Mass Tax Calculator Tool

Introduction to Mass Tax Calculator Tool

The Mass Tax Calculator Tool is a revolutionary online platform designed to simplify the process of calculating taxes for individuals and businesses. With its user-friendly interface and advanced features, this tool has become an essential resource for those looking to navigate the complex world of taxation. In this article, we will delve into the world of tax calculation, exploring the benefits and features of the Mass Tax Calculator Tool, and providing a comprehensive guide on how to use it effectively.

Benefits of Using the Mass Tax Calculator Tool

The Mass Tax Calculator Tool offers a wide range of benefits, including: * Accuracy and Reliability: The tool is designed to provide accurate and reliable calculations, reducing the risk of errors and ensuring that users comply with tax regulations. * Time-Saving: With its automated features, the Mass Tax Calculator Tool saves users time and effort, allowing them to focus on other important aspects of their financial lives. * Convenience: The tool is accessible online, making it convenient for users to calculate their taxes from anywhere, at any time. * Compliance: The Mass Tax Calculator Tool is regularly updated to reflect changes in tax laws and regulations, ensuring that users remain compliant with the latest requirements.

Features of the Mass Tax Calculator Tool

The Mass Tax Calculator Tool boasts an array of features that make it an indispensable resource for tax calculation. Some of the key features include: * Tax Bracket Calculator: This feature allows users to determine their tax bracket and calculate their tax liability. * Deduction Calculator: The tool provides a deduction calculator that helps users identify eligible deductions and claim them accordingly. * Credit Calculator: The credit calculator feature enables users to calculate their eligible tax credits and claim them on their tax return. * Tax Estimate Calculator: This feature provides users with an estimate of their tax liability, helping them plan and prepare for tax season.

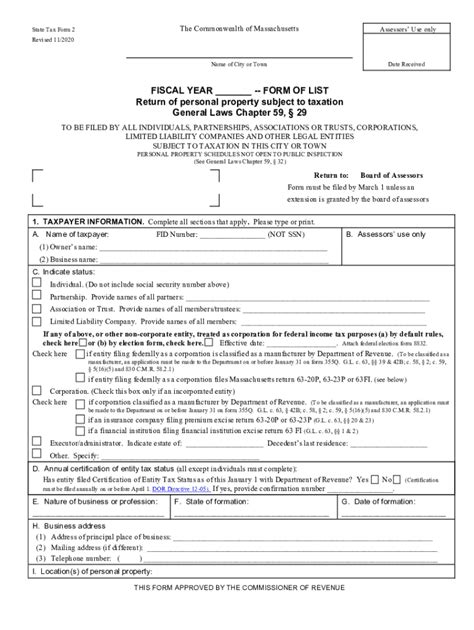

How to Use the Mass Tax Calculator Tool

Using the Mass Tax Calculator Tool is a straightforward process that requires minimal effort and expertise. Here’s a step-by-step guide to get you started: * Gather Required Information: Before using the tool, gather all necessary information, including income statements, receipts, and other relevant documents. * Select the Relevant Tax Year: Choose the tax year for which you want to calculate your taxes. * Enter Your Income and Deductions: Input your income and deductions into the tool, following the prompts and guidelines provided. * Calculate Your Tax Liability: Once you’ve entered all the required information, the tool will calculate your tax liability and provide you with an estimate of your tax refund or payment.

💡 Note: It's essential to ensure that you have all the necessary information and follow the instructions carefully to avoid errors and inaccuracies.

Tax Calculation Tips and Tricks

To get the most out of the Mass Tax Calculator Tool, here are some tips and tricks to keep in mind: * Keep Accurate Records: Maintaining accurate and up-to-date records is crucial for accurate tax calculation. * Take Advantage of Deductions and Credits: Ensure that you claim all eligible deductions and credits to minimize your tax liability. * Stay Informed: Stay informed about changes in tax laws and regulations to ensure that you’re compliant with the latest requirements. * Seek Professional Help: If you’re unsure about any aspect of tax calculation, consider seeking professional help from a tax expert or accountant.

Common Tax Calculation Mistakes to Avoid

When using the Mass Tax Calculator Tool, it’s essential to avoid common mistakes that can lead to inaccuracies and errors. Some of the most common mistakes to avoid include: * Incorrect Income Reporting: Failing to report all income or reporting incorrect income can lead to inaccuracies and potential penalties. * Ineligible Deductions and Credits: Claiming ineligible deductions and credits can result in errors and potential penalties. * Failure to Update Information: Failing to update your information or neglecting to report changes in your financial situation can lead to inaccuracies and errors.

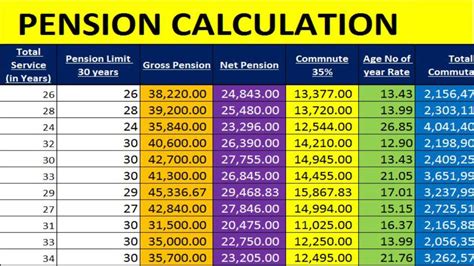

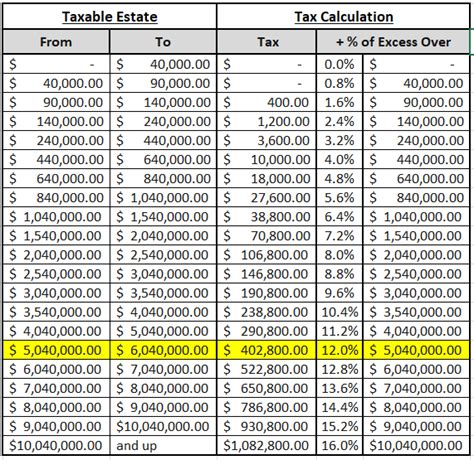

Table of Tax Brackets and Rates

The following table provides a summary of tax brackets and rates for the current tax year:

| Tax Bracket | Tax Rate |

|---|---|

| 10% | 0 - 9,875 |

| 12% | 9,876 - 40,125 |

| 22% | 40,126 - 80,250 |

| 24% | 80,251 - 164,700 |

| 32% | 164,701 - 214,700 |

| 35% | 214,701 - 518,400 |

| 37% | $518,401 and above |

In summary, the Mass Tax Calculator Tool is a powerful resource that simplifies the process of calculating taxes. By following the steps and tips outlined in this article, users can ensure accurate and reliable calculations, saving time and effort in the process. Whether you’re an individual or a business, the Mass Tax Calculator Tool is an essential resource for navigating the complex world of taxation.

What is the Mass Tax Calculator Tool?

+

The Mass Tax Calculator Tool is an online platform designed to simplify the process of calculating taxes for individuals and businesses.

How do I use the Mass Tax Calculator Tool?

+

To use the Mass Tax Calculator Tool, gather all necessary information, select the relevant tax year, enter your income and deductions, and calculate your tax liability.

What are the benefits of using the Mass Tax Calculator Tool?

+

The benefits of using the Mass Tax Calculator Tool include accuracy and reliability, time-saving, convenience, and compliance with tax regulations.

Related Terms:

- Massachusetts paycheck tax calculator

- Sales tax calculator ma

- Mass tax calculator 2021

- Weekly paycheck calculator Massachusetts

- Income tax calculator

- Federal income tax Massachusetts