IL Paycheck Calculator Tool

Introduction to IL Paycheck Calculator Tool

The IL Paycheck Calculator Tool is an essential resource for employees and employers in the state of Illinois. This tool is designed to help calculate the correct amount of taxes to be withheld from an employee’s paycheck, taking into account various factors such as income level, filing status, and number of dependents. In this blog post, we will delve into the details of the IL Paycheck Calculator Tool, its features, and how it can benefit users.

How the IL Paycheck Calculator Tool Works

The IL Paycheck Calculator Tool is a user-friendly online application that requires users to input specific information about their employment and tax situation. The tool will then use this information to calculate the correct amount of taxes to be withheld from the employee’s paycheck. The calculation is based on the current tax laws and regulations in the state of Illinois, ensuring that the results are accurate and up-to-date. The tool takes into account various factors, including:

- Gross income

- Filing status (single, married, head of household, etc.)

- Number of dependents

- Other income sources (such as investments or self-employment)

- Tax deductions and credits

Benefits of Using the IL Paycheck Calculator Tool

The IL Paycheck Calculator Tool offers several benefits to users, including:

- Accuracy: The tool ensures that taxes are calculated accurately, reducing the risk of errors or penalties.

- Convenience: The tool is easily accessible online, making it convenient for users to calculate their taxes from anywhere.

- Time-saving: The tool saves time and effort by automating the tax calculation process, eliminating the need for manual calculations.

- Up-to-date information: The tool is regularly updated to reflect changes in tax laws and regulations, ensuring that users have access to the most current information.

Features of the IL Paycheck Calculator Tool

The IL Paycheck Calculator Tool offers several features that make it a valuable resource for users, including:

- Easy-to-use interface: The tool has a user-friendly interface that makes it easy to navigate and input information.

- Customizable calculations: Users can customize their calculations by inputting specific information about their employment and tax situation.

- Access to tax tables and charts: The tool provides access to tax tables and charts, making it easy for users to understand and visualize their tax situation.

- Support for multiple tax scenarios: The tool supports multiple tax scenarios, including calculations for employees, self-employed individuals, and businesses.

Common Uses of the IL Paycheck Calculator Tool

The IL Paycheck Calculator Tool has several common uses, including:

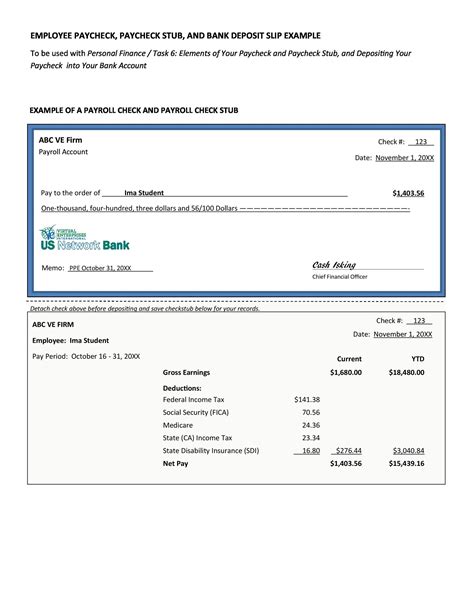

- Payroll processing: Employers can use the tool to calculate the correct amount of taxes to be withheld from employee paychecks.

- Tax planning: Individuals can use the tool to plan their taxes and estimate their tax liability.

- Financial planning: The tool can be used to estimate tax deductions and credits, helping individuals and businesses plan their finances more effectively.

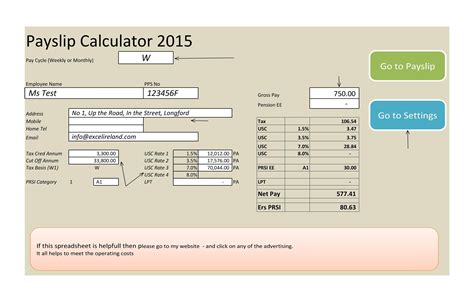

| Feature | Description |

|---|---|

| Easy-to-use interface | The tool has a user-friendly interface that makes it easy to navigate and input information. |

| Customizable calculations | Users can customize their calculations by inputting specific information about their employment and tax situation. |

| Access to tax tables and charts | The tool provides access to tax tables and charts, making it easy for users to understand and visualize their tax situation. |

💡 Note: The IL Paycheck Calculator Tool is subject to change, and users should regularly check for updates to ensure they have access to the most current information.

To summarize, the IL Paycheck Calculator Tool is a valuable resource for employees and employers in the state of Illinois. It offers a range of features and benefits, including accuracy, convenience, and up-to-date information. By using the tool, users can calculate their taxes accurately, plan their finances more effectively, and ensure compliance with tax laws and regulations.

What is the IL Paycheck Calculator Tool?

+

The IL Paycheck Calculator Tool is an online application that helps calculate the correct amount of taxes to be withheld from an employee’s paycheck.

How does the IL Paycheck Calculator Tool work?

+

The tool uses user-inputted information to calculate the correct amount of taxes to be withheld from an employee’s paycheck, taking into account various factors such as income level, filing status, and number of dependents.

What are the benefits of using the IL Paycheck Calculator Tool?

+

The tool offers several benefits, including accuracy, convenience, and up-to-date information. It also saves time and effort by automating the tax calculation process.