Military

MA Paycheck Calculator Tool

Introduction to MA Paycheck Calculator Tool

The Massachusetts paycheck calculator tool is a vital resource for employees and employers alike, designed to help calculate take-home pay and understand the impact of taxes and deductions on an individual’s paycheck. This tool is particularly useful for those living and working in Massachusetts, as it takes into account the state’s specific tax laws and regulations. In this article, we will explore the features and benefits of the MA paycheck calculator tool, as well as provide guidance on how to use it effectively.

Understanding the MA Paycheck Calculator Tool

The MA paycheck calculator tool is an online resource that allows users to input their gross income, tax filing status, and other relevant information to calculate their net pay. This tool is essential for employees who want to understand how much of their hard-earned money will be deducted for federal, state, and local taxes, as well as other deductions such as health insurance and 401(k) contributions. By using the MA paycheck calculator tool, individuals can get a clear picture of their take-home pay and make informed decisions about their finances.

Key Features of the MA Paycheck Calculator Tool

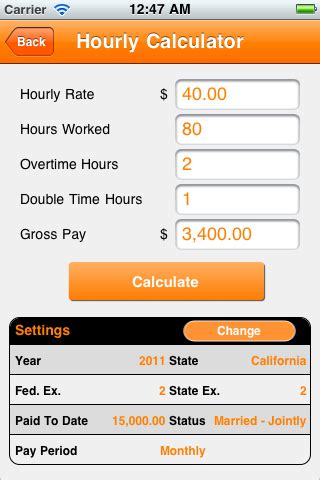

Some of the key features of the MA paycheck calculator tool include: * Gross income calculator: allows users to input their hourly wage or annual salary to calculate their gross income * Tax calculator: takes into account federal, state, and local taxes to calculate the total amount of taxes deducted from the user’s paycheck * Deductions calculator: allows users to input their health insurance premiums, 401(k) contributions, and other deductions to calculate the total amount deducted from their paycheck * Net pay calculator: calculates the user’s take-home pay after all taxes and deductions have been accounted for

How to Use the MA Paycheck Calculator Tool

Using the MA paycheck calculator tool is straightforward and easy. Here are the steps to follow: * Input your gross income or hourly wage * Select your tax filing status (single, married, head of household, etc.) * Input your number of dependents * Input your health insurance premiums and other deductions * Click calculate to get your net pay

📝 Note: It's essential to have accurate information about your income, taxes, and deductions to get the most out of the MA paycheck calculator tool.

Benefits of Using the MA Paycheck Calculator Tool

The MA paycheck calculator tool offers several benefits, including: * Accurate calculations: get an accurate picture of your take-home pay and understand how much of your money is being deducted for taxes and other deductions * Informed decision-making: make informed decisions about your finances, such as adjusting your 401(k) contributions or health insurance premiums * Reduced stress: reduce stress and uncertainty about your finances by having a clear understanding of your net pay

Common Mistakes to Avoid When Using the MA Paycheck Calculator Tool

When using the MA paycheck calculator tool, there are several common mistakes to avoid, including: * Inaccurate income information: make sure to input your gross income or hourly wage accurately to get an accurate calculation * Incorrect tax filing status: select the correct tax filing status to ensure accurate calculations * Failure to account for deductions: make sure to input all relevant deductions, such as health insurance premiums and 401(k) contributions

| Gross Income | Tax Filing Status | Number of Dependents | Health Insurance Premiums | Net Pay |

|---|---|---|---|---|

| $50,000 | Single | 0 | $200 | $3,500 |

| $75,000 | Married | 2 | $300 | $5,500 |

Conclusion and Final Thoughts

In conclusion, the MA paycheck calculator tool is a valuable resource for employees and employers in Massachusetts. By using this tool, individuals can get an accurate picture of their take-home pay and make informed decisions about their finances. It’s essential to use the tool correctly and avoid common mistakes to get the most out of it. By following the steps outlined in this article and using the MA paycheck calculator tool effectively, individuals can reduce stress and uncertainty about their finances and make the most of their hard-earned money.

What is the MA paycheck calculator tool?

+

The MA paycheck calculator tool is an online resource that allows users to calculate their take-home pay and understand the impact of taxes and deductions on their paycheck.

How do I use the MA paycheck calculator tool?

+

To use the MA paycheck calculator tool, simply input your gross income, tax filing status, number of dependents, and health insurance premiums, and click calculate to get your net pay.

What are the benefits of using the MA paycheck calculator tool?

+

The benefits of using the MA paycheck calculator tool include accurate calculations, informed decision-making, and reduced stress and uncertainty about finances.