5 Minnesota Tax Tips

Introduction to Minnesota Tax Tips

When it comes to managing your finances, understanding the tax system in your state is crucial. Minnesota, like other states, has its unique set of tax rules and regulations that can significantly impact your financial planning. Whether you’re a resident, a business owner, or just someone looking to optimize your tax strategy, being informed about Minnesota tax tips can help you navigate the system more efficiently. In this article, we’ll delve into five key Minnesota tax tips that can help you make the most of your financial situation.

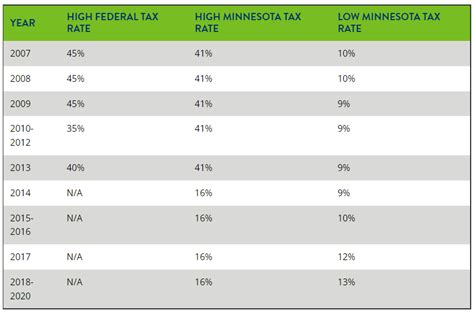

Understanding Minnesota Tax Brackets

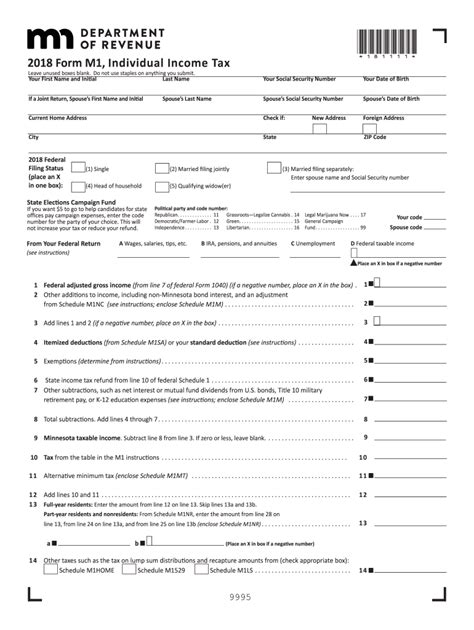

Minnesota has a progressive income tax system, which means that the rate of taxation increases as the taxable amount increases. It’s essential to understand the different tax brackets and how they apply to your income. For the latest tax year, Minnesota has several tax brackets ranging from about 5.35% to 9.85%. Knowing which bracket you fall into can help you plan your income and deductions more effectively. Being aware of these rates can also guide your decisions on investments and retirement savings.

Itemizing Deductions vs. Standard Deduction

When filing your taxes, you have the option to either itemize your deductions or take the standard deduction. Itemizing deductions can be beneficial if you have significant expenses that exceed the standard deduction amount. These can include mortgage interest, charitable donations, medical expenses, and more. However, if your expenses are relatively low, the standard deduction might be the more straightforward and beneficial choice. It’s crucial to calculate both options to see which one results in a lower taxable income.

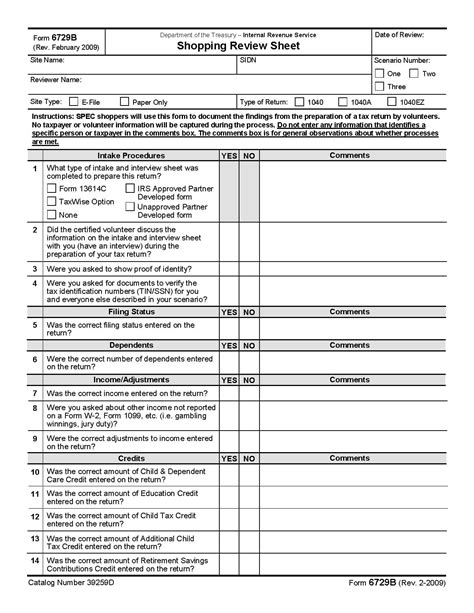

Tax Credits for Individuals and Families

Minnesota offers several tax credits that can directly reduce the amount of tax you owe. These credits are designed to support low-income families, individuals with disabilities, and those pursuing higher education. For example, the Working Family Credit is a refundable credit for low- and moderate-income working individuals and families. There’s also the K-12 Education Credit for parents who pay for education expenses. Understanding and claiming these credits can significantly reduce your tax liability and even result in a refund.

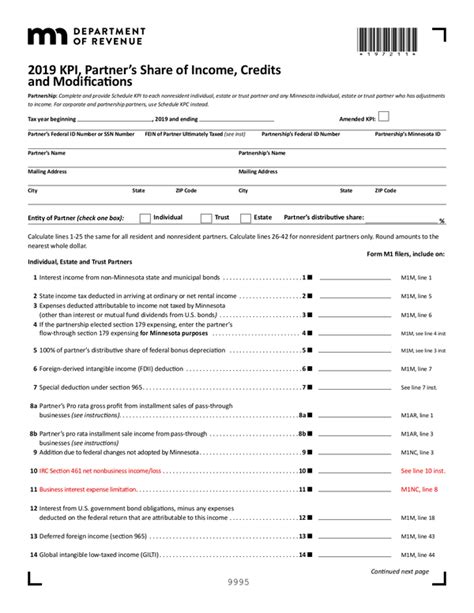

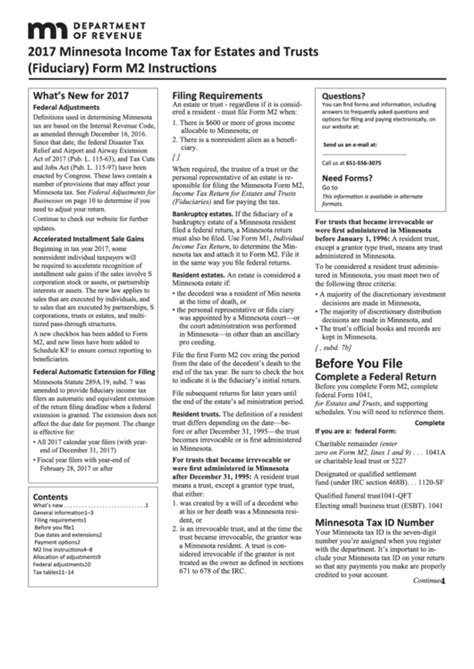

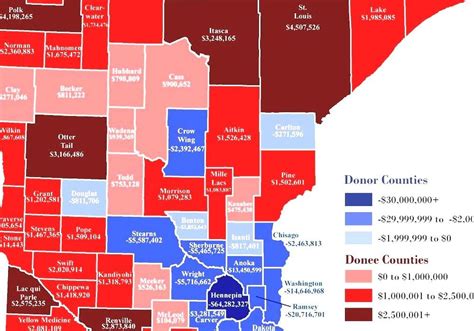

Business Tax Incentives

For businesses operating in Minnesota, there are several tax incentives designed to encourage growth, job creation, and investment in the state. The Angel Tax Credit is one such incentive, providing a credit to investors who invest in start-up businesses, especially those in the technology sector. Another incentive is the Jobs Creation Fund, which provides financial incentives to businesses that create new jobs in the state. These incentives can help businesses reduce their tax burden and allocate more resources to expansion and development.

Sales Tax Exemptions

Minnesota also offers several sales tax exemptions that can help individuals and businesses save on certain purchases. For instance, clothing items and groceries are generally exempt from sales tax. Additionally, certain business equipment and manufacturing materials may also be exempt. Understanding what purchases are exempt from sales tax can help you make more tax-efficient purchasing decisions.

📝 Note: Tax laws and regulations are subject to change, so it's always a good idea to consult with a tax professional or check the official Minnesota tax authority website for the most current information.

In summary, being informed about Minnesota’s tax system can help you make smarter financial decisions. Whether it’s understanding the tax brackets, deciding between itemizing deductions and the standard deduction, claiming tax credits, leveraging business tax incentives, or taking advantage of sales tax exemptions, there are numerous ways to optimize your tax strategy. By considering these Minnesota tax tips, you can potentially reduce your tax liability and keep more of your hard-earned money.

What are the tax brackets in Minnesota?

+

Minnesota has a progressive income tax system with several tax brackets. The rates range from about 5.35% to 9.85%, depending on your taxable income.

How do I know if I should itemize deductions or take the standard deduction?

+

You should calculate both options to see which results in a lower taxable income. Itemizing can be beneficial if you have significant expenses, but the standard deduction might be more straightforward and beneficial if your expenses are relatively low.

What tax credits are available for individuals and families in Minnesota?

+

Minnesota offers several tax credits, including the Working Family Credit for low- and moderate-income working individuals and families, and the K-12 Education Credit for parents who pay for education expenses.