5 Ways to Effectively Use a Journal Entry Worksheet

Journal entry worksheets are not just tools for financial reporting but are dynamic aids for managing daily finances, tracking expenses, planning budgets, and enhancing personal or business growth. In this post, we'll explore how to effectively use these worksheets to maximize their utility and benefits.

Understanding Journal Entry Worksheets

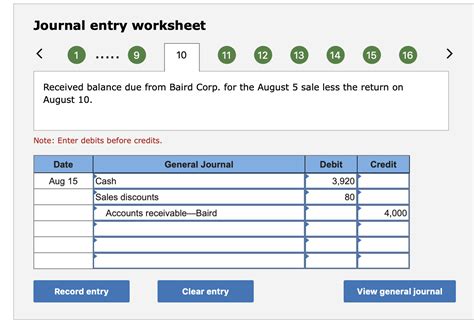

A journal entry worksheet is essentially a template that helps organize financial transactions into a structured format. Here are the key components:

- Date: When the transaction occurred.

- Description: A brief note about the transaction or event.

- Debit and Credit: The amount involved with the financial activity.

- Account: The relevant account the transaction should be posted to.

1. Streamline Your Accounting Process

One of the primary uses of a journal entry worksheet is to streamline the accounting process. Here’s how:

- Categorize Transactions: Use the worksheet to sort transactions into relevant categories like income, expenses, assets, or liabilities.

- Ensure Accuracy: By having a structured template, the likelihood of entering data incorrectly reduces, ensuring your records are accurate.

- Time Efficiency: Pre-formatted worksheets save time, enabling quick entries without needing to recreate the format each time.

2. Budget Planning and Tracking

A well-constructed journal entry worksheet can help in:

- Budget Creation: Use it to track all anticipated expenses and income for the upcoming period.

- Variance Analysis: Compare planned versus actual expenditures to identify where deviations occur and adjust future budgets.

- Financial Goals: Track progress towards financial goals like saving for a vacation or reducing debt by regularly updating the worksheet.

💡 Note: Remember that effective budget tracking requires consistent updates, ideally daily or weekly.

3. Enhancing Financial Decision-Making

The data entered into a journal entry worksheet can be a goldmine for:

- Analyzing Trends: Identify spending patterns or unexpected financial drains by analyzing the entries over time.

- Forecasting: Use historical data to make informed predictions about future financial health.

- Decision Support: Provide concrete data for decisions like whether to invest in a new business opportunity or cut back on discretionary spending.

🗓️ Note: Regular reviews of your journal entries can greatly enhance your ability to make timely and strategic financial decisions.

4. Managing Cash Flow

Cash flow management is crucial, especially for small businesses or personal finance. Here’s how you can utilize a journal entry worksheet:

- Record Cash Transactions: Document all cash inflows and outflows to get a real-time view of liquidity.

- Future Cash Projections: Use past entries to forecast future cash positions, helping avoid cash shortages.

| Date | Description | Amount | Cash Balance |

|---|---|---|---|

| Jan 1, 2023 | Sales | 1000</td> <td>1500 | |

| Jan 2, 2023 | Utilities | -150</td> <td>1350 |

5. Compliance and Audit Readiness

Using journal entry worksheets can significantly ease:

- Compliance: Ensure all transactions are documented to meet tax and regulatory requirements.

- Audit Preparation: Having organized financial records makes the audit process smoother and less stressful.

- Transparency: Provide clear and traceable records to stakeholders or investors.

Journal entry worksheets are invaluable tools that go beyond mere accounting. They help in organizing finances, making informed decisions, and ensuring your financial activities are transparent and compliant. Whether you're managing your personal finances or overseeing a business's financial operations, these worksheets can be tailored to fit your specific needs, making them a versatile component of financial management.

How often should I update my journal entry worksheet?

+

Ideally, update your journal entry worksheet daily for real-time financial management. Weekly updates are sufficient for personal or small business finances.

Can journal entry worksheets help in managing personal debt?

+

Yes, by tracking all financial transactions, including debts, repayments, and interest, you can gain insights into your debt patterns and plan repayment strategies.

What are some digital tools for creating journal entry worksheets?

+

Tools like Google Sheets, Microsoft Excel, or specialized accounting software like QuickBooks or Xero can be used to create and manage journal entry worksheets.

Do I need accounting knowledge to effectively use a journal entry worksheet?

+

Basic accounting knowledge helps, but with clear categories and simple instructions, anyone can manage a journal entry worksheet.