Uncertainty in Excel Made Easy

Introduction to Uncertainty in Excel

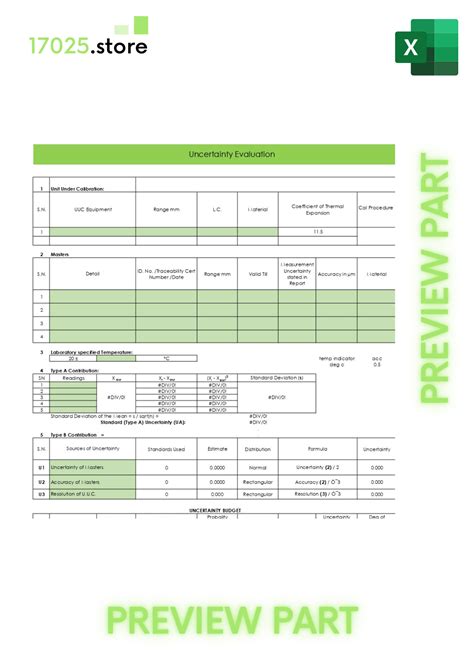

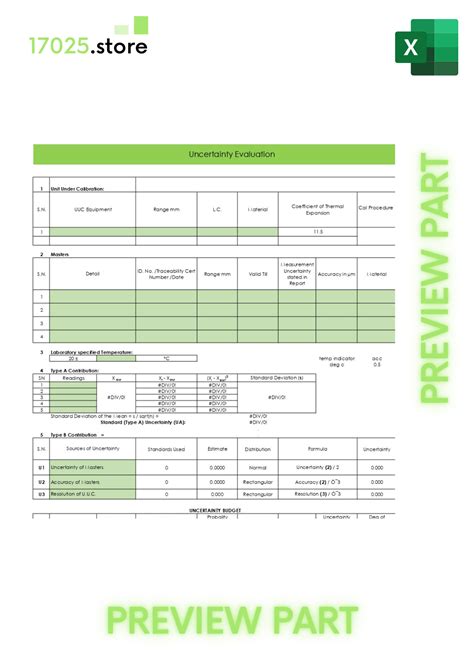

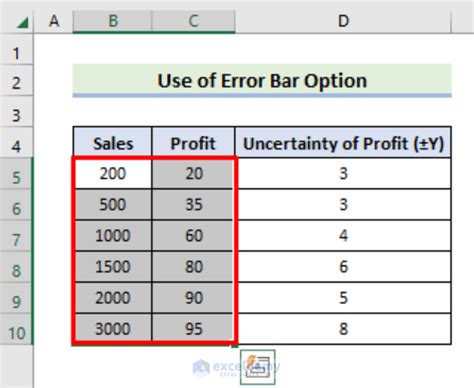

When working with data in Excel, it’s essential to understand and manage uncertainty. Uncertainty can arise from various sources, such as measurement errors, sampling variability, or model assumptions. In this blog post, we’ll explore how to handle uncertainty in Excel using various tools and techniques. We’ll cover topics such as probability distributions, confidence intervals, and sensitivity analysis.

Understanding Probability Distributions

Probability distributions are a crucial concept in managing uncertainty. A probability distribution describes the probability of different outcomes for a random variable. In Excel, you can use the NORM.DIST function to calculate the probability of a normal distribution. For example, to calculate the probability of a value being less than 10 in a normal distribution with a mean of 5 and a standard deviation of 2, you can use the formula: =NORM.DIST(10, 5, 2, TRUE).

Some common probability distributions used in Excel include: * Normal distribution: Used to model continuous data that follows a bell-shaped curve. * Binomial distribution: Used to model binary data, such as success or failure. * Poisson distribution: Used to model count data, such as the number of events occurring in a fixed interval.

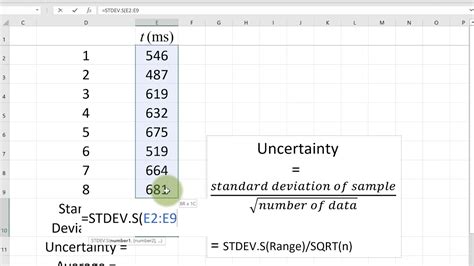

Calculating Confidence Intervals

Confidence intervals are a way to quantify uncertainty in estimates. A confidence interval provides a range of values within which the true value is likely to lie. In Excel, you can use the CONFIDENCE.T function to calculate a confidence interval for a sample mean. For example, to calculate a 95% confidence interval for a sample mean with a standard deviation of 1.5 and a sample size of 20, you can use the formula: =CONFIDENCE.T(0.05, 1.5, 20).

Some key concepts to keep in mind when working with confidence intervals include: * Margin of error: The amount of uncertainty in the estimate. * Confidence level: The probability that the true value lies within the confidence interval. * Sample size: The number of observations used to calculate the estimate.

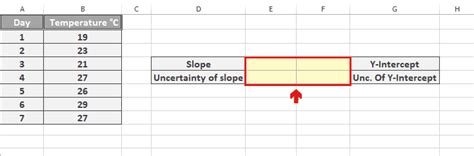

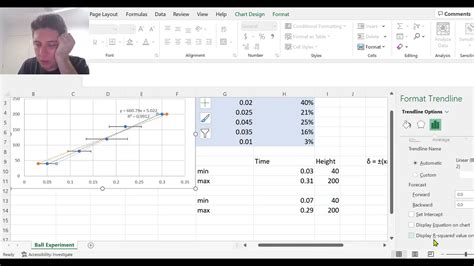

Performing Sensitivity Analysis

Sensitivity analysis is a technique used to understand how changes in input values affect output values. In Excel, you can use the WHAT-IF analysis tool to perform sensitivity analysis. For example, to analyze how changes in the interest rate affect the present value of a cash flow, you can use the WHAT-IF analysis tool to create a table of values.

Some benefits of performing sensitivity analysis include: * Identifying key drivers: Understanding which input values have the most significant impact on output values. * Quantifying uncertainty: Estimating the range of possible output values. * Informing decision-making: Providing insights to support informed decision-making.

Using Monte Carlo Simulations

Monte Carlo simulations are a powerful tool for managing uncertainty in Excel. A Monte Carlo simulation involves running multiple scenarios with random input values to estimate the probability of different outcomes. In Excel, you can use the RAND function to generate random numbers and the DATA TABLE function to run multiple scenarios.

Some advantages of using Monte Carlo simulations include: * Handling complex uncertainty: Modeling complex systems with multiple sources of uncertainty. * Estimating probability distributions: Calculating the probability of different outcomes. * Informing risk analysis: Providing insights to support risk analysis and decision-making.

| Tool | Description |

|---|---|

| NORM.DIST | Calculates the probability of a normal distribution |

| CONFIDENCE.T | Calculates a confidence interval for a sample mean |

| WHAT-IF | Performs sensitivity analysis |

| RAND | Generates random numbers |

| DATA TABLE | Runs multiple scenarios |

📝 Note: When working with uncertainty in Excel, it's essential to understand the limitations of each tool and technique. Be sure to carefully evaluate the assumptions and results to ensure accurate and reliable insights.

In summary, managing uncertainty in Excel requires a combination of tools and techniques, including probability distributions, confidence intervals, sensitivity analysis, and Monte Carlo simulations. By understanding and applying these concepts, you can make more informed decisions and better navigate uncertain environments. The key takeaways from this blog post include the importance of probability distributions, confidence intervals, and sensitivity analysis in managing uncertainty, as well as the benefits of using Monte Carlo simulations to estimate probability distributions and inform risk analysis.

What is the purpose of using probability distributions in Excel?

+

The purpose of using probability distributions in Excel is to model and analyze uncertain events or outcomes. By using probability distributions, you can estimate the probability of different outcomes and make more informed decisions.

How do I calculate a confidence interval in Excel?

+

To calculate a confidence interval in Excel, you can use the CONFIDENCE.T function. This function requires the alpha value, standard deviation, and sample size as inputs. For example, to calculate a 95% confidence interval for a sample mean with a standard deviation of 1.5 and a sample size of 20, you can use the formula: =CONFIDENCE.T(0.05, 1.5, 20)

What is the benefit of using Monte Carlo simulations in Excel?

+

The benefit of using Monte Carlo simulations in Excel is that they allow you to model complex systems with multiple sources of uncertainty. By running multiple scenarios with random input values, you can estimate the probability of different outcomes and inform risk analysis and decision-making.