Master Minimum Payments: Worksheet Answer Key Revealed

Minimum payments on your credit card may seem like a safety net for those times when your budget is stretched thin, yet they can lead to long-term debt if not handled correctly. Understanding how to manage and calculate these minimum payments effectively is crucial for maintaining financial health. This detailed guide will reveal the master key for worksheets on credit card minimum payments, offering practical steps, considerations, and insights to help you take control of your credit card debt.

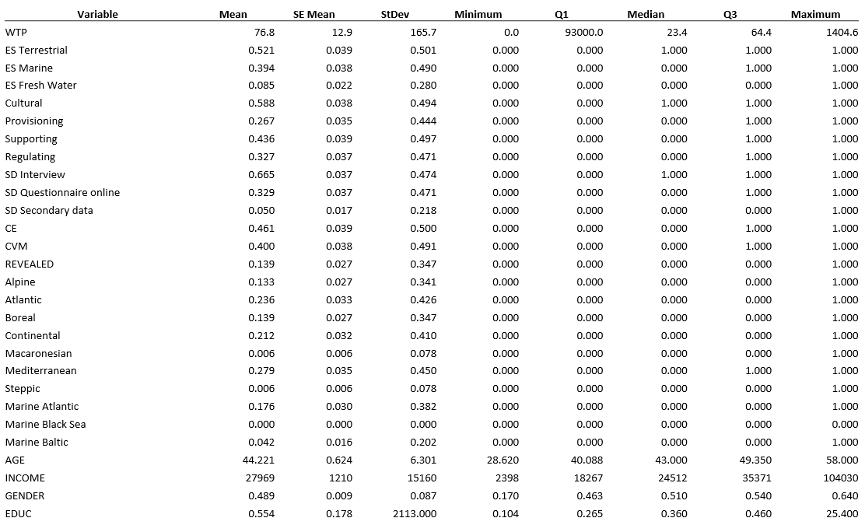

Understanding Credit Card Minimum Payments

Credit card minimum payments are the smallest amount you’re required to pay each month to avoid late fees and keep your account in good standing. Here’s what you need to know:

- Percentage of Balance: Most credit card issuers calculate minimum payments based on a percentage of your current balance. This percentage can range from 1% to 3%.

- Flat Fee: Some might include a flat fee or interest-only payments, whichever is greater.

- Compound Interest: Understand that unpaid interest is added to the balance, making future minimums larger.

How to Calculate Your Minimum Payment

Here’s a step-by-step guide on how to calculate your minimum payment:

- Identify your statement balance: This is the total amount you owe at the end of each billing cycle.

- Find the minimum payment rate: Check your credit card agreement for the percentage or minimum payment terms.

- Calculate: Multiply the statement balance by the minimum payment rate. For example, if your balance is 2,000 and the rate is 2%, your minimum payment would be 40.

- Check for a flat fee: If your minimum payment includes a flat fee, take the higher of the two amounts.

⚠️ Note: Always check your credit card agreement for specific terms as payment calculations can vary between issuers.

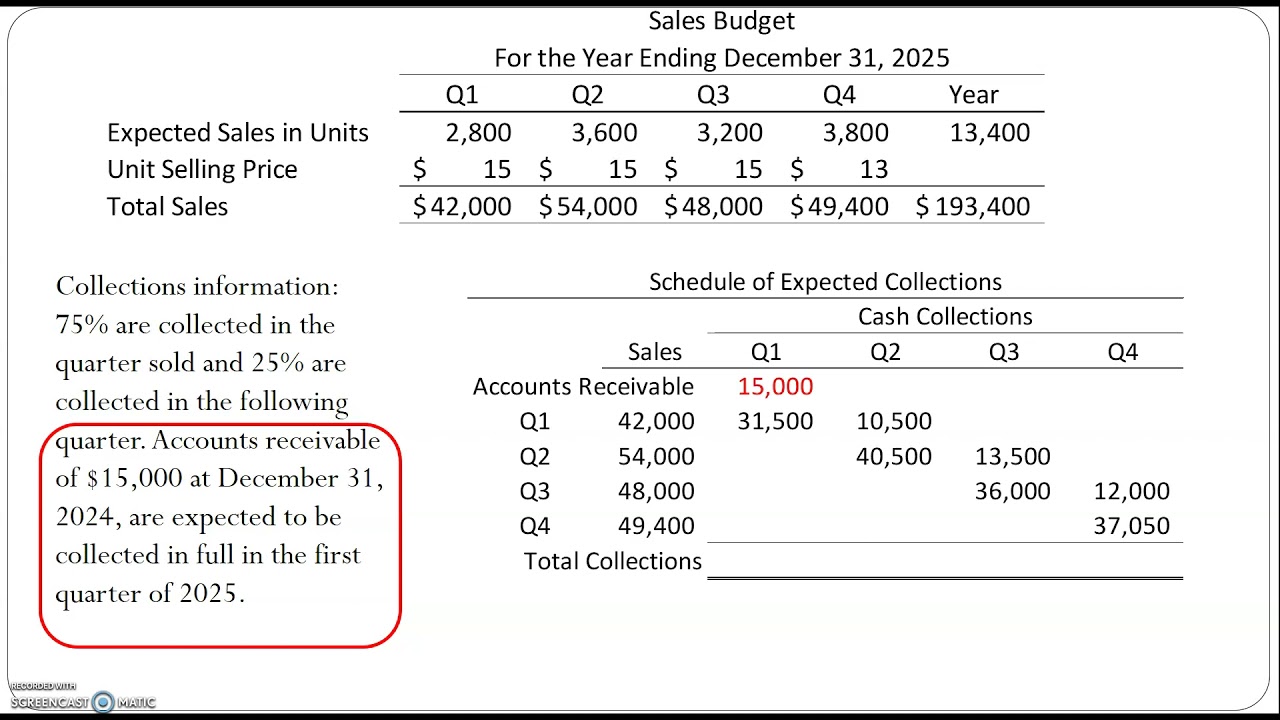

The Worksheet: Calculating Minimum Payments

Let’s use a worksheet example to illustrate how you can work out your minimum payment:

| Month | Balance | Min. Payment Rate | Min. Payment Calculation | New Balance |

|---|---|---|---|---|

| January | $2,000.00 | 2% | $40.00 | $1,960.00 + interest |

| February | $1,960.00 | 2% | $39.20 | $1,920.80 + interest |

| March | $1,920.80 | 2% | $38.42 | $1,882.38 + interest |

🔍 Note: This table does not include interest accrued, which would increase the new balance for each month.

Strategies to Manage Credit Card Debt

Now that you understand how to calculate your minimum payment, let’s look at strategies for managing and reducing your credit card debt:

- Pay more than the minimum: Even small increases over the minimum payment can significantly reduce the total interest paid over time.

- Use the debt snowball or avalanche method: Choose between tackling smaller debts first or those with the highest interest rate.

- Consolidate: If you have multiple credit cards, consider a balance transfer or debt consolidation loan to simplify payments.

- Negotiate interest rates: Sometimes, calling your credit card provider can result in a lower interest rate.

- Create a budget: Allocate money for debt payments, prioritizing high-interest debts.

💡 Note: Always track your progress by reviewing statements and planning your payments accordingly.

Future Proofing: Avoiding Credit Card Debt

Preventing credit card debt from becoming an issue is as important as managing it:

- Understand your spending habits: Analyze your past credit card statements to see where you can cut back.

- Emergency fund: Building an emergency fund can prevent reliance on credit cards during unexpected expenses.

- Spend within your means: Only charge what you can afford to pay off each month.

- Use tools and apps: There are numerous budgeting apps and tools that can help you stay on top of your finances.

- Stay financially educated: Continuously educate yourself on financial management and credit practices.

To wrap up, mastering minimum payments isn't just about keeping the banks at bay; it's about setting yourself up for a financially stable future. By understanding how these payments work and applying strategies to manage and reduce debt, you're not just paying the bare minimum—you're actively working towards financial freedom.

Why should I pay more than the minimum on my credit card?

+

Paying more than the minimum significantly reduces the amount of interest you’ll pay over time, allowing you to become debt-free much faster.

Can I negotiate my credit card’s minimum payment?

+

While you can’t directly negotiate minimum payments, you might be able to negotiate your interest rate or seek a hardship plan with your creditor.

What happens if I can’t afford even the minimum payment?

+

Contact your credit card issuer to discuss options like a lower minimum payment temporarily or entering a hardship program.

Is it better to pay off credit cards with the smallest balance or highest interest rate?

+

Paying off cards with the highest interest rate saves you more money over time (debt avalanche), but some prefer the motivation of paying off smaller balances first (debt snowball).

How can I prevent credit card debt in the future?

+

To prevent future debt, create a budget, save for emergencies, understand your spending patterns, and use credit responsibly by paying off the balance each month.