Read Your W2 Form Easily

Understanding Your W2 Form: A Comprehensive Guide

Your W2 form is a crucial document that you receive from your employer at the end of each year, typically by January 31st. It outlines the amount of money you earned from your job, the taxes that were withheld, and other essential details that you’ll need to file your tax return. In this guide, we’ll walk you through the different parts of the W2 form, explain what each section means, and provide tips on how to read it accurately.

What is a W2 Form?

A W2 form, also known as the Wage and Tax Statement, is a document that your employer is required to provide to you and the Internal Revenue Service (IRS) by law. It summarizes your income and tax withholding for the previous tax year. You’ll receive a separate W2 form for each job you held during the year, and you’ll need to report the information from each form on your tax return.

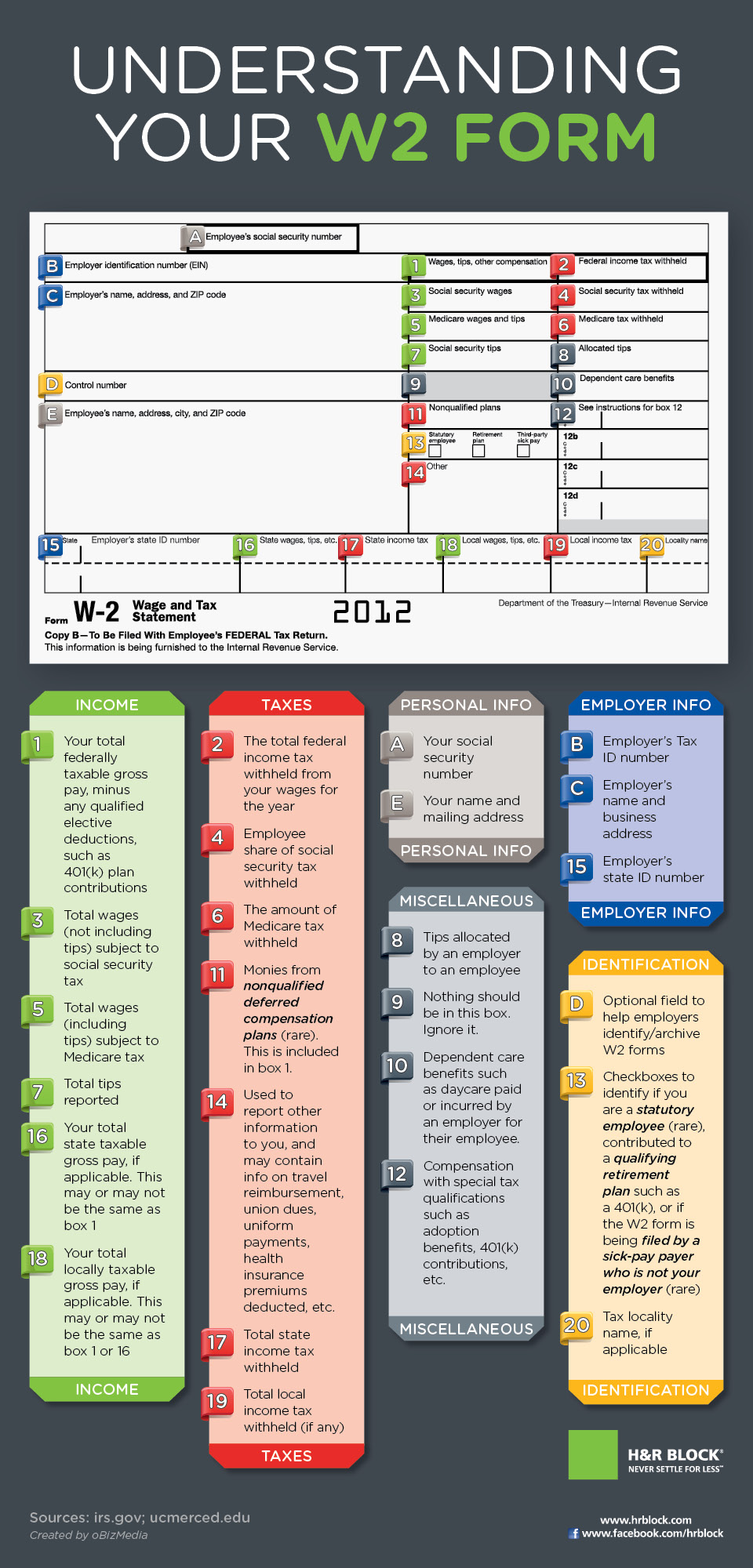

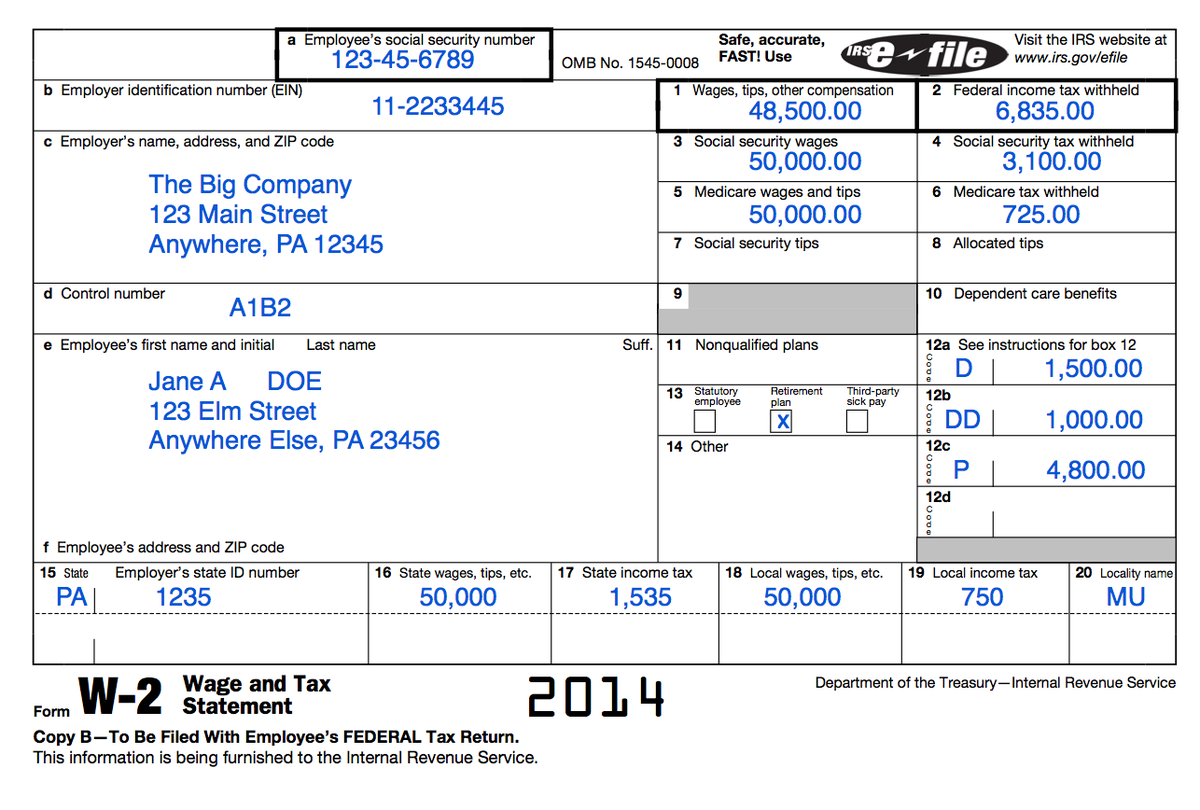

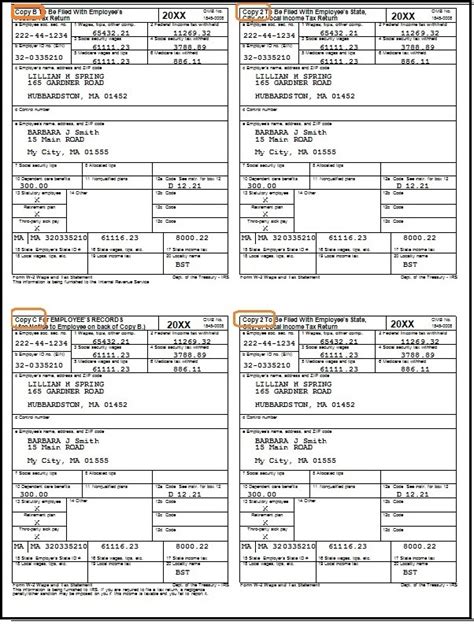

Parts of the W2 Form

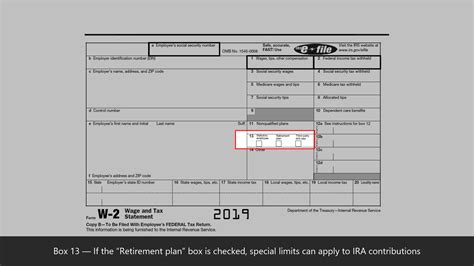

The W2 form is divided into several boxes, each containing specific information. Here’s a breakdown of what you’ll find in each box: * Box 1: Wages, tips, other compensation: This box shows the total amount of money you earned from your job, including wages, tips, and other forms of compensation. * Box 2: Federal income tax withheld: This box indicates the amount of federal income tax that was withheld from your paychecks throughout the year. * Box 3: Social Security wages: This box shows the amount of money that was subject to Social Security tax. * Box 4: Social Security tax withheld: This box indicates the amount of Social Security tax that was withheld from your paychecks. * Box 5: Medicare wages and tips: This box shows the amount of money that was subject to Medicare tax. * Box 6: Medicare tax withheld: This box indicates the amount of Medicare tax that was withheld from your paychecks. * Box 7: Social Security tips: This box shows the amount of tips you reported to your employer, which are subject to Social Security tax. * Box 8: Allocated tips: This box indicates the amount of tips that your employer allocated to you, which are also subject to Social Security tax. * Box 9: Advance EIC payment: This box shows any advance payments you received for the Earned Income Tax Credit (EITC). * Box 10: Dependent care benefits: This box indicates the amount of dependent care benefits you received from your employer. * Box 11: Nonqualified plans: This box shows any distributions from nonqualified plans, such as certain retirement plans. * Box 12: Codes: This box contains codes that explain any special tax withholding or benefits you received. * Box 13: Statutory employee: This box indicates whether you’re a statutory employee, which can affect your tax filing status. * Box 14: Other: This box shows any other tax-related information that your employer needs to report.

How to Read Your W2 Form

Now that you know what each box on the W2 form means, here are some tips on how to read it accurately: * Make sure your name and address are correct, as well as your Social Security number or Individual Taxpayer Identification Number (ITIN). * Verify that your employer’s name and address are correct. * Check the boxes that show your income and tax withholding to ensure they match your pay stubs and other financial records. * Look for any errors or discrepancies, such as incorrect income or tax withholding amounts. * If you have multiple jobs, make sure you receive a separate W2 form for each job.

📝 Note: If you find any errors or discrepancies on your W2 form, contact your employer immediately to request a corrected form.

What to Do with Your W2 Form

Once you’ve received and reviewed your W2 form, here’s what you need to do: * Keep a copy of the form for your records, in case you need to refer to it later. * Use the information on the W2 form to file your tax return, either electronically or by mail. * If you’re using tax software or consulting a tax professional, provide them with a copy of your W2 form to ensure accurate reporting. * If you have any questions or concerns about your W2 form, contact your employer or the IRS for assistance.

Tips for Accurate Tax Filing

To ensure accurate tax filing, follow these tips: * Double-check your math and ensure you’re reporting all income and tax withholding correctly. * Claim all eligible deductions and credits to minimize your tax liability. * Keep accurate records of your income, expenses, and tax-related documents, in case you’re audited. * Consider consulting a tax professional or using tax software to guide you through the filing process.

As you can see, understanding your W2 form is essential for accurate tax filing and avoiding any potential issues with the IRS. By following the tips and guidelines outlined in this guide, you’ll be well on your way to navigating the world of tax preparation with confidence.

What is the purpose of the W2 form?

+

The W2 form is used to report your income and tax withholding to the IRS and provide you with the information you need to file your tax return.

How do I correct errors on my W2 form?

+

If you find any errors or discrepancies on your W2 form, contact your employer immediately to request a corrected form.

Can I file my tax return without a W2 form?

+

No, you'll need to receive a W2 form from your employer to file your tax return accurately. If you don't receive a W2 form, contact your employer or the IRS for assistance.

In summary, your W2 form is a critical document that plays a vital role in the tax filing process. By understanding what each box on the form means and following the tips outlined in this guide, you’ll be able to navigate the world of tax preparation with confidence and accuracy. Remember to review your W2 form carefully, correct any errors or discrepancies, and use the information to file your tax return accurately.