Mastering Money: Free Learn Money Worksheets for Kids

One of the essential life skills to impart to children is money management. Understanding the basic concepts of finance from a young age can set a solid foundation for fiscal responsibility in adulthood. This is where money worksheets come into play. These educational tools help children learn about money in an engaging and hands-on manner. In this post, we'll delve into why financial literacy for kids is vital, how you can teach them through free learn money worksheets, and provide actionable tips for making the learning process both fun and effective.

Why Financial Literacy is Crucial for Kids

Financial literacy is more than just about counting coins or saving allowance. Here's why it's indispensable:

- Future Independence: Understanding money helps kids become financially independent adults.

- Money Management: It teaches them how to budget, save, and invest their earnings wisely.

- Decision Making: They learn to make informed decisions about spending, thereby avoiding impulsive purchases.

- Math Skills: Money handling improves arithmetic proficiency, as kids need to perform basic operations.

- Responsibility: They learn the value of earning, saving, and spending money responsibly.

The Role of Money Worksheets in Education

Money worksheets are more than just a teaching tool; they are a bridge to financial literacy. Here's how:

- Practical Application: They turn abstract financial concepts into tangible exercises.

- Visual Learning: Kids often learn better with visuals, and worksheets provide pictorial representation of money.

- Incremental Learning: They allow for progressive learning, building from basic to complex concepts.

- Self-Paced Learning: Children can work at their own pace, which fosters independence and confidence.

Getting Started with Free Learn Money Worksheets

Here's how you can introduce your child to the world of finance using free worksheets:

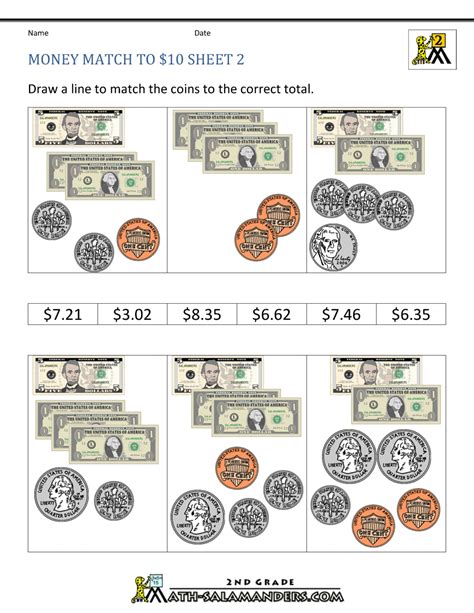

1. Identifying Money

Start with the basics. Worksheets that help kids identify coins and bills by name, value, and appearance are crucial. They can:

- Match coins to their correct values

- Sort money into groups based on type

- Practice counting and summing up values

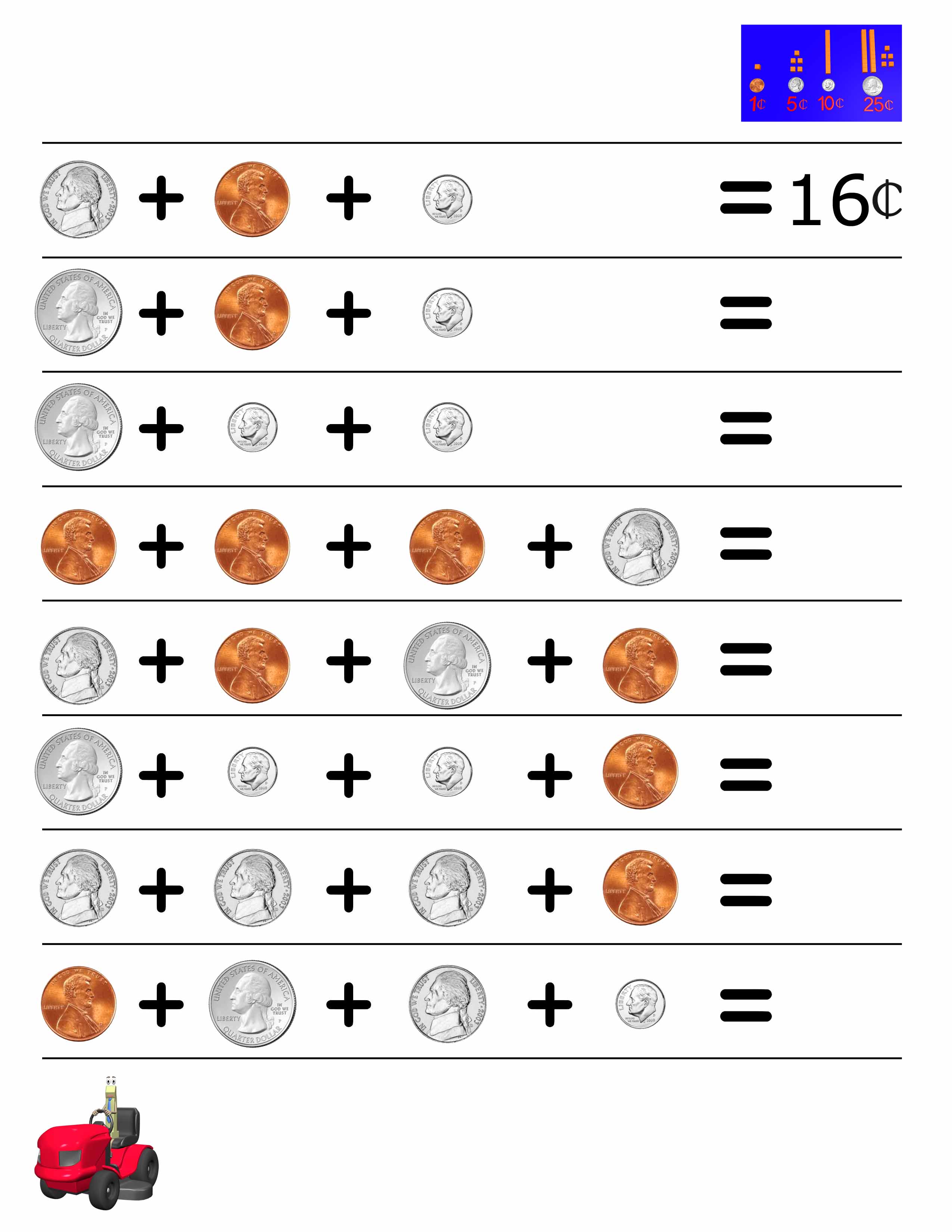

2. Simple Arithmetic with Money

Progress to using worksheets that involve basic arithmetic:

- Addition and subtraction to calculate change

- Multiplication for doubling or tripling amounts

- Division to split money

3. Shopping and Budgeting

Introduce worksheets that simulate real-life shopping experiences:

- Calculate the cost of items in a virtual grocery store

- Practice budgeting with fixed amounts

- Learn about discounts and the concept of saving money

4. Savings and Investments

Use worksheets to teach the concepts of saving and investing:

- Simple interest calculations

- Introduction to compounding

- Understanding basic stocks or bonds concepts

📋 Note: Always ensure the level of the worksheet matches your child's grade and comprehension level. Too complex a worksheet can lead to frustration, while too simple might not challenge them enough.

Incorporating Fun into Financial Learning

Learning should be enjoyable. Here are some ways to make money education fun:

- Games: Turn worksheets into games, like a scavenger hunt for coins or a board game involving money management.

- Rewards: Offer small rewards for completing money tasks, teaching them the value of earning money.

- Stories: Use story time to introduce financial concepts. For example, share a tale about a character who learns to save.

- Role Play: Role-play real-life situations like going to a restaurant or paying for a toy.

Building a Financial Literacy Routine

Incorporate financial education into daily life:

- Daily Activities: Involve kids in simple financial tasks like paying at the store or setting up a savings jar.

- Allowance: Give them a small allowance, and use worksheets to help them plan how to spend and save it.

- Chore Chart: Link earning to doing chores, teaching work ethic and money management simultaneously.

Remember, consistency in applying these practices will reinforce the learning.

Money management is a skill best learned early. By providing children with access to free learn money worksheets, we give them the tools to understand financial principles that will serve them for a lifetime. These worksheets, when used correctly, can transform the abstract concept of money into a clear, manageable, and even enjoyable subject of study. Through identification, basic arithmetic, budgeting, shopping, and learning about savings and investments, kids can develop a strong foundation in financial literacy. The key is to integrate these learning experiences into daily routines, ensure they are fun, and adjust the difficulty to match the child's level of understanding. By doing so, we're not just teaching them about money; we're nurturing responsible, independent, and savvy future adults.

At what age should children start learning about money?

+

Children can start grasping the basic concepts of money around age 3-5, although formal education usually begins in elementary school.

How often should children practice with money worksheets?

+

Regular practice is beneficial. Once or twice a week, or incorporating money tasks into daily life, can reinforce learning effectively.

Are there any free resources for money worksheets?

+

Yes, numerous educational websites and blogs offer free printable money worksheets tailored for various age groups.