5 Paycheck Calculator Tips

Introduction to Paycheck Calculators

A paycheck calculator is a valuable tool for employees and employers alike, helping to accurately calculate take-home pay based on gross income, deductions, and other factors. With the complexity of tax laws and varying rates of deductions, using a paycheck calculator can simplify the process and ensure accuracy. Whether you’re an individual trying to understand your paycheck or an employer looking to manage payroll effectively, these tools are indispensable.

Understanding Paycheck Calculator Basics

Before diving into the advanced features and tips for using a paycheck calculator, it’s essential to understand the basics. A typical paycheck calculator will ask for your gross income, the number of pay periods per year (e.g., biweekly, monthly), and then various deductions such as federal and state income taxes, health insurance premiums, 401(k) contributions, and other deductions. By inputting these figures, you can get an estimate of your net pay. Understanding these basics is crucial for making the most out of a paycheck calculator.

Tips for Using a Paycheck Calculator Effectively

Here are some tips to enhance your experience with paycheck calculators: - Choose the Right Calculator: With numerous paycheck calculators available online, it’s vital to choose one that is reputable and updated with the latest tax laws and rates. Some calculators are more comprehensive, allowing for detailed inputs such as different types of income, various deductions, and even predictions for future pay periods. - Input Accurate Information: The accuracy of the calculator’s output depends on the accuracy of the input. Ensure that you have the correct figures for your income, deductions, and any other relevant financial information. Double-checking your numbers can prevent errors in your calculations. - Consider All Deductions: Don’t forget to include all deductions, not just the obvious ones like federal and state taxes. Other deductions might include health insurance premiums, retirement plan contributions, life insurance premiums, and any pre-tax deductions for things like childcare or health savings accounts. - Account for Changes: If there are changes in your income, deductions, or tax status, update your calculations accordingly. This could be due to a promotion, a change in marital status, having children, or moving to a different state. - Use for Planning: A paycheck calculator is not just for calculating your current take-home pay. It can also be a powerful planning tool. You can use it to predict how changes in your income or deductions might affect your net pay, helping you make informed financial decisions.

Advanced Features of Paycheck Calculators

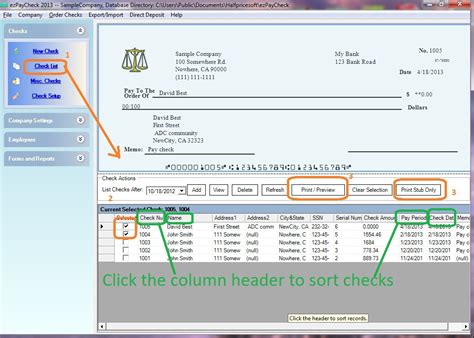

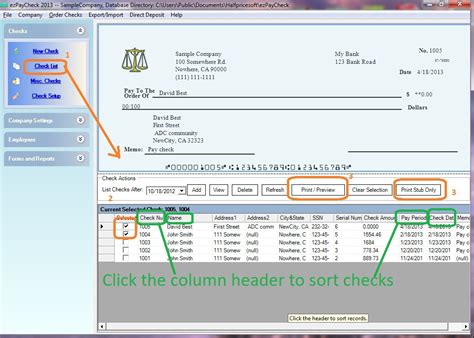

Some paycheck calculators come with advanced features that can further assist in financial planning and management. These might include: - Tax Estimator: Some calculators can estimate your annual tax liability based on your income and deductions, helping you avoid any surprises during tax season. - Pay Stub Generator: After calculating your net pay, some tools can generate a pay stub that outlines all the deductions and contributions, providing a clear breakdown of your paycheck. - Comparative Analysis: Advanced calculators might allow you to compare different scenarios, such as the impact of increasing your 401(k) contributions or changing your tax filing status.

Benefits of Using Paycheck Calculators

The benefits of using paycheck calculators are numerous: - Accuracy: They help ensure that your paycheck calculations are accurate, reducing the risk of errors that could lead to financial stress. - Planning: By providing a clear picture of your take-home pay, these calculators enable better financial planning and budgeting. - Transparency: They offer a detailed breakdown of deductions and contributions, promoting understanding and management of your financial situation. - Flexibility: Many calculators allow for scenario planning, enabling you to explore how different financial decisions might impact your income.

💡 Note: Always ensure that the paycheck calculator you use is updated with the latest tax laws and regulations to get the most accurate calculations.

In summary, paycheck calculators are essential tools for anyone looking to understand and manage their income effectively. By choosing the right calculator, inputting accurate information, considering all deductions, accounting for changes, and using it for planning, you can maximize the benefits of these tools. Whether you’re an employee trying to make sense of your paycheck or an employer managing payroll, a paycheck calculator can provide valuable insights and help in making informed financial decisions.

What is the primary purpose of a paycheck calculator?

+

The primary purpose of a paycheck calculator is to calculate an individual’s take-home pay based on their gross income and deductions, providing an accurate estimate of their net pay.

How often should I update my paycheck calculations?

+

You should update your paycheck calculations whenever there is a change in your income, deductions, or tax status. This ensures that your calculations remain accurate and reflect your current financial situation.

Can paycheck calculators help with financial planning?

+

Yes, paycheck calculators can be a valuable tool for financial planning. They allow you to predict how changes in your income or deductions might affect your net pay, helping you make informed decisions about your financial future.