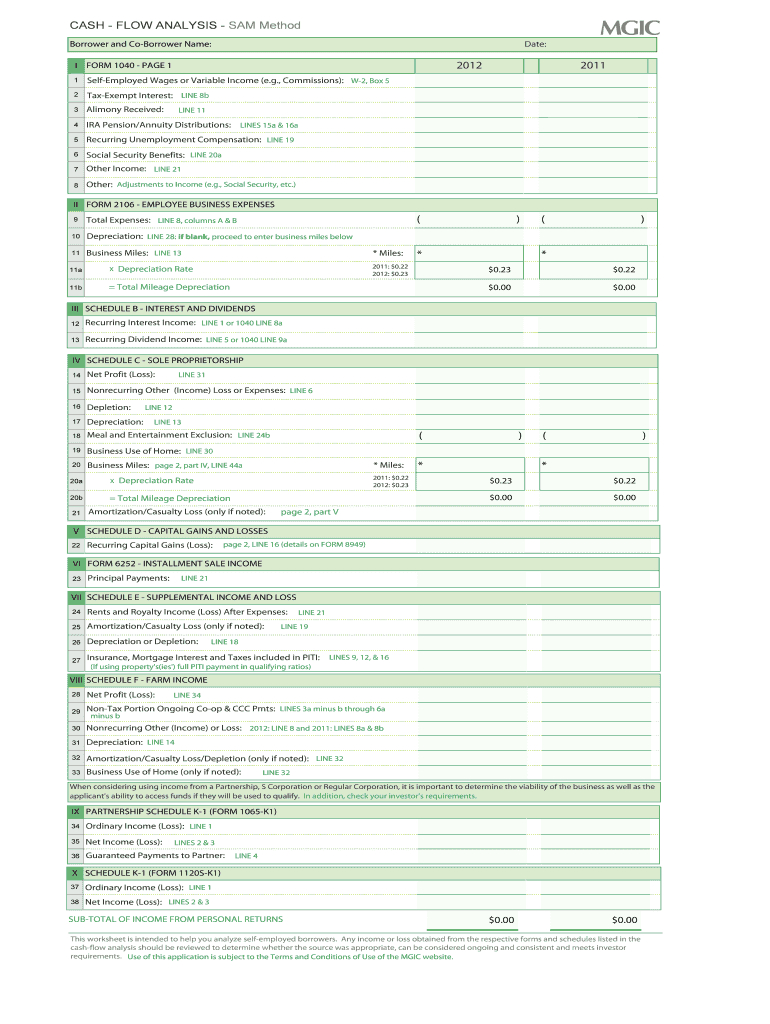

- Income Analysis: It assesses your regular income, including bonuses, commissions, and other variable income sources.

- Expense Tracking: Helps you input your monthly expenses to see how much disposable income you have for mortgage payments.

- Scenario Modelling: Allows you to test different mortgage scenarios based on interest rates, down payments, and loan terms to find the most suitable option for your financial goals.

This worksheet not only simplifies mortgage calculations but also integrates future income changes, giving a more realistic view of affordability over time.

💡 Note: The Magic Income Worksheet is not a replacement for professional financial advice. It’s a tool to guide your decisions, but always consult with a mortgage advisor for personalized guidance.

Using the Magic Income Worksheet

To use the Magic Income Worksheet effectively:

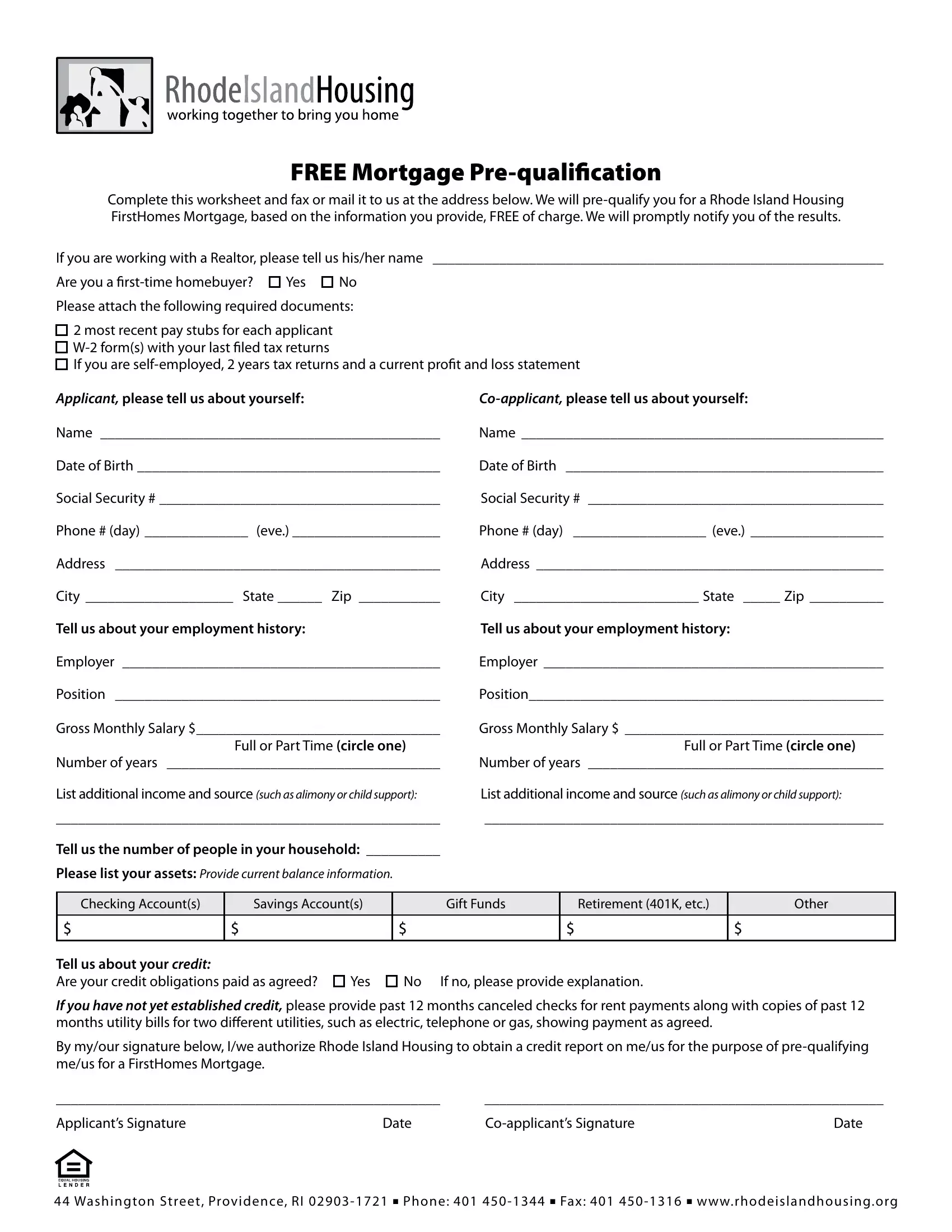

- Gather Your Financial Data: Collect recent bank statements, pay stubs, tax returns, and any other income documents to get an accurate picture of your finances.

- Input Your Data: Enter all your income and expenses into the worksheet. Ensure you include all potential income sources and future income increases.

- Analyze Different Scenarios: Test various mortgage scenarios to see how changes in down payments or interest rates affect your monthly payments and total interest paid.

Here's a basic example of how the worksheet might look:

| Category | Amount |

|---|---|

| Monthly Income | $5,000 |

| Monthly Expenses | $3,000 |

| Current Mortgage Payment | $1,200 |

| Disposable Income | $800 |

🔍 Note: Always update your Magic Income Worksheet when significant financial changes occur to keep your mortgage planning up-to-date.

Maximizing Mortgage Value with the Worksheet

With the Magic Income Worksheet in hand, you can:

- Explore Refinancing Options: If your financial situation has improved, use the worksheet to determine if refinancing could save you money.

- Adjust Payment Schedules: See how making bi-weekly payments or additional principal payments can affect your loan term and interest.

- Plan for Financial Changes: Use projections to prepare for potential future expenses or income changes that might affect your mortgage payments.

Strategies for Mortgage Success

Beyond the mechanics of the worksheet, here are some strategic considerations for mortgage management:

- Down Payment Strategy: A larger down payment can significantly reduce your interest rate and monthly payments. Use the worksheet to find the sweet spot between saving for a down payment and your overall financial stability.

- Fixed vs. Variable Rates: Decide whether locking in with a fixed rate or taking a chance on a variable rate is better for your financial outlook.

- Extra Payments: Determine if it's beneficial to pay extra on your mortgage principal, reducing the loan term and interest paid.

By consistently analyzing your mortgage using the Magic Income Worksheet, you can ensure that you're always making the most informed financial decisions.

Ultimately, mastering your mortgage isn't just about understanding the numbers; it's about strategic planning, adapting to life changes, and optimizing your financial health. With the Magic Income Worksheet, you have a tool that not only simplifies the calculation process but also offers a strategic approach to home financing. Whether you're looking to buy, refinance, or simply manage your existing mortgage, this worksheet provides the insights you need to make the best decisions for your future.

What is the primary advantage of using the Magic Income Worksheet?

+

The primary advantage is the ability to model different mortgage scenarios based on your income, expenses, and potential future changes, enabling informed financial decision-making.

Can the Magic Income Worksheet help with refinancing decisions?

+

Yes, by analyzing your current financial situation against various interest rates and loan terms, the worksheet can indicate if refinancing would be beneficial.

How often should I update my Magic Income Worksheet?

+

Update the worksheet whenever there are significant changes in your income, expenses, or when you consider altering your mortgage terms.