Lockheed Martin Credit Union: Serving Employees Financial Needs

Understanding the Lockheed Martin Credit Union

As one of the largest and most reputable defense contractors in the world, Lockheed Martin has a long history of serving the United States and its allies. But what many people may not know is that the company also has a credit union that serves the financial needs of its employees. In this blog post, we will delve into the world of Lockheed Martin Credit Union and explore its history, benefits, and services.

A Brief History of Lockheed Martin Credit Union

Lockheed Martin Credit Union was founded in 1966 as a not-for-profit financial cooperative to serve the financial needs of Lockheed Martin employees. Over the years, the credit union has grown and evolved to meet the changing needs of its members. Today, Lockheed Martin Credit Union has over 30,000 members and assets of over $1 billion.

Benefits of Lockheed Martin Credit Union Membership

Membership in Lockheed Martin Credit Union offers a wide range of benefits to its members, including:

- Competitive Rates: Lockheed Martin Credit Union offers competitive rates on loans, credit cards, and deposit accounts.

- Personalized Service: The credit union is committed to providing personalized service to its members, with a focus on building long-term relationships.

- Financial Education: Lockheed Martin Credit Union offers financial education and counseling to its members, to help them make informed financial decisions.

- Convenience: The credit union offers online banking, mobile banking, and a network of ATMs and branches for easy access to your accounts.

Services Offered by Lockheed Martin Credit Union

Lockheed Martin Credit Union offers a wide range of financial services to its members, including:

- Deposit Accounts: The credit union offers a variety of deposit accounts, including checking, savings, money market, and certificate accounts.

- Loans: Lockheed Martin Credit Union offers a range of loan products, including auto loans, personal loans, mortgages, and home equity loans.

- Credit Cards: The credit union offers a range of credit card products, including cash back, rewards, and low-interest cards.

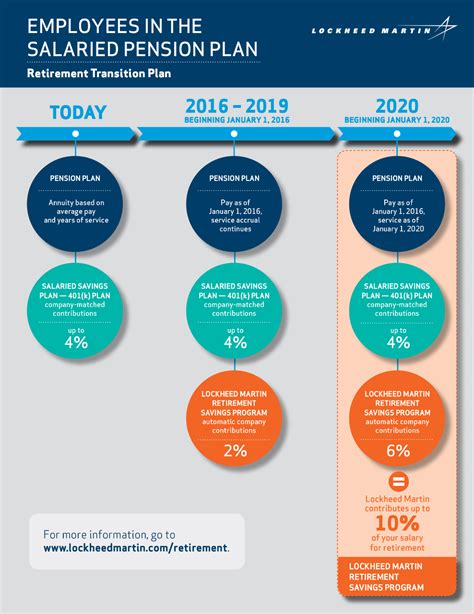

- Investment Services: Lockheed Martin Credit Union offers investment services, including retirement accounts, brokerage services, and financial planning.

📝 Note: Lockheed Martin Credit Union membership is restricted to Lockheed Martin employees, retirees, and their families.

How to Join Lockheed Martin Credit Union

To join Lockheed Martin Credit Union, you must be an employee, retiree, or family member of a Lockheed Martin employee. Here are the steps to join:

- Step 1: Visit the Lockheed Martin Credit Union website and review the membership requirements.

- Step 2: Download and complete the membership application.

- Step 3: Gather required documents, including proof of employment or family relationship.

- Step 4: Submit the application and supporting documents to the credit union.

📝 Note: Membership is subject to approval by the credit union's board of directors.

Conclusion

Lockheed Martin Credit Union is a not-for-profit financial cooperative that serves the financial needs of Lockheed Martin employees, retirees, and their families. With a wide range of financial services and competitive rates, the credit union is a great option for those who are eligible to join. By understanding the history, benefits, and services of Lockheed Martin Credit Union, you can make informed decisions about your financial future.

Who is eligible to join Lockheed Martin Credit Union?

+

Membership is restricted to Lockheed Martin employees, retirees, and their families.

What types of deposit accounts does Lockheed Martin Credit Union offer?

+

The credit union offers a variety of deposit accounts, including checking, savings, money market, and certificate accounts.

Does Lockheed Martin Credit Union offer online banking?

+

Yes, the credit union offers online banking, mobile banking, and a network of ATMs and branches for easy access to your accounts.