5 Illinois Salary Tips

Understanding Illinois Salary Landscape

The state of Illinois, known for its vibrant city of Chicago and rich agricultural lands, has a diverse economy that supports a wide range of professions and industries. When it comes to salaries, Illinois follows the national trend in many aspects but also has its unique characteristics due to local economic conditions, cost of living, and industry dominance. For individuals looking to understand or navigate the salary landscape in Illinois, there are several key points to consider.

One of the first considerations is the cost of living in Illinois, which can significantly impact the purchasing power of one's salary. The cost of living in Illinois is slightly higher than the national average, primarily due to the high cost of living in cities like Chicago. Understanding this can help individuals better assess salary offers and negotiate for compensation that reflects the true cost of living in their area.

Salary Negotiation Strategies

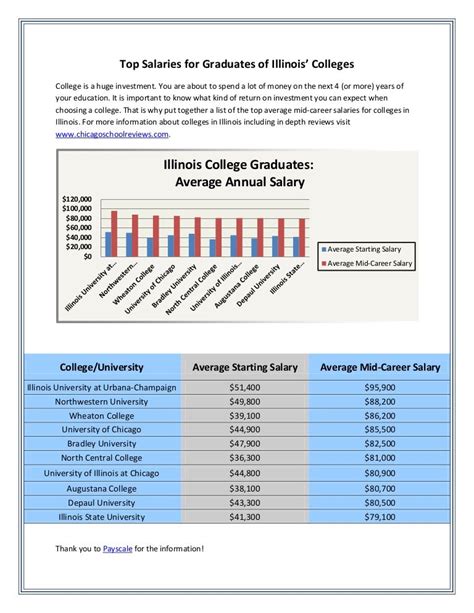

Salary negotiation is an art that requires preparation, confidence, and a clear understanding of one’s worth in the job market. In Illinois, as in other states, research is key. Individuals should research the average salary for their position in their specific location within Illinois. Websites like Glassdoor, Payscale, and the Bureau of Labor Statistics can provide valuable insights into salary ranges for different professions.

- Know Your Worth: Understand your skills, experience, and the value you bring to the employer.

- Research Thoroughly: Look into salaries for similar positions in your area to make a strong case for your desired salary.

- Be Flexible: Consider benefits, work-life balance, and opportunities for growth alongside the salary.

- Practice Your Pitch: Prepare to confidently and clearly state your case for why you deserve a certain salary.

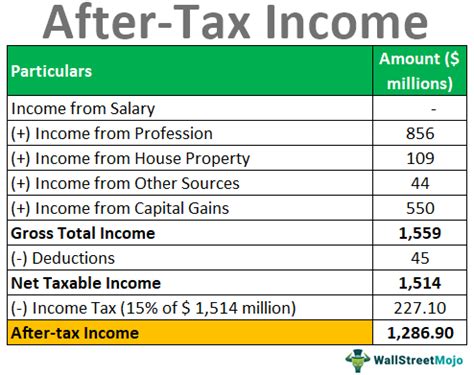

Taxes and Salary in Illinois

Illinois has a flat state income tax rate of 4.95%, which means that regardless of one’s income level, the same rate applies. This can impact take-home pay and is an important consideration for salary negotiations. Understanding how taxes affect net income can help individuals better plan their financial lives and make informed decisions about salary and benefits.

Moreover, the federal tax rates apply on top of the state tax, ranging from 10% to 37%, depending on the income level. For high-income earners, this can result in a significant portion of their salary going towards taxes, highlighting the importance of considering tax implications when evaluating salary offers.

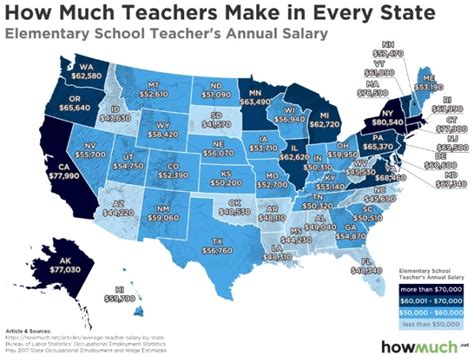

Industry Salaries in Illinois

Different industries in Illinois have varying salary ranges. For instance, tech and finance industries, which are prevalent in Chicago, tend to offer higher salaries compared to other parts of the state. On the other hand, agriculture and manufacturing, which are significant in rural areas, may offer salaries that are more modest but still reflect the local cost of living and skill requirements.

| Industry | Average Salary Range |

|---|---|

| Tech | $80,000 - $150,000 |

| Finance | $70,000 - $200,000 |

| Agriculture | $40,000 - $80,000 |

| Manufacturing | $50,000 - $90,000 |

📝 Note: These salary ranges are approximate and can vary widely depending on specific job roles, experience, and locations within Illinois.

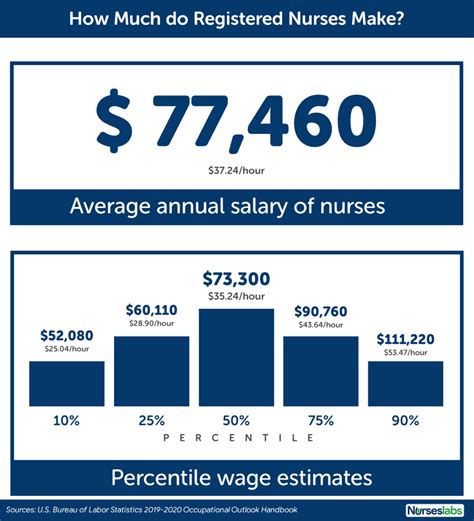

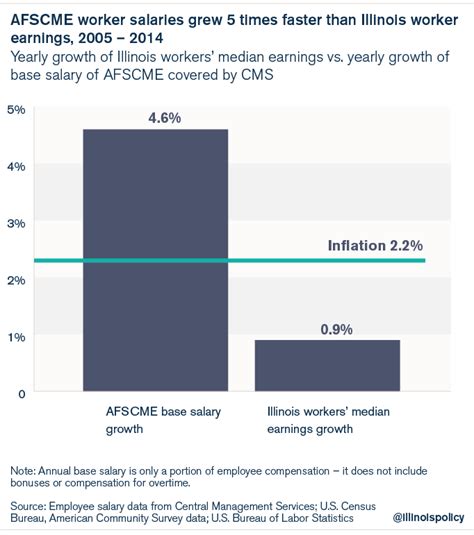

Future Outlook and Salary Growth

The future outlook for salaries in Illinois is influenced by the state’s economic growth, industry trends, and the national economy. As industries like technology and healthcare continue to grow, there is potential for salary increases in these sectors. However, economic uncertainties and changes in state and federal policies can also impact salary growth.

Individuals looking to maximize their salary potential in Illinois should focus on developing in-demand skills, staying informed about industry trends, and being proactive in their career development. This includes pursuing higher education, certifications, and continuous learning to stay competitive in the job market.

In summary, navigating the salary landscape in Illinois requires a thorough understanding of the local economy, industry trends, and personal financial planning. By being informed and proactive, individuals can make the most of their career opportunities and achieve their financial goals in the state. The key to success lies in research, preparation, and continuous learning, allowing individuals to thrive in Illinois’s diverse and dynamic job market.

What is the average cost of living in Illinois?

+

The cost of living in Illinois is slightly higher than the national average, primarily due to the high cost of living in cities like Chicago.

How do taxes affect salaries in Illinois?

+

Illinois has a flat state income tax rate of 4.95%, and federal taxes range from 10% to 37%, depending on income level, which can significantly impact take-home pay.

What industries offer the highest salaries in Illinois?

+

Industries like tech and finance tend to offer higher salaries, especially in urban areas like Chicago, compared to agriculture and manufacturing which are more prevalent in rural areas.