Military

New York Income Calculator

Introduction to New York Income Calculator

When it comes to managing personal finances, understanding how much you take home after taxes is crucial. The state of New York, with its unique tax laws and regulations, can make calculating your net income a bit complex. This is where a New York income calculator comes into play, helping individuals and families accurately estimate their take-home pay. In this article, we’ll delve into the details of how such a calculator works, its importance, and what factors it considers to provide an accurate estimation of your net income.

How Does a New York Income Calculator Work?

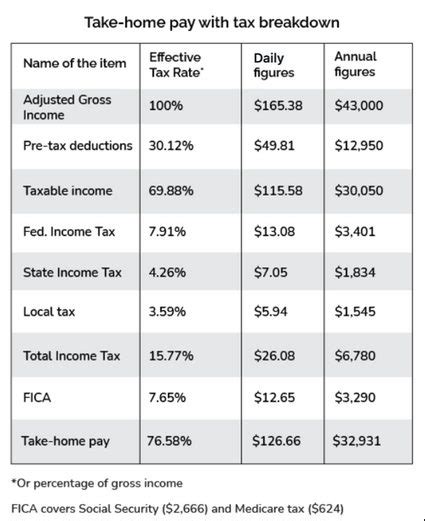

A New York income calculator is a tool designed to compute an individual’s net income, taking into account the state’s income tax rates, federal income taxes, and other deductions. Here’s a simplified breakdown of the process: - Gross Income Input: You start by entering your gross income, which is your total income before any deductions. - Federal Income Tax Calculation: The calculator then applies the federal income tax rates to your gross income, considering your filing status and the number of dependents. - New York State Income Tax Calculation: Next, it calculates the New York state income tax, which ranges from 4% to 8.82%, depending on your income level and filing status. - Other Deductions and Taxes: Other deductions such as social security taxes, Medicare taxes, and any local taxes are also considered. - Net Income Calculation: Finally, the calculator subtracts all the taxes and deductions from your gross income to provide your net income, or take-home pay.

Factors Considered by the Calculator

To provide an accurate estimation, a New York income calculator considers several key factors: * Filing Status: Whether you’re single, married filing jointly, married filing separately, head of household, or qualifying widow(er). * Number of Dependents: The number of children or other dependents you claim, which can affect your tax liability. * Gross Income: Your total income from all sources before any taxes or deductions. * Tax Credits and Deductions: Eligibility for tax credits such as the Earned Income Tax Credit (EITC) or deductions like the standard deduction. * New York State and Local Taxes: The specific tax rates and laws in New York, including any local taxes that may apply.

Importance of Using a New York Income Calculator

Using a New York income calculator is essential for several reasons: * Accurate Budgeting: Knowing your net income helps you budget more accurately, ensuring you can cover your expenses and plan for savings or investments. * Tax Planning: It helps in understanding how much you’ll pay in taxes, allowing for better tax planning and potential savings through deductions and credits. * Financial Planning: For long-term financial goals, such as buying a house, retirement planning, or funding education, understanding your take-home pay is crucial.

Benefits for Different Income Groups

The benefits of using a New York income calculator vary across different income groups: * Low-Income Households: Can help identify eligibility for tax credits like the EITC and ensure they’re taking advantage of all available deductions. * Middle-Income Households: Helps in navigating the complexities of tax law to minimize tax liability and maximize take-home pay. * High-Income Households: Although they may face higher tax rates, using a calculator can help optimize their financial strategies, including considerations for investments and retirement savings.

Conclusion and Future Planning

In summary, a New York income calculator is a valuable tool for anyone living in New York, providing a clear picture of their financial situation after taxes. By understanding the factors that influence your net income and using these tools effectively, you can make more informed decisions about your finances, from daily budgeting to long-term investment strategies. Whether you’re just starting your career or nearing retirement, having a clear understanding of your take-home pay is key to achieving financial stability and security.

What is the main purpose of a New York income calculator?

+

The main purpose of a New York income calculator is to estimate an individual’s net income after deducting federal, state, and local taxes, along with other deductions.

How does the calculator account for New York state taxes?

+

The calculator applies New York state income tax rates, which range from 4% to 8.82%, based on the individual’s income level and filing status.

Can using a New York income calculator help with tax planning?

+

Yes, by providing an accurate estimation of your tax liability, a New York income calculator can help in planning for taxes, identifying potential deductions, and optimizing your financial strategy.