Find APR in Excel

Understanding APR and Its Calculation

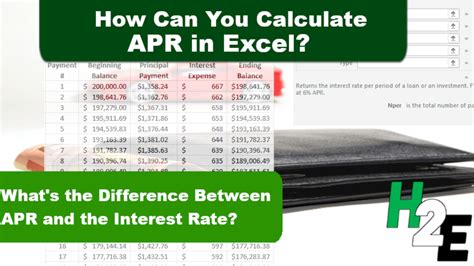

The Annual Percentage Rate (APR) is the rate charged on a loan or credit product over a year, including fees. It’s a crucial factor in determining the cost of borrowing. Calculating APR can be complex due to the variables involved, such as the loan amount, interest rate, compounding frequency, and fees. However, Excel provides a straightforward way to calculate APR using its built-in financial functions.

Using the APR Formula in Excel

To calculate the APR in Excel, you can use the RATE function, which is designed to calculate the interest rate of a loan. The syntax for the RATE function is:

RATE(nper, pmt, pv, [fv], [type], [guess])

Where: - nper is the total number of payment periods. - pmt is the payment amount per period. - pv is the present value (the initial amount of the loan). - [fv] is the future value (the amount left after the loan is paid off). This is optional and defaults to 0 if not provided. - [type] indicates when payments are due (0 for end of period, 1 for beginning of period). This is optional and defaults to 0 if not provided. - [guess] is your guess for the interest rate. This is optional and defaults to 10% if not provided.

Steps to Calculate APR in Excel

Here are the steps to follow: 1. Determine Your Inputs: Identify the total number of payments (nper), the payment amount per period (pmt), and the initial loan amount (pv). 2. Use the RATE Function: Enter the RATE function in a cell with your inputs. For example, if you have a 1,000 loan to be repaid over 12 months with monthly payments of 100, the formula might look like this:

=RATE(12, -100, 1000)

Note: The payment is negative because it represents cash outflow from your perspective. 3. Interpret the Result: The result of the RATE function will be a decimal representing the monthly interest rate. To find the APR, you need to annualize this rate by multiplying by 12 (since there are 12 payment periods in a year).

Calculating APR from Monthly Rate

If the monthly interest rate is known, you can calculate the APR by multiplying this rate by 12. For example, if the monthly rate is 1%, the APR would be 12% (1% * 12).

Example Calculation

Suppose you borrow 5,000 for 2 years at an interest rate of 6% per annum, compounded annually. However, you want to know the APR, taking into account that you make monthly payments. - nper = 24 (2 years \* 12 months/year) - pmt = -241.61 (monthly payment, which can be calculated using the PMT function in Excel:

=PMT(0.06/12, 24, 5000))

- pv = 5000 (the initial loan amount)

Using the RATE function:

=RATE(24, -241.61, 5000)

This will give you the monthly interest rate. To convert it to APR, you multiply by 12.

Important Considerations

- Compounding Frequency: The frequency at which interest is compounded can significantly affect the APR. Ensure you adjust your calculation accordingly. - Fees: Some loans include fees that are not accounted for in the basic interest rate calculation. These need to be factored into your APR calculation for an accurate picture. - Balloon Payments: Loans with balloon payments can complicate APR calculations since a large payment at the end of the loan term can skew the interest rate calculation.

📝 Note: Always review the terms and conditions of a loan carefully to understand all costs involved, including fees and the compounding frequency, which can impact the APR.

To finalize, calculating APR in Excel involves understanding the loan’s terms and using the appropriate financial functions, such as the RATE function, to derive the interest rate and then annualizing it to find the APR. This process helps borrowers make informed decisions by providing a clear picture of the loan’s total cost.

What does APR stand for and what does it represent?

+

APR stands for Annual Percentage Rate, representing the rate charged on a loan or credit product over a year, including fees.

How do I calculate APR in Excel?

+

You can calculate APR in Excel by using the RATE function, which calculates the interest rate of a loan based on the loan amount, payment amount, and number of payments.

What factors can affect the APR calculation?

+

Factors such as compounding frequency, fees, and balloon payments can significantly affect the APR calculation, making it crucial to consider these when determining the total cost of a loan.