5 Tips for Calculating Child Support in Louisiana

Louisiana's approach to child support is structured to ensure that both parents contribute financially to their child's upbringing after a separation or divorce. Here's how you can navigate the complex system of calculating child support in the state.

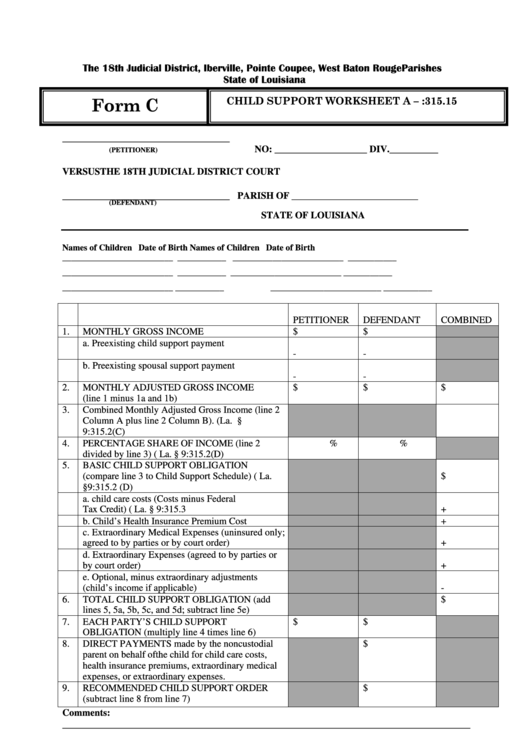

Understand Louisiana's Child Support Guidelines

Before diving into the specifics, it's crucial to understand that Louisiana uses a fixed percentage model to calculate child support payments. Here's how it works:

- One Child: 25% of the non-custodial parent's adjusted gross income.

- Two Children: 30% of the non-custodial parent's adjusted gross income.

- Three Children: 35% of the non-custodial parent's adjusted gross income.

- Four Children: 40% of the non-custodial parent's adjusted gross income.

- Five or More Children: 45% of the non-custodial parent's adjusted gross income.

⚠️ Note: Adjusted gross income considers all income sources but excludes certain allowable deductions.

Calculate Your Adjusted Gross Income

The first step in applying Louisiana's child support guidelines is to determine your adjusted gross income. Here's what you need to know:

- Income Includes: Wages, overtime, bonuses, self-employment income, child support received from other children, etc.

- Deductions: Child support paid for other children, health insurance premiums, mandatory retirement contributions, etc.

💡 Note: Self-employed individuals should account for business expenses to arrive at their net income.

Account for Additional Expenses

While the fixed percentages provide a base calculation, there are often additional expenses that need consideration:

- Child Care Costs: Both parents might share these expenses proportionally.

- Health Insurance: Costs for the child's health insurance are divided, often equally, between parents.

- Extraordinary Expenses: Uncovered medical expenses, private school tuition, or other special needs costs might be added to the base support.

🔍 Note: Court might require evidence of these additional expenses.

Navigate Deviation from Guidelines

Though the percentages are a starting point, courts have the discretion to deviate based on various factors:

- Combined Household Income: If high or low compared to state averages, this might alter the support amount.

- Custody Arrangement: Shared custody arrangements can change how child support is calculated.

- The Child's Needs: Special needs or talents might justify an increase in support.

- The Non-Custodial Parent's Means: Economic situation, unemployment, or inability to pay might lead to a deviation.

🌟 Note: These deviations must be adequately justified in court.

Seek Legal Counsel

While understanding the basics of child support calculation is essential, legal nuances often require expert advice:

- Lawyer: A family law attorney can offer tailored advice and representation.

- Consultation: Even a one-time consultation can provide clarity on your specific situation.

- Support Services: Many courts provide self-help resources and free legal clinics.

Remember, child support is not just about fulfilling a legal obligation but also about ensuring the well-being of your child. Calculations based on income and expenses can be adjusted to meet the child’s needs while being fair to both parents. After the separation or divorce, parents need to remain open to revisiting child support agreements as circumstances change.

What if my income changes significantly?

+

You can file for a modification of child support if there's a substantial change in either parent's financial situation or in the needs of the child.

How are shared custody arrangements considered?

+

Shared custody can impact child support. The guidelines might be adjusted to account for time spent with each parent, leading to potentially lower payments or a different arrangement altogether.

Can I deduct child support payments from my taxes?

+

No, child support payments are not tax-deductible, and the custodial parent does not have to report them as income.

In summary, calculating child support in Louisiana requires an understanding of the state’s guidelines, calculating adjusted gross income, accounting for additional expenses, recognizing when deviations from the guidelines might apply, and seeking legal counsel. This careful navigation ensures that the child’s needs are met in a fair and just manner, reflecting changes in both parents’ lives and the child’s evolving needs. Remember, child support is about fostering the best environment for your child to grow, thrive, and succeed.