Illinois Take Home Pay Calculator Tool

Understanding Illinois Take Home Pay Calculator Tool

When it comes to managing personal finances, understanding how much money you take home from your salary is crucial. The Illinois Take Home Pay Calculator Tool is designed to help individuals calculate their net income, considering various factors such as gross income, deductions, and taxes. In this article, we will explore the features and benefits of using this tool, as well as provide guidance on how to use it effectively.

Key Features of the Illinois Take Home Pay Calculator Tool

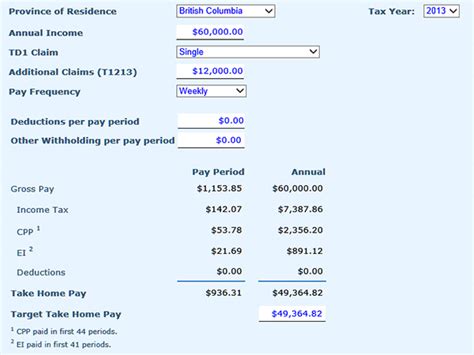

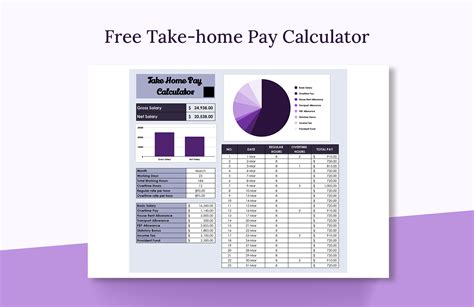

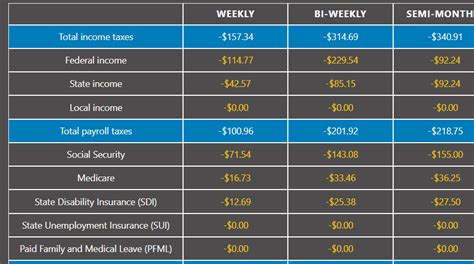

The Illinois Take Home Pay Calculator Tool offers several key features that make it an essential resource for individuals living in Illinois. Some of the notable features include: * Gross Income Calculation: The tool allows users to input their gross income, which is then used to calculate their net income. * Deductions and Exemptions: Users can input various deductions and exemptions, such as 401(k) contributions, health insurance premiums, and dependent exemptions, to get an accurate calculation of their net income. * Illinois State Taxes: The tool takes into account Illinois state taxes, including the state income tax rate of 4.95%. * Federal Taxes: The tool also considers federal taxes, including the federal income tax brackets and deductions. * Pay Frequency: Users can select their pay frequency, whether it’s weekly, bi-weekly, monthly, or annually, to get an accurate calculation of their net income.

Benefits of Using the Illinois Take Home Pay Calculator Tool

Using the Illinois Take Home Pay Calculator Tool offers several benefits, including: * Accurate Calculations: The tool provides accurate calculations of net income, taking into account various factors such as deductions, exemptions, and taxes. * Financial Planning: By using the tool, individuals can plan their finances more effectively, making informed decisions about budgeting, saving, and investing. * Tax Planning: The tool helps individuals understand how taxes impact their net income, allowing them to make informed decisions about tax planning and optimization. * Convenience: The tool is easy to use and provides quick results, making it a convenient resource for individuals who want to calculate their net income.

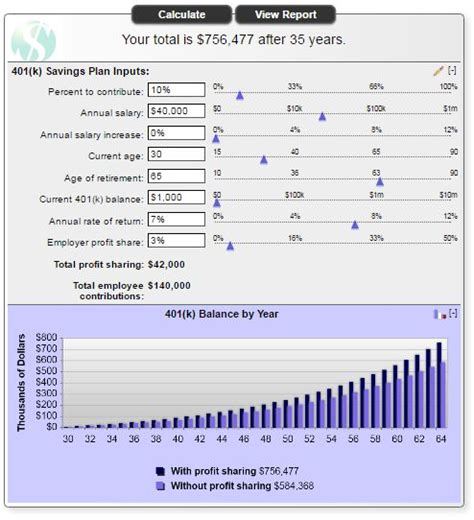

How to Use the Illinois Take Home Pay Calculator Tool

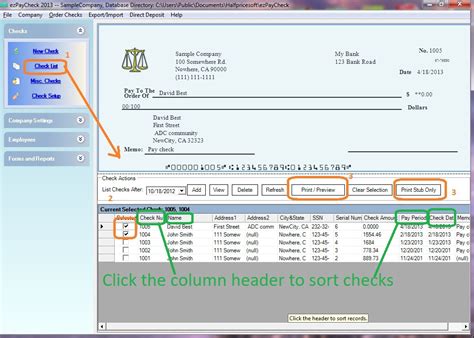

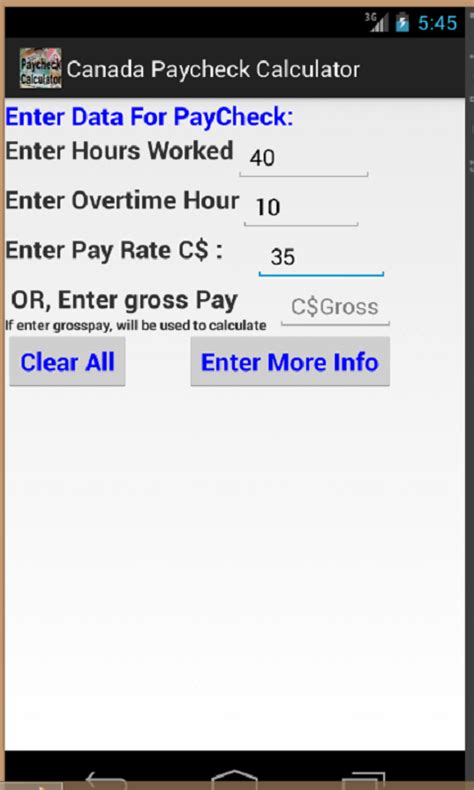

Using the Illinois Take Home Pay Calculator Tool is straightforward. Here’s a step-by-step guide: * Input Gross Income: Enter your gross income, which is your salary before deductions and taxes. * Input Deductions and Exemptions: Enter various deductions and exemptions, such as 401(k) contributions, health insurance premiums, and dependent exemptions. * Select Pay Frequency: Select your pay frequency, whether it’s weekly, bi-weekly, monthly, or annually. * Calculate Net Income: Click the “Calculate” button to get an accurate calculation of your net income.

📝 Note: It's essential to input accurate information to get accurate calculations. Make sure to review your inputs carefully before calculating your net income.

Illinois Tax Rates and Brackets

Understanding Illinois tax rates and brackets is essential to calculating net income accurately. The state of Illinois has a flat income tax rate of 4.95%, which means that all taxpayers pay the same rate regardless of their income level. Here are the federal income tax brackets for the 2022 tax year:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 9,875 | 10% |

| 9,876 - 40,125 | 12% |

| 40,126 - 80,250 | 22% |

| 80,251 - 164,700 | 24% |

| 164,701 - 214,700 | 32% |

| 214,701 - 518,400 | 35% |

| $518,401 and above | 37% |

Conclusion and Final Thoughts

In conclusion, the Illinois Take Home Pay Calculator Tool is a valuable resource for individuals living in Illinois who want to calculate their net income accurately. By understanding how to use the tool and considering various factors such as deductions, exemptions, and taxes, individuals can make informed decisions about their finances. Whether you’re planning your budget, saving for retirement, or optimizing your taxes, the Illinois Take Home Pay Calculator Tool is an essential resource to have in your financial toolkit.

What is the Illinois state income tax rate?

+

The Illinois state income tax rate is 4.95%.

How do I calculate my net income using the Illinois Take Home Pay Calculator Tool?

+

To calculate your net income, input your gross income, deductions, and exemptions, and select your pay frequency. Then, click the “Calculate” button to get an accurate calculation of your net income.

What are the federal income tax brackets for the 2022 tax year?

+

The federal income tax brackets for the 2022 tax year are: 10% for taxable income between 0 and 9,875, 12% for taxable income between 9,876 and 40,125, 22% for taxable income between 40,126 and 80,250, 24% for taxable income between 80,251 and 164,700, 32% for taxable income between 164,701 and 214,700, 35% for taxable income between 214,701 and 518,400, and 37% for taxable income above $518,400.