5 IRR Facts

Introduction to IRR

The Internal Rate of Return (IRR) is a metric used in finance and investing to estimate the profitability of a project or investment. It is a crucial tool for investors, businesses, and financial analysts to evaluate the viability of a potential investment. In this article, we will delve into the world of IRR, exploring its definition, calculation, and significance in investment decisions.

What is IRR?

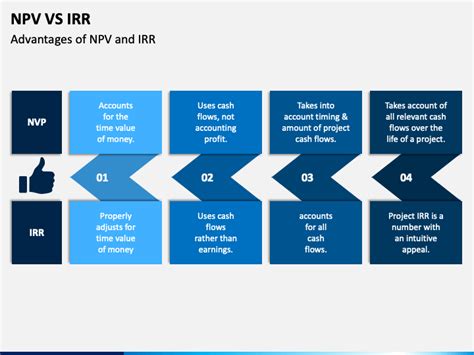

IRR is the rate at which the net present value (NPV) of a project or investment equals zero. In simpler terms, it is the rate at which the total value of future cash flows equals the initial investment. IRR takes into account the time value of money, making it a more accurate measure of an investment’s potential return than other metrics like the payback period. A higher IRR indicates a more attractive investment opportunity.

How to Calculate IRR

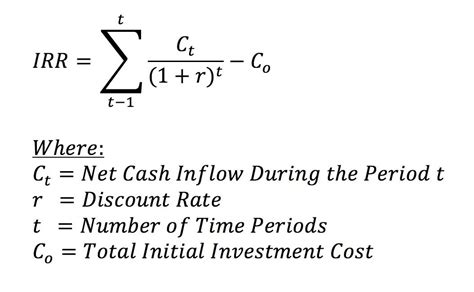

Calculating IRR involves finding the discount rate that makes the NPV of an investment equal to zero. The formula for NPV is:

NPV = Σ (CFt / (1 + r)^t)

Where: - NPV = Net Present Value - CFt = Cash flow at time t - r = Discount rate (IRR) - t = Time period

The IRR calculation can be done using financial calculators, spreadsheet software like Excel, or online IRR calculators. It’s essential to note that IRR calculations assume that all intermediate cash flows are reinvested at the IRR rate.

Importance of IRR in Investment Decisions

IRR plays a vital role in investment decisions, as it helps investors and businesses evaluate the potential return on investment. Here are some key points to consider: * IRR helps to compare different investment opportunities and choose the most profitable one. * It takes into account the time value of money, providing a more accurate picture of an investment’s potential return. * IRR can be used to evaluate the performance of existing investments and make adjustments as needed.

💡 Note: IRR should be used in conjunction with other metrics, such as NPV and payback period, to get a comprehensive view of an investment's potential.

5 IRR Facts

Here are five essential facts about IRR that every investor and business should know: * IRR is not the same as return on investment (ROI): While both metrics measure investment return, IRR takes into account the time value of money, making it a more accurate measure. * IRR assumes reinvestment of intermediate cash flows: This assumption can impact the accuracy of IRR calculations, especially for investments with high intermediate cash flows. * IRR is sensitive to the timing of cash flows: The timing of cash inflows and outflows can significantly impact IRR calculations, making it essential to accurately forecast cash flows. * IRR can be used to evaluate multiple investment scenarios: By calculating the IRR for different investment scenarios, investors and businesses can compare and choose the most profitable option. * IRR has its limitations: IRR does not take into account external factors like inflation, tax rates, and risk, which can impact the actual return on investment.

Real-World Applications of IRR

IRR has numerous real-world applications, including: * Evaluating investment opportunities in stocks, bonds, and real estate * Comparing the potential return on investment for different business projects * Assessing the viability of new business ventures or expansions * Measuring the performance of existing investments and making adjustments as needed

| Investment | IRR | NPV |

|---|---|---|

| Stock A | 10% | $100,000 |

| Stock B | 12% | $120,000 |

| Real Estate | 8% | $80,000 |

As we can see from the table above, IRR can be used to compare the potential return on investment for different assets, helping investors make informed decisions.

In summary, IRR is a powerful tool for evaluating investment opportunities and making informed decisions. By understanding the definition, calculation, and significance of IRR, investors and businesses can make more accurate assessments of potential investments and choose the most profitable options.

What is the main difference between IRR and ROI?

+

The main difference between IRR and ROI is that IRR takes into account the time value of money, making it a more accurate measure of investment return.

How is IRR calculated?

+

IRR is calculated by finding the discount rate that makes the NPV of an investment equal to zero. This can be done using financial calculators, spreadsheet software, or online IRR calculators.

What are the limitations of IRR?

+

IRR has several limitations, including the assumption of reinvestment of intermediate cash flows, sensitivity to the timing of cash flows, and failure to account for external factors like inflation and tax rates.