5 MD Paycheck Tips

Introduction to Managing Your Paycheck

Managing your paycheck effectively is crucial for achieving financial stability and security. With the rising costs of living and the uncertainty of economic conditions, it’s essential to make the most out of your hard-earned money. In this article, we will explore five key tips to help you manage your paycheck like a pro, ensuring you make the most out of your income and secure your financial future.

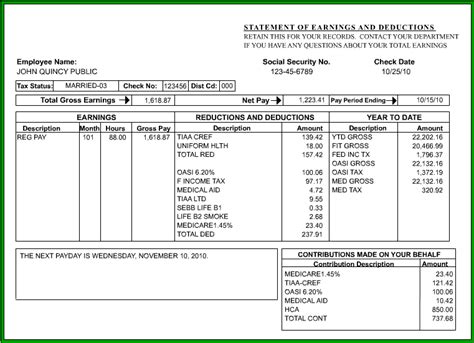

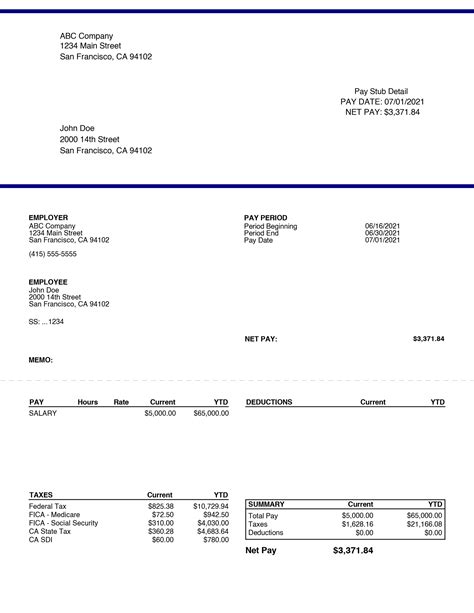

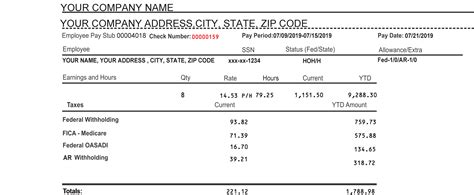

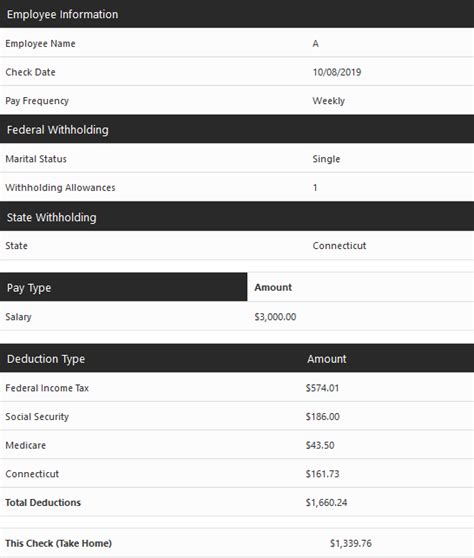

Understanding Your Paycheck

Before diving into the tips, it’s vital to understand the components of your paycheck. Your paycheck typically consists of your gross income, deductions (such as taxes, health insurance, and retirement contributions), and your net income (the amount you take home). Gross income is your total income before deductions, while net income is the amount you receive after all deductions have been made. Understanding these components will help you make informed decisions about your financial planning.

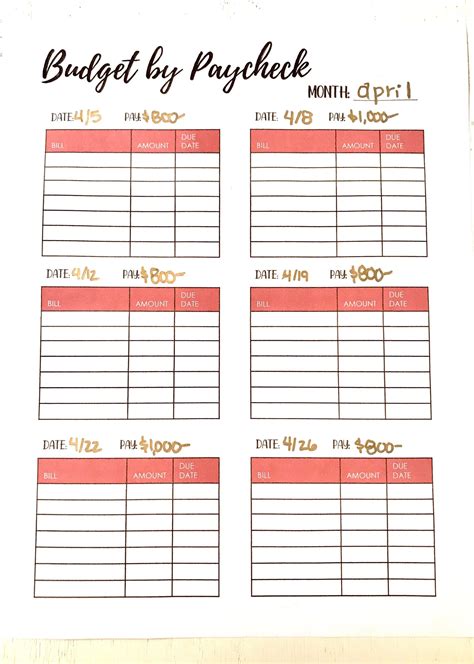

Tip 1: Create a Budget

Creating a budget is the first step towards managing your paycheck effectively. A budget helps you track your income and expenses, ensuring you allocate your money wisely. When creating a budget, consider the 50/30/20 rule: 50% of your income should go towards necessary expenses like rent, utilities, and groceries; 30% towards discretionary spending like entertainment and hobbies; and 20% towards saving and debt repayment. By following this rule, you can ensure you’re making the most out of your paycheck.

Tip 2: Prioritize Needs Over Wants

Distinguishing between needs and wants is crucial for effective paycheck management. Needs include essential expenses like rent, utilities, and food, while wants include discretionary spending like dining out or buying luxury items. Prioritizing your needs over your wants will help you allocate your money more efficiently, ensuring you have enough for essential expenses and saving.

Tip 3: Save and Invest

Saving and investing are critical components of managing your paycheck. Setting aside a portion of your income each month will help you build an emergency fund, pay off debt, and achieve long-term financial goals. Consider contributing to a 401(k) or IRA for retirement savings, and explore other investment options like stocks or mutual funds. Remember, saving and investing are long-term strategies, so be patient and consistent.

Tip 4: Manage Debt

Debt can be a significant obstacle to achieving financial stability. When managing your paycheck, it’s essential to prioritize debt repayment, especially high-interest debt like credit card balances. Consider the debt snowball method, where you pay off smaller debts first to build momentum, or the debt avalanche method, where you prioritize debts with the highest interest rates. By managing your debt effectively, you can free up more money in your budget for savings and investments.

Tip 5: Monitor and Adjust

Finally, it’s essential to monitor your budget and financial progress regularly and make adjustments as needed. Life is unpredictable, and your financial situation may change over time. By regularly reviewing your budget and financial goals, you can identify areas for improvement and make adjustments to stay on track. Consider using budgeting apps or spreadsheets to track your income and expenses, and don’t be afraid to seek professional advice if you need help managing your finances.

📝 Note: Remember to review and adjust your budget regularly to ensure you're on track to meet your financial goals.

As you implement these five tips, you’ll be well on your way to managing your paycheck like a pro. By creating a budget, prioritizing needs over wants, saving and investing, managing debt, and monitoring and adjusting your financial plan, you can achieve financial stability and security. With patience, discipline, and the right strategies, you can make the most out of your hard-earned money and secure your financial future.

In summary, effective paycheck management is all about making informed decisions about your income and expenses. By following these five tips and staying committed to your financial goals, you can achieve financial stability and security, and build a brighter financial future.

What is the 50/30/20 rule?

+

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

How do I prioritize needs over wants?

+

Prioritizing needs over wants involves distinguishing between essential expenses (needs) and discretionary spending (wants). Make a list of your essential expenses and allocate your income accordingly, then use any remaining balance for discretionary spending.

What is the debt snowball method?

+

The debt snowball method involves paying off smaller debts first to build momentum, while making minimum payments on larger debts. This approach can help you quickly eliminate smaller debts and free up more money in your budget for larger debts.