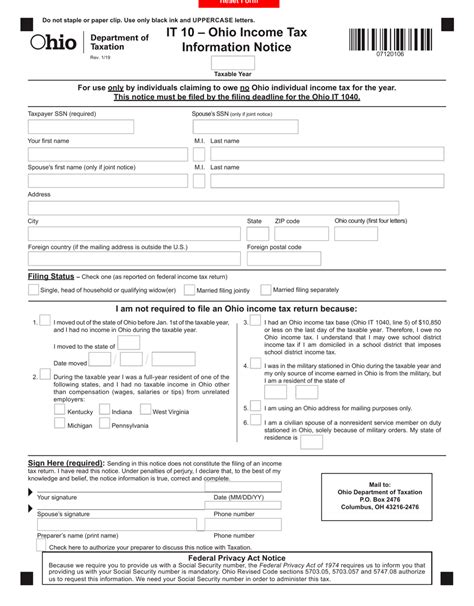

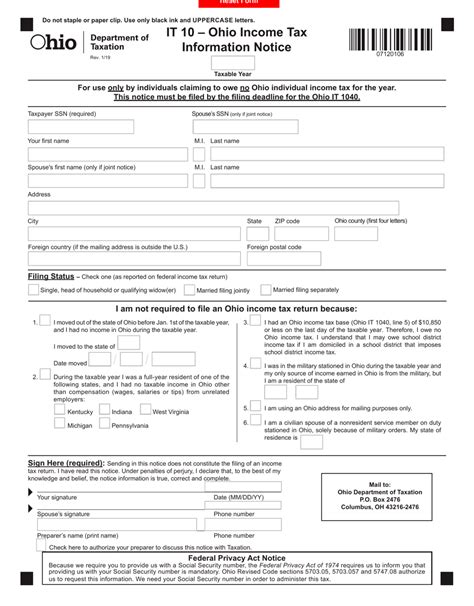

Military

5 Ways Ohio Income

Introduction to Ohio Income Tax

Ohio is a state in the United States that has a unique system for taxing its residents’ income. The state’s income tax is a progressive tax, meaning that the tax rate increases as the taxpayer’s income increases. In this article, we will explore five ways that Ohio income tax affects residents and non-residents alike.

Understanding Ohio Income Tax Rates

The state of Ohio has a progressive income tax system with eight tax brackets. The tax rates range from 2.85% to 4.24%. The tax bracket an individual falls into depends on their filing status and taxable income. For example, single filers with a taxable income of 44,250 or less are taxed at a rate of <b>2.85%</b>, while those with a taxable income of 88,450 or more are taxed at a rate of 4.24%.

Residency Status and Ohio Income Tax

Ohio residents are required to file a state income tax return if they have gross income that exceeds the filing threshold. The filing threshold varies depending on the taxpayer’s filing status and age. For example, single filers under the age of 65 must file a return if they have gross income of 12,500 or more, while those 65 and older must file a return if they have gross income of 14,300 or more. Non-residents are also required to file an Ohio income tax return if they have income earned in Ohio, such as from a job or investments.

Deductions and Credits

Ohio allows taxpayers to claim itemized deductions on their state income tax return, which can help reduce their taxable income. Some common itemized deductions include: * Medical expenses * Mortgage interest * Charitable donations * State and local taxes Ohio also offers several tax credits that can help reduce the amount of tax owed. Some common tax credits include: * Earned Income Tax Credit (EITC) * Child Tax Credit * Education Credits

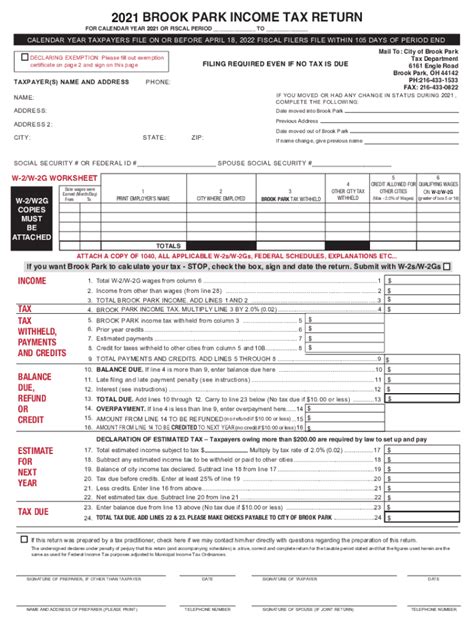

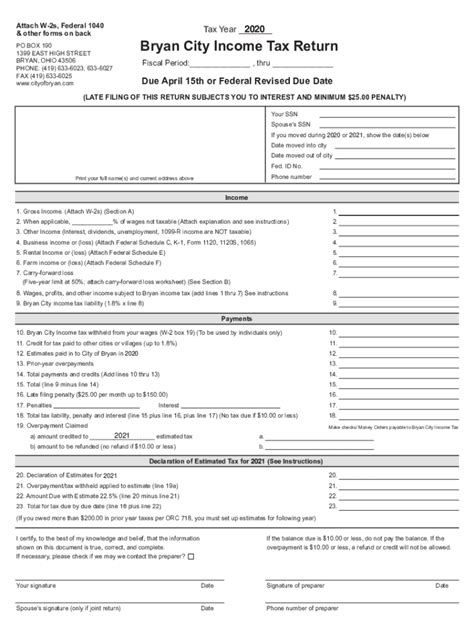

Tax Filing Requirements

Taxpayers in Ohio are required to file their state income tax return by April 15th of each year. Taxpayers can file their return electronically or by mail. The state of Ohio also offers an automatic extension of six months to file their return, which can be requested by filing Form IT 374.

💡 Note: Taxpayers who owe additional tax with their return may be subject to penalties and interest, so it's essential to file and pay on time.

Tax Planning Strategies

Taxpayers in Ohio can use several strategies to minimize their state income tax liability. Some common strategies include: * Maximizing retirement contributions * Harvesting investment losses * Deferring income * Accelerating deductions Taxpayers should consult with a tax professional to determine the best tax planning strategy for their individual situation.

Conclusion and Final Thoughts

In conclusion, Ohio’s income tax system can be complex and nuanced, but understanding the tax rates, residency status, deductions, and credits can help taxpayers navigate the system and minimize their tax liability. By being aware of the tax filing requirements and using tax planning strategies, taxpayers in Ohio can ensure they are in compliance with state tax laws and minimize their tax burden. The key is to stay informed and plan ahead to maximize tax savings.

What is the tax filing deadline in Ohio?

+

The tax filing deadline in Ohio is April 15th of each year.

Can I file an extension for my Ohio state tax return?

+

Yes, you can file an automatic extension of six months by filing Form IT 374.

What are some common itemized deductions in Ohio?

+

Some common itemized deductions in Ohio include medical expenses, mortgage interest, charitable donations, and state and local taxes.