Worksheet

Unveil Economic Choices: Lesson 2 Worksheet Answers

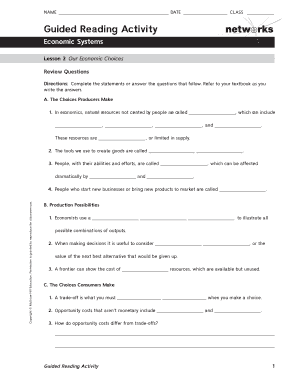

<p>In Lesson 2 of the "Unveil Economic Choices" curriculum, we delve into fundamental economic principles like scarcity, choice, and opportunity cost. These concepts are not only central to economics but also critically important for understanding decision-making in daily life. Let's explore the answers to the Lesson 2 Worksheet to better comprehend how these principles play out in practical situations.</p>

<h2>Understanding Economic Principles</h2>

<p>Economics isn't just about money or finance; it's a study of how people make choices with limited resources. Here’s what you need to know:</p>

<ul>

<li><strong>Scarcity:</strong> This refers to the fundamental economic problem that resources are limited, while wants are virtually unlimited. Individuals, firms, and governments must therefore decide how to best allocate these scarce resources.</li>

<li><strong>Choice:</strong> Due to scarcity, every economic decision involves choosing one option over others. This choice is driven by the perceived value of different options and the costs associated with them.</li>

<li><strong>Opportunity Cost:</strong> The most significant cost of choosing an option is the loss of potential gain from other alternatives not chosen. This is known as the opportunity cost.</li>

</ul>

<h2>Worksheet Answers</h2>

<p>Here are the answers to the questions presented in the worksheet:</p>

<ol>

<li>

<p><strong>Why must people make economic choices?</strong><br>

People must make economic choices because resources (like time, money, and goods) are limited, while wants and needs are infinite. This forces individuals to make decisions on how to utilize these scarce resources most efficiently.</p>

</li>

<li>

<p><strong>Define scarcity and explain how it relates to choice.</strong><br>

Scarcity occurs when human wants for goods and services exceed the available supply. Choice is a direct result of scarcity, as individuals must choose among limited options, often at the expense of alternative goods or services that could have been pursued.</p>

</li>

<li>

<p><strong>What is opportunity cost, and can you provide an example?</strong><br>

Opportunity cost is the value of the next best alternative forgone as a result of making a decision. For example, if you choose to spend an hour studying for an exam, the opportunity cost could be the leisure activity or work you could have done instead.</p>

</li>

</ol>

<h2>Practical Application</h2>

<p>Now let's apply these concepts with some practical examples:</p>

<h3>Scenario: Saving vs. Spending</h3>

<ul>

<li>You have $100. You could:

<ul>

<li>Buy a new pair of shoes.</li>

<li>Add the money to your savings account.</li>

<li>Purchase tickets for an upcoming concert.</li>

</ul>

</li>

</ul>

<p>Your choice represents an economic decision influenced by scarcity (limited funds), choice (which option to select), and opportunity cost (what you must give up when choosing one option).</p>

<p class="pro-note">🔍 Note: The 'right' choice varies with individual preferences, financial goals, and personal circumstances, highlighting the subjective nature of opportunity cost.</p>

<h3>Scenario: Time Management</h3>

<ul>

<li>Imagine you have two hours free in the evening. You could:

<ul>

<li>Work on a side project to earn extra income.</li>

<li>Spend time with family.</li>

<li>Relax and watch a movie.</li>

</ul>

</li>

</ul>

<p>Here, your decision involves evaluating what benefits each option brings and what you're sacrificing by choosing one over the others.</p>

<h2>Table of Opportunity Costs</h2>

<table border="1">

<tr>

<th>Choice</th>

<th>Opportunity Cost</th>

</tr>

<tr>

<td>Buy New Shoes</td>

<td>Savings, Concert Tickets</td>

</tr>

<tr>

<td>Add to Savings</td>

<td>New Shoes, Leisure</td>

</tr>

<tr>

<td>Concert Tickets</td>

<td>New Shoes, Future Savings</td>

</tr>

</table>

<p>This table demonstrates how each option carries with it a specific opportunity cost, emphasizing the need for careful decision-making.</p>

<p>Having explored these concepts, we can see that economics is deeply intertwined with daily life. Every time we decide to spend money, time, or resources on one thing, we are simultaneously choosing not to spend it on another. Understanding these principles helps us make more informed and thoughtful economic decisions. It allows us to appreciate the value of our choices and the sacrifices they entail. The significance of these lessons lies in their applicability, from personal finance to business strategy, and even in policy-making. By becoming aware of the economic choices we make, we can optimize our decisions to better align with our goals and priorities.</p>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What if all options seem equally valuable?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In cases where all options seem equally valuable, you might consider additional factors like long-term benefits, risks involved, or personal satisfaction. Sometimes, choosing any option is better than making no decision at all, as indecision can also have opportunity costs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can opportunity cost be negative?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While opportunity cost is generally considered as a loss, in scenarios where an option has lower utility or value than doing nothing or a default action, one might view the opportunity cost as negative or beneficial. However, this interpretation is less common in traditional economic analysis.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do we quantify opportunity costs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Quantifying opportunity cost involves assessing the potential value of all alternatives foregone. This can be monetary, in terms of time, or even happiness and satisfaction. Methods like cost-benefit analysis, comparative advantage analysis, or simply evaluating personal priorities can help in this process.</p>

</div>

</div>

</div>

</div>