Military

Maximize TSP Contribution Limits

Understanding the Thrift Savings Plan (TSP)

The Thrift Savings Plan (TSP) is a retirement savings plan offered to federal employees and members of the military. It provides a tax-advantaged way to save for retirement, with the option to contribute to a traditional or Roth TSP account. The TSP offers a range of investment options, including stocks, bonds, and mutual funds, allowing participants to diversify their portfolios and potentially grow their savings over time.

TSP Contribution Limits

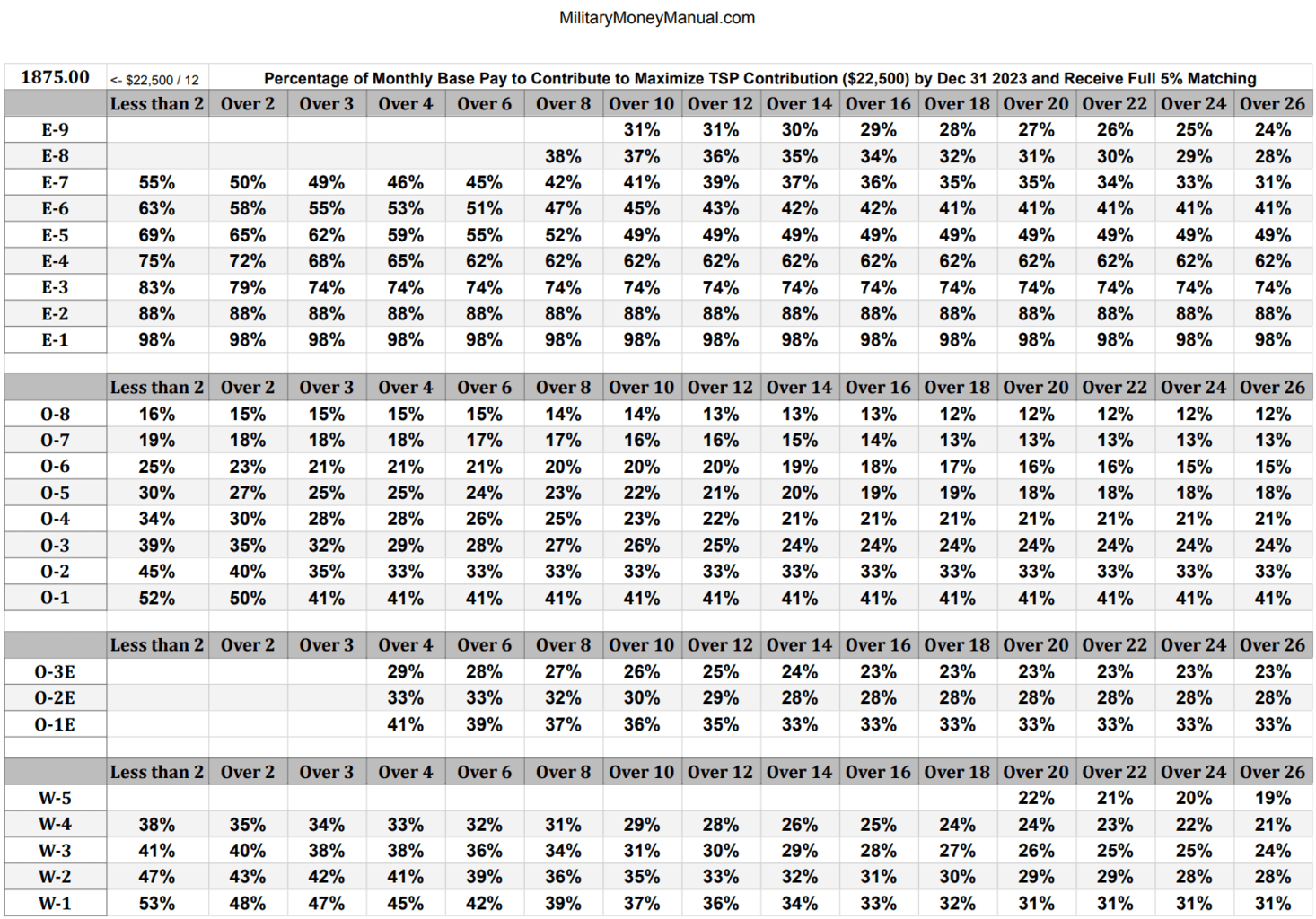

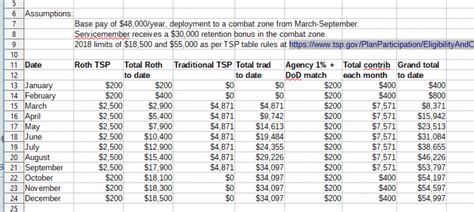

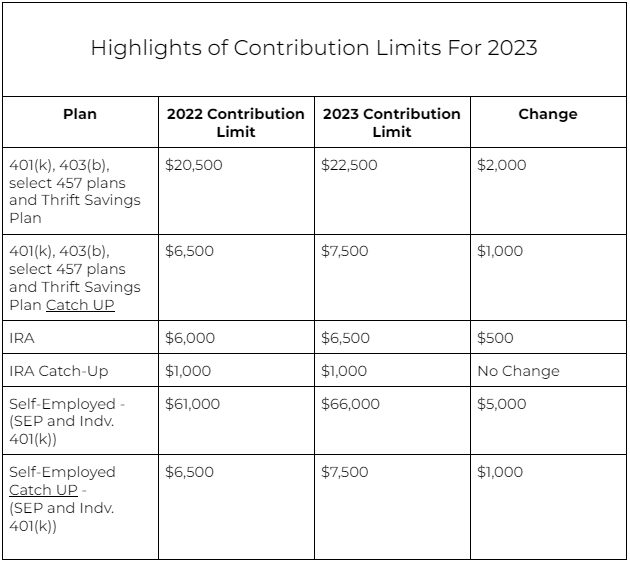

The Internal Revenue Service (IRS) sets annual contribution limits for the TSP. In 2023, the annual contribution limit is 22,500. Additionally, participants who are 50 years or older can make catch-up contributions of up to 7,500, bringing the total annual contribution limit to $30,000. It’s essential to understand these limits to maximize your TSP contributions and make the most of this retirement savings opportunity.

Benefits of Maximizing TSP Contributions

Maximizing your TSP contributions can have significant benefits for your retirement savings. Some of the advantages include: * Tax benefits: Contributions to a traditional TSP account are made before taxes, reducing your taxable income for the year. Roth TSP contributions are made with after-tax dollars, but the money grows tax-free and is not subject to taxes when withdrawn in retirement. * Compound interest: The earlier you start contributing to your TSP, the more time your money has to grow. Consistent contributions can help you build a significant nest egg over time. * Employer matching: Many federal agencies and military branches offer matching contributions to the TSP. By maximizing your contributions, you can also maximize the amount of employer matching funds you receive.

How to Maximize TSP Contributions

To maximize your TSP contributions, follow these steps: * Start early: Begin contributing to your TSP as soon as possible, even if it’s just a small amount each month. * Increase contributions over time: As your income grows, consider increasing your TSP contributions to take advantage of the full annual limit. * Take advantage of catch-up contributions: If you’re 50 or older, make catch-up contributions to boost your retirement savings. * Review and adjust: Periodically review your TSP contributions to ensure you’re on track to meet your retirement goals. Adjust your contributions as needed to stay on track.

💡 Note: It's essential to understand the TSP contribution limits and rules to avoid exceeding the annual limit and incurring penalties.

TSP Investment Options

The TSP offers a range of investment options, including: * G Fund: A low-risk investment fund that invests in government securities. * F Fund: A fixed-income investment fund that invests in bonds. * C Fund: A stock investment fund that tracks the S&P 500 index. * S Fund: A small-cap stock investment fund that tracks the Dow Jones U.S. Completion Total Stock Market Index. * I Fund: An international stock investment fund that tracks the MSCI EAFE Index. * L Funds: A range of lifestyle investment funds that offer a diversified portfolio with a mix of stocks, bonds, and other investments.

Managing Your TSP Account

To get the most out of your TSP, it’s essential to manage your account effectively. Here are some tips: * Monitor your account: Regularly review your TSP account to ensure you’re on track to meet your retirement goals. * Adjust your investments: Periodically review your investment options and adjust your portfolio as needed to ensure it remains aligned with your retirement goals and risk tolerance. * Consider professional advice: If you’re unsure about how to manage your TSP account or need help creating a retirement plan, consider consulting a financial advisor.

Conclusion Summary and Final Thoughts

Maximizing your TSP contributions can help you build a significant retirement nest egg over time. By understanding the TSP contribution limits, benefits, and investment options, you can make informed decisions about your retirement savings. Start early, increase your contributions over time, and take advantage of catch-up contributions to make the most of this valuable retirement savings opportunity.

What is the annual contribution limit for the TSP in 2023?

+

The annual contribution limit for the TSP in 2023 is 22,500, with an additional 7,500 available for catch-up contributions for participants 50 years or older.

How do I contribute to my TSP account?

+

You can contribute to your TSP account through payroll deductions or by making lump-sum contributions. You can also adjust your contributions at any time by submitting a new election form.

What are the benefits of contributing to a Roth TSP account?

+

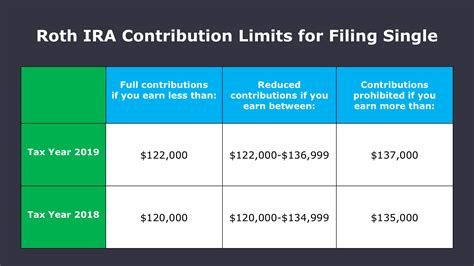

Contributing to a Roth TSP account allows you to make after-tax contributions, which can grow tax-free and are not subject to taxes when withdrawn in retirement. This can provide more flexibility and tax benefits in retirement.